Under GST, Input Tax Credit (ITC) refers to the tax already paid by a person on input, which is available as a deduction from tax payable on output. This means that if you have paid tax on some purchases, then at the time of paying tax on the sale of goods, you can reduce it by the amount you alreadRead more

Under GST, Input Tax Credit (ITC) refers to the tax already paid by a person on input, which is available as a deduction from tax payable on output. This means that if you have paid tax on some purchases, then at the time of paying tax on the sale of goods, you can reduce it by the amount you already paid on purchase and pay only the balance amount.

EXAMPLE

Suppose Ashok purchased goods worth Rs 100 while paying tax at 10%, that is Rs 10. He now sold the goods for Rs 200, with a tax payable of Rs 20. Now, Ashok can avail input tax credit of Rs 10 that he already paid for the purchase and hence the net tax payable is Rs 10 (20-10).

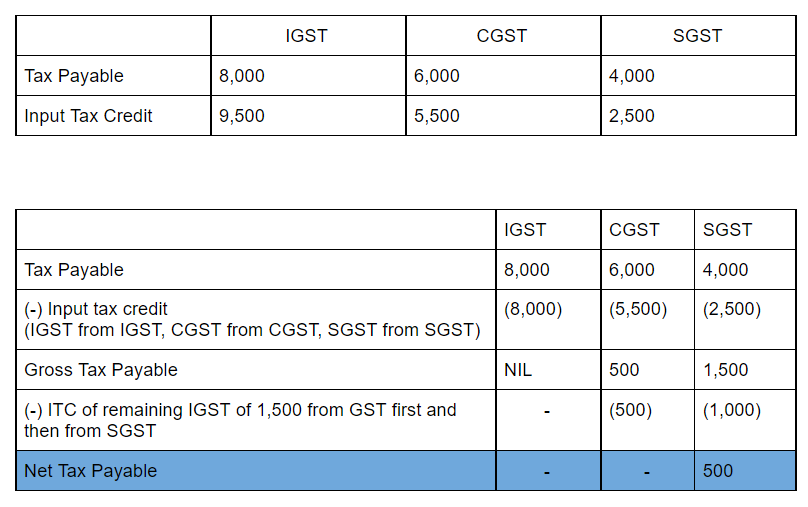

METHOD OF UTILISATION OF ITC

The central government collects CGST, SGST, UTGST or IGST based on whether the transactions are done intrastate or interstate.

The amount of input tax credit on IGST is first used for paying IGST and then utilised for the payment of CGST and SGST or UTGST. Similarly, the amount of ITC relating to CGST is first utilised for payment of CGST and then for the payment of IGST. It is not used for the payment of SGST or UTGST. Meanwhile, the amount of ITC relating to SGST is utilised for payment of SGST or UTGST and then for the payment of IGST. Such amounts are not used for payment of CGST.

We can see how Input Tax Credit is used from the below example and table:

Let us assume that we are discussing Input Tax Credit in GST of India. Input Tax Credit or ITC is the tax that a business pays on a purchase and that it can claim credit and use it to reduce its tax liability when it makes a sale. In other words, it means at the time of paying tax on output (Final sRead more

Let us assume that we are discussing Input Tax Credit in GST of India.

Input Tax Credit or ITC is the tax that a business pays on a purchase and that it can claim credit and use it to reduce its tax liability when it makes a sale. In other words, it means at the time of paying tax on output (Final sale product), you can reduce the tax you have already paid on inputs (Purchase).

Example For a manufacturer, tax payable on output (Final product) is Rs 500 and tax paid on input A is Rs 100, input B is Rs 50 and, input C is Rs50. You can claim INPUT CREDIT of Rs 200(100+50+50) and you only need to deposit Rs 300(500-200) in taxes.

Conditions- Only a Registered Person would be able to claim the benefit of Input Tax Credit of GST after satisfying the following:

Claiming of ITC – Discussed by taking an example, seller A sold his goods to B. Now B who is a buyer will be eligible to claim the input tax credit on purchases based on the invoices when he makes further sales. Now,

- S will upload the details of all the tax invoices in GSTR 1.

- All the details in accordance with the sales to B will reflect in GSTR 2A, and the same data will be taken by B to file GSTR 2 (i.e. details of inward supply).

- B will accept the details about the purchase that has been made and uploaded by the seller, the tax on purchases will be credited to ‘Electronic Credit Ledger’ of B and he can adjust it against future output tax liability and get the refund.

See less