Definition Section 43 of the companies act 2013 prescribes that the share capital of a company broadly can be of two types or classes : Preference shares Equity shares Preference shares Preference shares are the shares that carry the following two preferential rights : Preferential rights to receivRead more

Definition

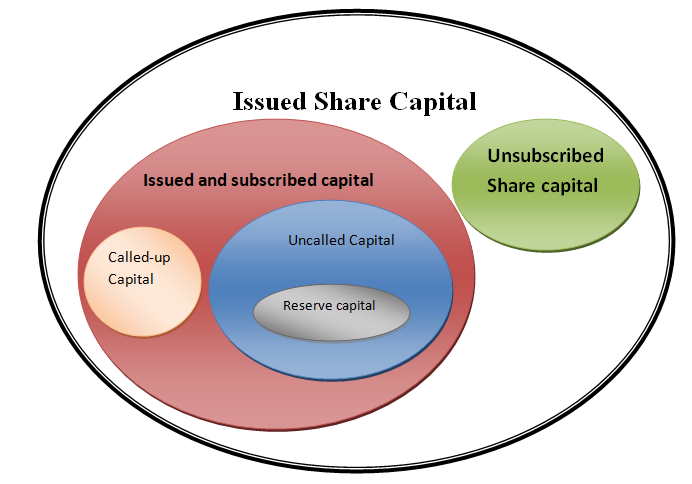

Section 43 of the companies act 2013 prescribes that the share capital of a company broadly can be of two types or classes :

- Preference shares

- Equity shares

Preference shares

Preference shares are the shares that carry the following two preferential rights :

- Preferential rights to receive dividends, to be paid as a fixed amount or an amount calculated at a fixed rate, which may either be free of or subject to income tax before it is paid to equity shareholders, and

- Return of capital on the winding up of the company before that of equity shares.

Classes of preference shares

Preference shares are broadly classified as follows :

- With reference to the dividend

- Participation in surplus profit

- Convertibility

- Redemption

With reference to the dividend

Cumulative preference shares are those preference shares that carry the right to receive arrears of dividends before the dividend is paid to the equity shareholders.

Non-cumulative preference shares are those that do not carry the right to receive arrears of dividends.

Participation in surplus profit

Participating preference shares of the company may provide that after the dividend has been paid to the equity shareholders, the holders of preference shares will also have a right to participate in the remaining profits.

Non-participating preference shares are those preference shares that do not carry the right to participate in the remaining profits after the equity shareholders have paid the dividend.

Convertibility

Convertible preference shares are those preference shares that carry the right to be converted into equity shares.

Non-convertible preference shares are those that do not carry the right to be converted into equity shares.

Redemption

Redeemable preference shares are those preference shares that are redeemed by the company at the time specified for the repayment or earlier.

Irredeemable preference shares are preference shares the amount of which can be returned by the company to the holders of such shares when the company is wound up.

Equity shares

Equity shares are those shares that are not preference shares.

Equity shares are the most commonly issued class of shares that carry the maximum ‘risk and reward ‘ of the business the risks of losing part or all the value of the shares if the business incurs losses.

The rewards are the payment of higher dividends and appreciation in the market value.

See less

Overview And Definition Shareholder's equity represents the net value of a company. As an accounting measure, shareholders’ equity (also referred to as stockholders’ equity) is the difference between a company’s assets and liabilities. It is also called the book value of equity. For example – retainRead more

Overview And Definition

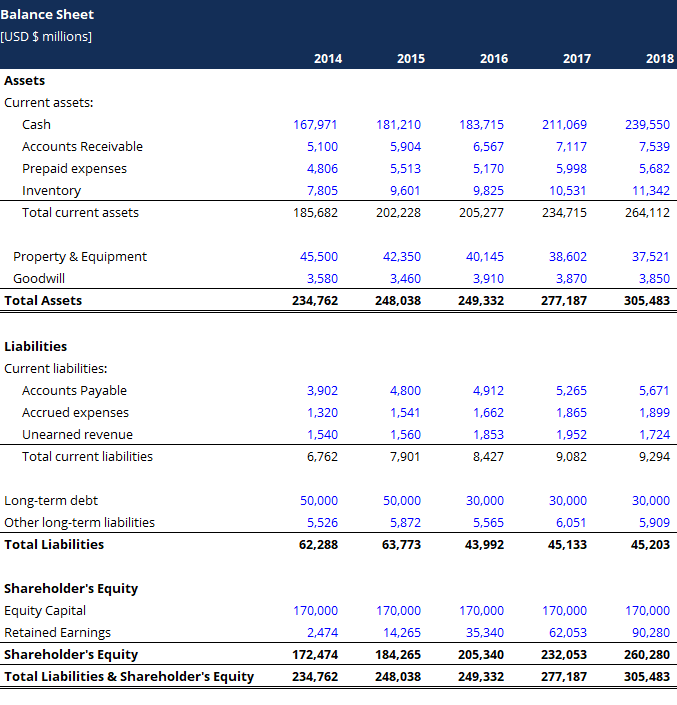

Shareholder’s equity represents the net value of a company. As an accounting measure, shareholders’ equity (also referred to as stockholders’ equity) is the difference between a company’s assets and liabilities. It is also called the book value of equity.

For example – retained earnings, common stock, etc.

Liabilities

Liabilities are the obligation or something a company or a person owes to another party. normally it is in cash form but it can be in other forms also.

And these liabilities need to be settled as per the terms agreed upon by the party.

For example – taxes owned, trade payables, etc.

Assets

Assets are those which has ownership of a company and controlling power with the company. In other words, Or something which will generate profits today and in the future.

For example – cash, building, etc.

Conclusion

Therefore I can conclude that stockholders’ equity refers to the assets remaining in a business once all liabilities have been settled, or I can say as it is not the same thing as the company’s assets. Assets are what the business owns.

How to Calculate Shareholders’ Equity

Shareholders’ equity is the owner’s claim when assets are liquidated, and debts are paid up. It can be calculated using the following two formulas:

Formula 1:

Shareholders’ Equity = Total Assets – Total Liabilities

Formula 2:

Shareholders’ Equity = Share Capital + Retained Earnings – Treasury Stock

Let me now take the example of a small business owner who is into the business of chairs in India.

As per the balance sheet of the proprietorship firm for the financial year ending on March 31, YYYY, the following information is available. Determine the shareholders’ equity of the firm.

Given, Total Assets = Net property, plant & equipment + Warehouse premises + Accounts Receivable + Inventory

= Rs (1000,000 + 300,000 + 500,000 + 800,000)

Total Assets = Rs 2600,000

Again, Total liabilities = Net debt+ Accounts payable + Other current liabilities

= Rs (700,000 + 700,000 + 600,000)

Total Liabilities = Rs 2,000,000

Therefore, the shareholders’ equity of the firm as on March 31, YYYY, can be calculated as,

= Rs (2600,000 – 2,000,000)

Shareholders’ Equity = Rs 600,000

Therefore, the shareholders’ equity, as of March 31, YYYY, stood at Rs 600,000.

See less