Deleting a company in Tally Prime Tally prime is the latest version of Tally ERP software. In its functionality, it is slightly different from its previous version Tally ERP 9. Hence, the process of deleting a company in Tally Prime is different from that in Tally ERP 9. To delete a company in TallRead more

Deleting a company in Tally Prime

Tally prime is the latest version of Tally ERP software. In its functionality, it is slightly different from its previous version Tally ERP 9. Hence, the process of deleting a company in Tally Prime is different from that in Tally ERP 9.

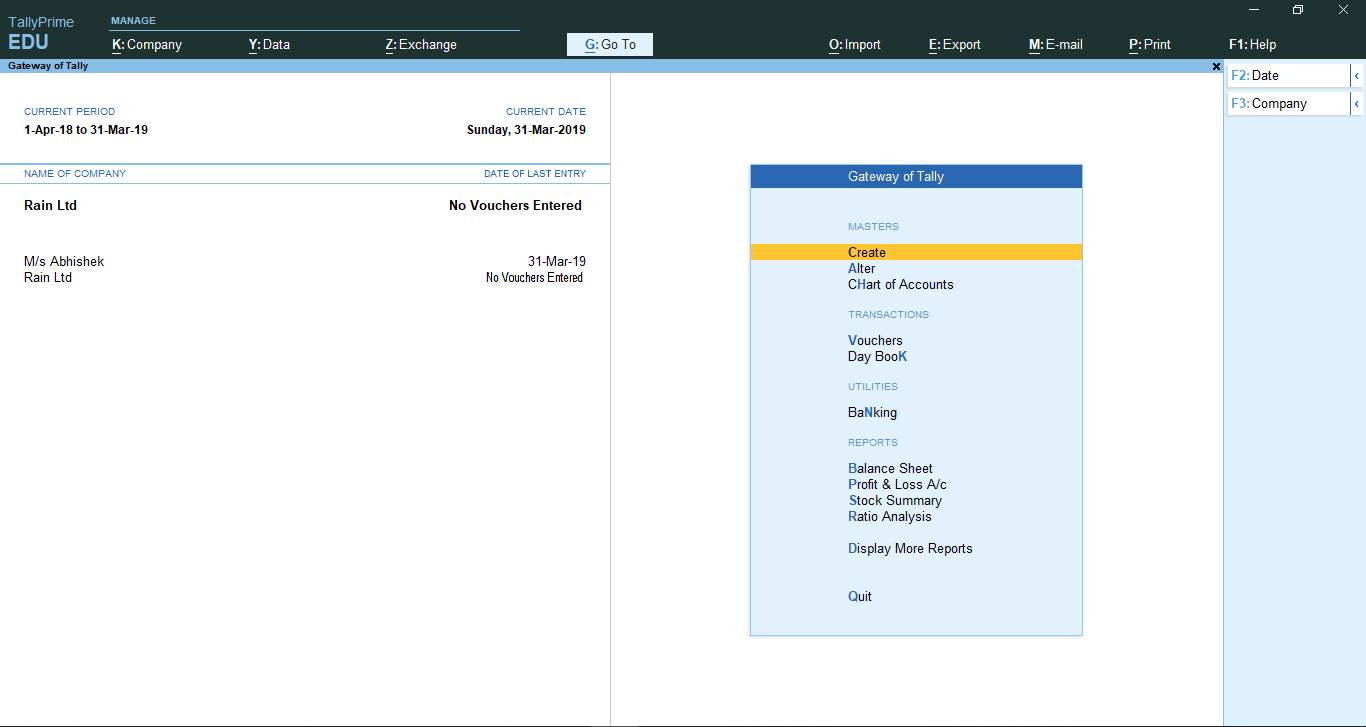

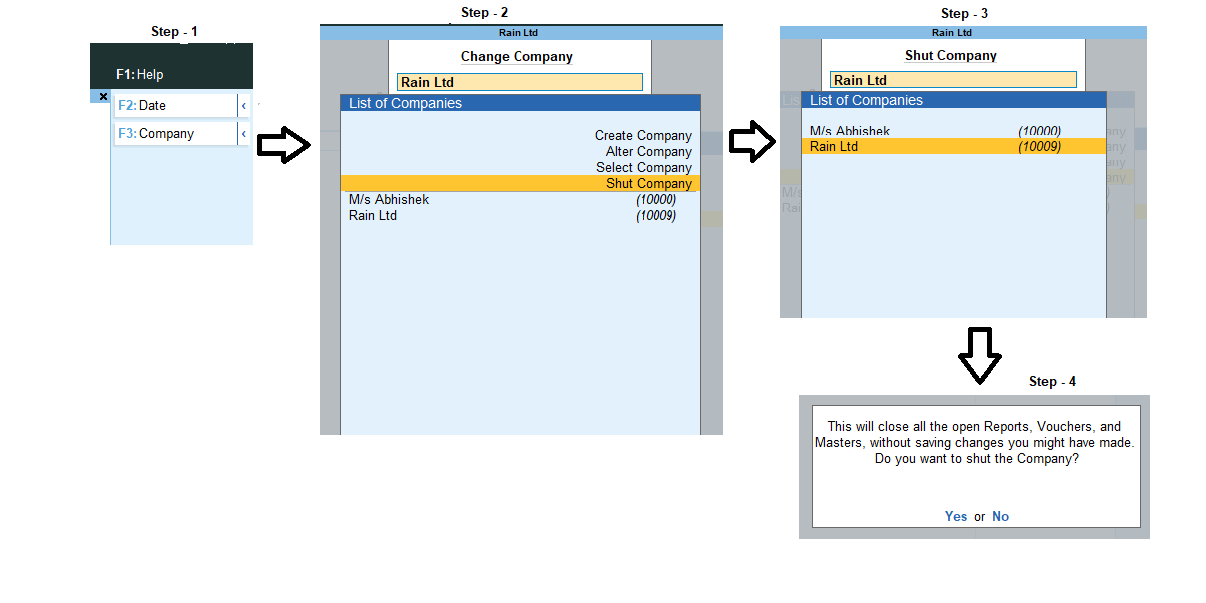

To delete a company in Tally Prime, you need to be in the Gateway of Tally window which looks the following:

On the right-hand side, there is a menu where is an option named ‘F3: Company’. You can either click on it or simply press F3.

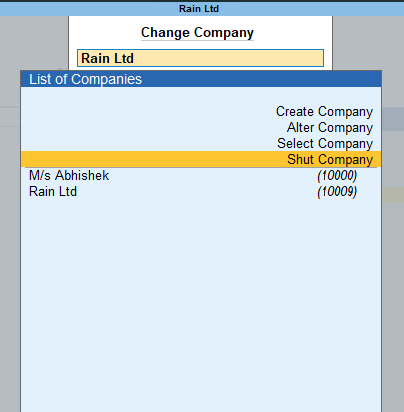

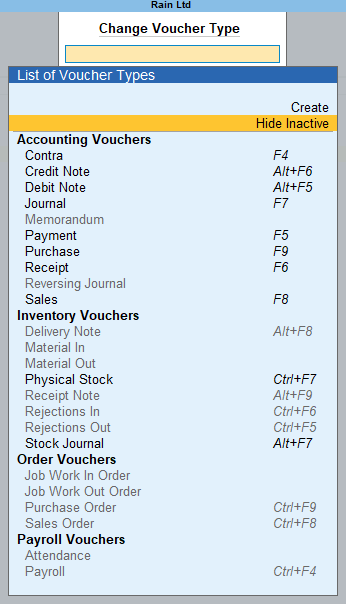

After clicking on the option, the Company menu where a list of names of the companies created in the Tally is there, along with some options above the company name list.

You have to select the option named, ‘Shut Company’. After clicking the option, the screen will display a ‘Shut Company’ menu.

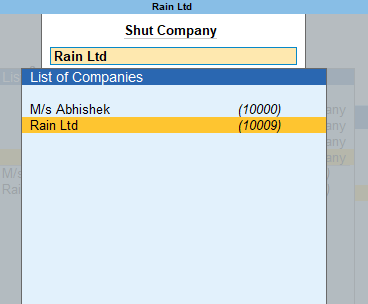

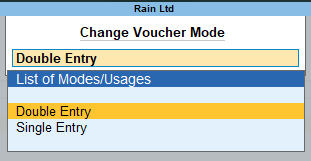

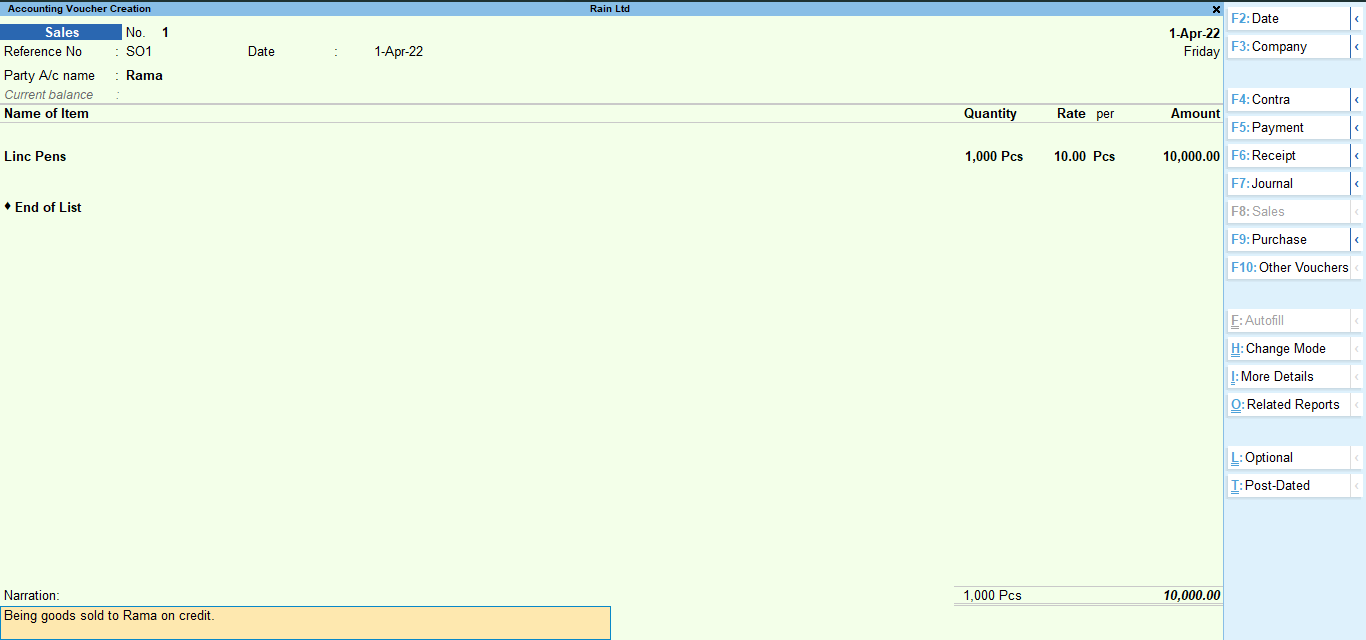

From there, you have to select the company you want to delete. Like in the example given, I have selected the company named Rain Ltd.

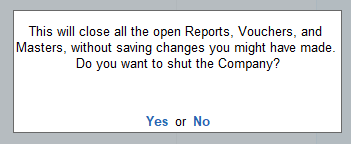

After selecting the name of the company you want to delete, a confirmation dialog box will appear.

You have to click OK and the company will be shut down or deleted.

In short, the steps to delete a company in Tally Prime are as follows:

Gateway of Tally –> Press F3 –> Select ‘Shut Company’ option –> Select the name of the company –> Confirm and press OK

Ledger is the book where the transaction related to a particular account is recorded. For example, the Sales ledger will only record the transactions related to sales. Ledgers in Tally also serve the same purpose. Posting in the ledger is automatically done when the transactions are entered in the vRead more

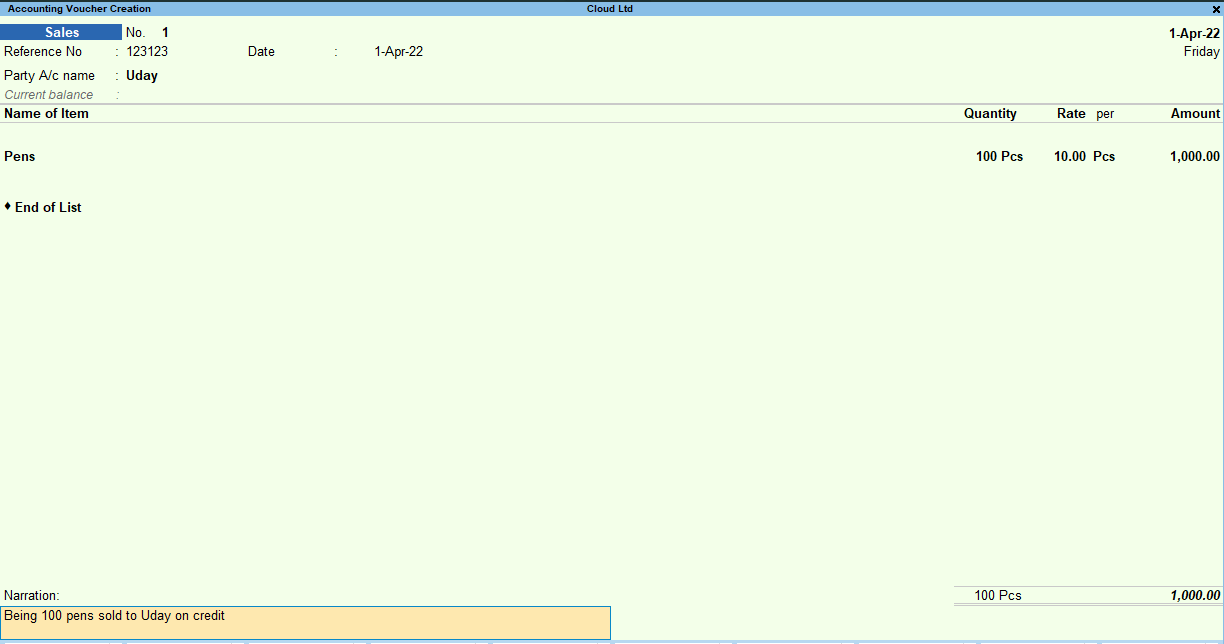

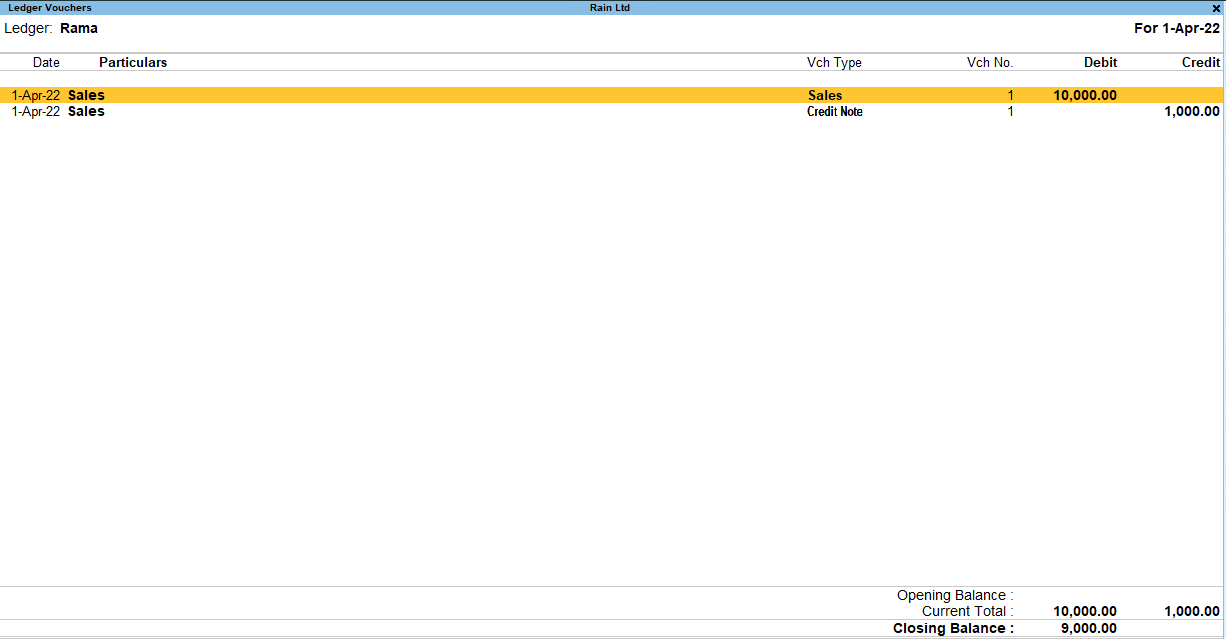

Ledger is the book where the transaction related to a particular account is recorded. For example, the Sales ledger will only record the transactions related to sales.

Ledgers in Tally also serve the same purpose. Posting in the ledger is automatically done when the transactions are entered in the vouchers.

Now, if you want to delete a ledger, you can easily do by following some simple steps.

I have shared the steps of deleting a ledger in Tally Prime and Tally ERP 9 both.

Deleting a ledger in Tally Prime

To delete a ledger in Tally Prime, the steps are as follows:

Gateway of Tally → Alter → Ledger → Click on the ledger you want to delete.

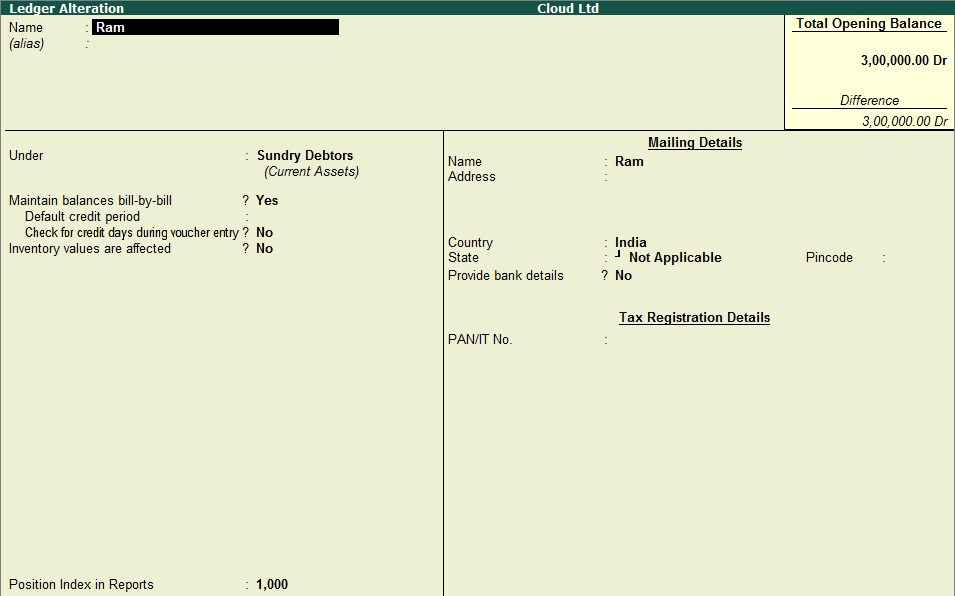

Upon clicking the ledger, the ledger alteration menu will open.

At the bottom, there is a ‘Delete’ option. Either click on it or simply press Alt + D and click on ‘Yes’. Your ledger will be deleted.

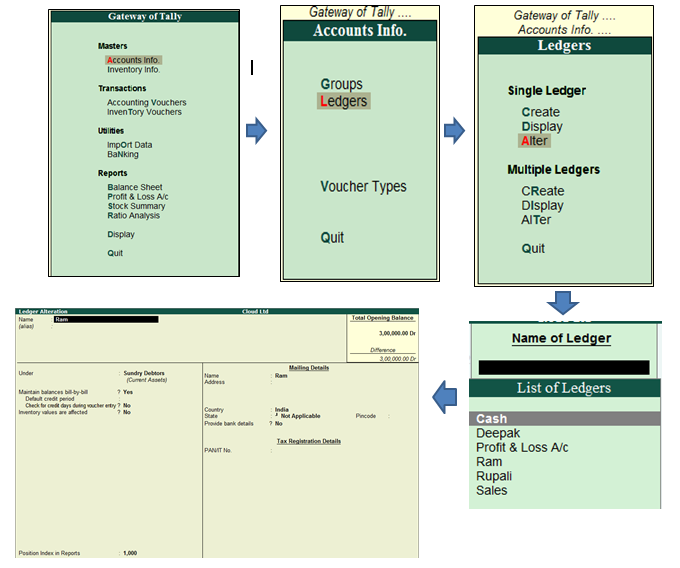

Deleting a ledger in Tally ERP 9

To delete a ledger in Tally ERP 9, the steps are as follows:

Gateway of Tally → Accounts Info → Ledger → Alter → Select the ledger you want to delete.

Steps are almost similar in both versions of Tally. Little difference is there due to the different interfaces of the two versions.

Just like Tally Prime, you can click on the ‘Delete’ option at the bottom or press Alt + D to delete the ledger.

See less