As the name suggests, unrecorded liabilities means the liabilities that a firm fails to record in its book of accounts. Usually, a firm gets to know about its unrecorded liabilities when it is about to get dissolved. What happens is that upon hearing that a firm is going to dissolve in near future,Read more

As the name suggests, unrecorded liabilities means the liabilities that a firm fails to record in its book of accounts.

Usually, a firm gets to know about its unrecorded liabilities when it is about to get dissolved. What happens is that upon hearing that a firm is going to dissolve in near future, its creditors and lenders report to the firm about their dues.

At that time, a firm may get to know that it had failed to record some liabilities in its books and it has settled them now.

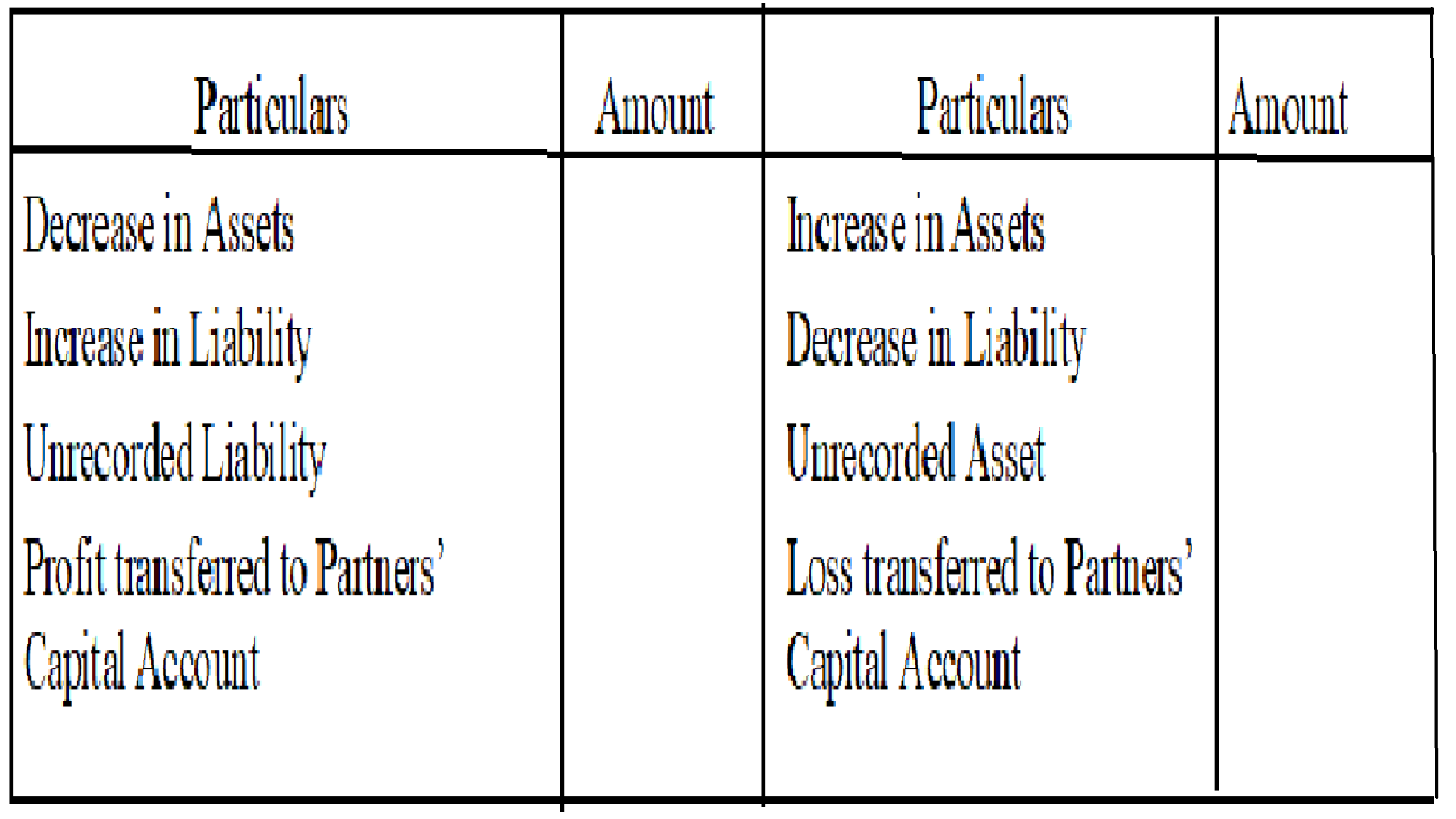

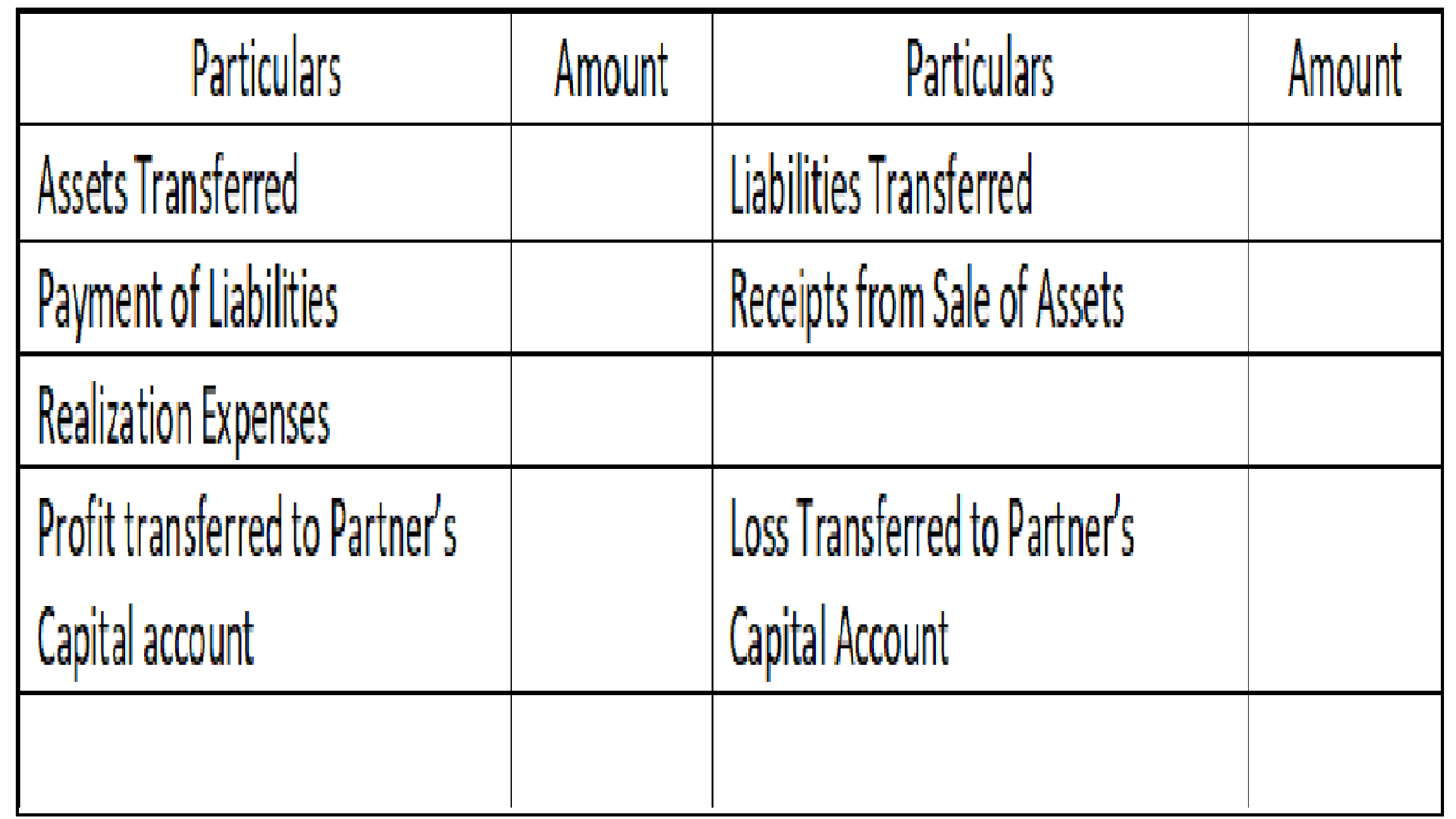

We know that when a partnership firm is dissolved, a realisation account is created to which all the assets and liabilities of the firm are transferred. Entries are as given below:

Realisation A/c Dr. ₹ Amt

To Assets A/c ₹ Amt

( Asset transferred to realisation account)

Liabilities A/c Dr. ₹ Amt

To Realisation A/c ₹ Amt

(Liabilities transferred to realisation account)

Hence, for transferring unrecorded liabilities, the procedure is the same for the recorded liabilities:

Unrecorded Liabilities A/c Dr. ₹ Amt

To Realisation A/c ₹ Amt

( Unrecorded liabilities transferred to realisation account)

Then to pay off the unrecorded liability the entry is:

Realisation A/c Dr. ₹ Amt

To Cash / Bank A/c ₹ Amt

(Unrecorded liabilities paid off)

That’s it, I hope I was able to make you understand.

See less

Types of Partnership A partnership is an agreement between two or more people who comes together to run a business. There are different types of partnerships formed with different perspectives as mentioned: General Partnership Limited Partnership Limited Liability Partnership Partnership at will ParRead more

Types of Partnership

A partnership is an agreement between two or more people who comes together to run a business.

There are different types of partnerships formed with different perspectives as mentioned:

General Partnership

Limited Partnership

Limited Liability Partnership

Partnership at will

Partnership for a fixed term

General Partnership

It refers to the partnership where all partners actively manage the business and have unlimited legal liability. Generally, all the partners share equal profit and loss in the business and are also equally liable for the outsider’s loan.

All the partners are responsible for the business’s day-to-day operations and managerial responsibility.

If the partners decided to share profit and loss in any other ratio (unequal ratio), then they have to disclose this in a agreement called a partnership deed.

In this, debts are equally borne by selling the partners assets of all the partners. In case of dissolution, if the partnership firm has taken a loan from outsiders and does not have sufficient funds to repay the amount then the payment can be done by selling the partner’s personal property.

It can be formed by signing the partnership agreement that would be proved as evident in case of disagreement among partners. For instance, if any partner dies or leaves the firm then they should follow the content of the agreement.

A general partnership does not pay the tax instead the partners personally report their income tax return.

Limited Partnership

In a Limited partnership, all the partners contribute capital but not necessarily all of them manage the business.

The old partners add a new partner into the partnership to fulfill the financial needs of the business i.e. for capital. The rights of decision-making are issued to new partners on the basis of their contribution of capital. The new partner is not associated with day-to-day business activities. He /She is called a limited partner or silent partner.

The liability partner has limited liability to the extent of his capital. The personal assets of the limited partner can not be used for the payment of the firm’s liability.

Limited Liability Partnership

It is a more popular type of partnership in today’s world. To form an LLP you have to register under the Limited Liability Partnership Act, 2008.

In this, all the partners have limited liability to the extent of the capital investment in the business. The personal assets of the partners can not be used to discharge the liability of the partnership.

A Minimum of 2 partners are required to form an LLP. However, no maximum limit on a number of partners.

It has also some features of the company. It has a separate legal entity. The LLP can buy property in its own name and sue and be sued in its name.

LLPs are often formed by professionals like Chartered Accountants, doctors and Legal firms.

Features

Partnership at will

Partnership at will is a form of business where there is no fixed tenure of the partnership. That means there is no expiration of the partnership. But if the partnership is formed for a fixed duration and its period has expired and still continues then it will become a partnership at will.

Partnership for a fixed term

The partnership is created for a fixed duration of the interval. After the expiration of such duration, the partnership may come to an end.

If the partners share profit and loss even after the expiration of the duration of the partnership then it will become a partnership at will.

See less