Reserve capital is part of ‘Uncalled capital’. ‘Uncalled capital’ means the outstanding amount on shares on which the call money is not yet called. A company may issue its shares and receive the money either in full or in instalments. The instalments are named: Application money – Received by a compRead more

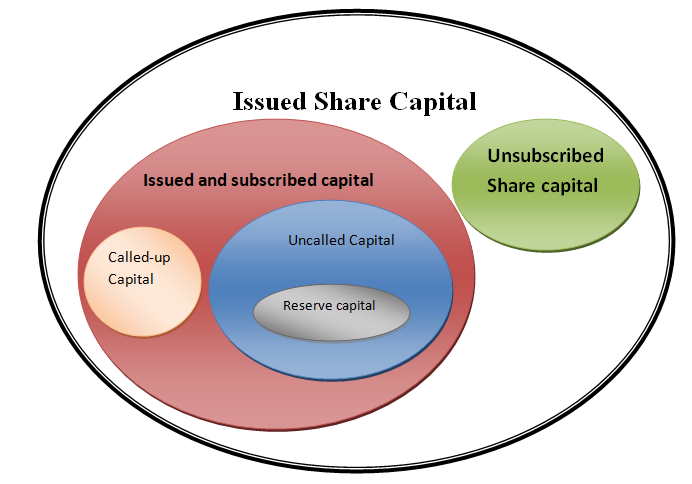

Reserve capital is part of ‘Uncalled capital’. ‘Uncalled capital’ means the outstanding amount on shares on which the call money is not yet called.

A company may issue its shares and receive the money either in full or in instalments. The instalments are named:

- Application money – Received by a company from the people who apply for allotment of the shares.

- Allotment money – Called by the company from the people to whom the shares are allotted at the time of allotment.

- Call money – The outstanding amount is called by way of call money in one or more instalments.

For example, X Ltd issues 1000 shares at a price of Rs. 100 per share which is payable Rs. 25 at application, Rs. 30 at the allotment, Rs. 25 at the first call and Rs. 20 at the second and final call.

The shares at fully subscribed and X Ltd has called and received money till the first call. The second call is not made yet.

This amount of Rs 20,000 (1000 x Rs.20) will be uncalled capital.

Now, It is up to the management when to make the second and final call.

If the management shows no intention of calling the outstanding money on such shares, then the uncalled capital will be called reserve capital.

Such shares which are not fully called are known as party paid shares.

It is ultimately payable to the company by the shareholders of partly paid shares at the time of dissolution.

Reserve capital is not shown either in the balance sheet or in the notes to accounts to the balance sheet. But one can ascertain it just by examining the notes to accounts to the balance. If the shares are partly paid and the management seems to have no intention of calling the outstanding money then such uncalled share capital is reserve capital.

Reserve capital is neither a liability nor an asset for the company.

But at the time of winding up of the company, it becomes a liability for the shareholders to pay the balance amount of their shares.

By now, you must have understood why reserve capital is not part of unsubscribed capital. It is because reserve capital is related to shares that are issued and subscribed.

Let us begin with a short explanation of what Calls-in-Advance is: Whenever a company accepts money from its shareholders for calls not yet made, then we call it calls-in-advance. To put it in even simpler terms, it is the amount not yet called up by the company but paid by the shareholder. An imporRead more

Let us begin with a short explanation of what Calls-in-Advance is:

Whenever a company accepts money from its shareholders for calls not yet made, then we call it calls-in-advance. To put it in even simpler terms, it is the amount not yet called up by the company but paid by the shareholder. An important thing to note here is that a company can accept calls-in-advance from its shareholders only when authorized by its Articles of Association.

Calls-in-advance is treated as the company’s liability because it has received the money in advance, which has not yet become due. Till the amount becomes due, it will be treated as a current liability of the company.

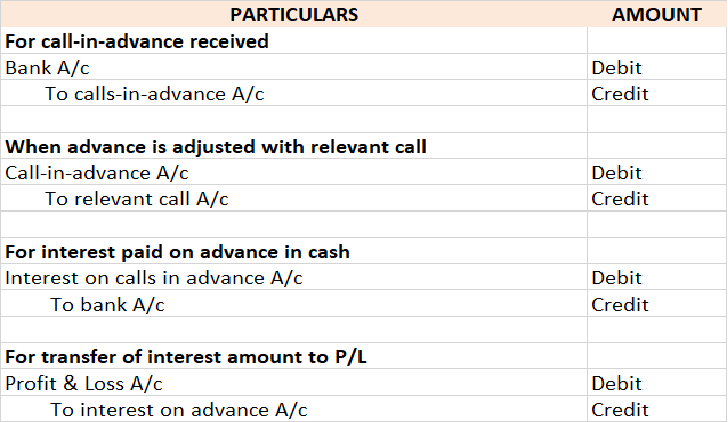

The journal entry for recording calls-in-advance is as follows:

The money received from the shareholder is an asset for the company and therefore Bank A/c is debited with the amount received as calls-in-advance. The calls-in-advance A/c is credited because it is a liability for the company.

Since Calls-in-Advance is a liability, it is shown in the Equities and Liabilities part of the Balance Sheet under the head Current Liabilities and sub-head Other Current Liabilities.

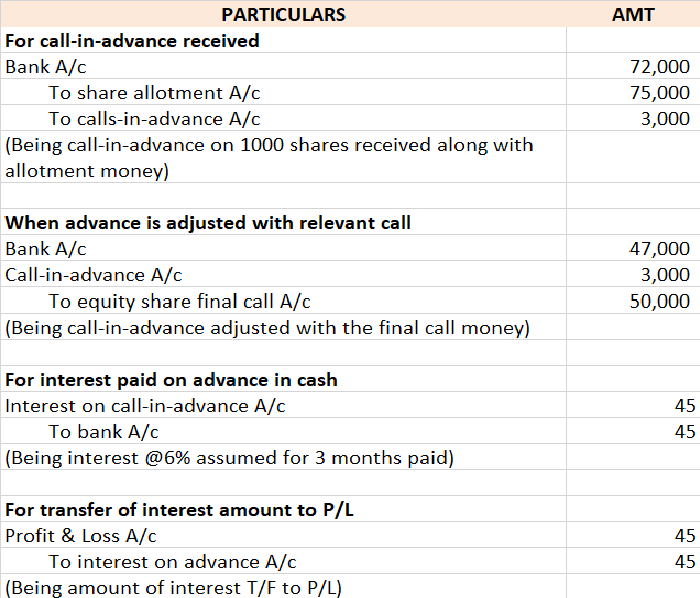

For better understanding, we will take an example,

ABC Ltd. made the first call of 3 per share on its 10,00,000 equity shares on 1st May. Max, a shareholder, holding 5,000 shares paid the final call amount 2 along with the first call money. Now let me show the journal entry to record calls-in-advance.

In the Balance Sheet, I will show calls-in-advance in the following manner,

The calls-in-advance of 10,000 is shown under the Equities and Liabilities side of the balance sheet under the head current liabilities and sub-head other current liabilities. It will be shown as a liability till the final call money becomes due. The amount received by the company from Max is shown on the Assets side of the balance sheet under head current assets and under the sub-head cash and cash equivalents.

See less