The Realisation account is prepared at the time of dissolution of the Partnership firm to ascertain profit or loss from the sale of assets and payment of liabilities of the firm. All assets that can be converted into cash (i.e. from which any value can be realised) and all external liabilities thatRead more

The Realisation account is prepared at the time of dissolution of the Partnership firm to ascertain profit or loss from the sale of assets and payment of liabilities of the firm. All assets that can be converted into cash (i.e. from which any value can be realised) and all external liabilities that are to be paid are recorded in the Realisation A/c.

DISSOLUTION OF PARTNERSHIP FIRM

It means the firm closes down its business and comes to an end. Simply, it means the firm will cease to exist in the future. As the firm is closing down, it will sell all its assets to realise all the value blocked in the assets, it is liable to pay off all of its liabilities whether due now or on some future date, and the remaining amount (if any) is distributed among the partners.

REALISATION ACCOUNT

This account is prepared only once, at the time of dissolution of the Partnership firm. It is opened to dispose of all the assets of the firm and make payments to all the external creditors of the firm.

It ascertains the profit earned or loss incurred on the realisation of assets and payment of liabilities.

The Realisation account is a NOMINAL ACCOUNT (Debit all expenses and losses, Credit all incomes and gains)

ITEMS RECORDED IN THE REALISATION ACCOUNT

DEBIT SIDE OF REALISATION ACCOUNT

1. TRANSFER OF ASSETS

Assets are any property or the possession of the business enterprise that allows it to get cash or any other benefit in the future.

Since all assets are sold at the time of the dissolution, all assets that can be converted into cash are transferred to the Debit side of the Realisation A/c at their book values.

Such as Plant & Machinery, Building, Debtors, etc.

EXCEPTIONS

- Cash and Bank balances (as already in the most liquid form)

- Fictitious assets ( Don’t have any realisable value)

NOTE – If there is any provision against any asset, such as ‘Provisions for Bad debts’ or ‘Provision for Depreciation, then such assets are transferred to the Debit side of the Realisation A/c at its gross value and the Provision is transferred to the Credit side of the Realisation A/c.

For example – Suppose there are Debtors of $50,000 and the Provision for Doubtful Debts is $2,000.

Then, Debtors will be recorded on the Debit side with a value of $50,000 and the Provision for Doubtful Debt on the Credit side with the amount of $2,000.

2. PAYMENT OF LIABILITIES

All liabilities are either paid in cash or the Partner agrees to pay for some liabilities. Since they are expenses, they are recorded on the debit side of the Realisation A/c as “Debit all expenses and Losses”

3. PROFIT ON REALISATION

There is profit when Cr. side > Dr. side, as it means incomes are more than the payments made. This profit is distributed among the partners.

CREDIT SIDE OF THE REALISATION ACCOUNT

1. TRANSFER OF LIABILITIES

Liabilities refer to the amount owed by the firm to outsiders. All liabilities must be paid off before accounts are closed. So, all external liabilities are transferred to the Credit side of the Realisation account, to make their payment.

Such as creditors, bills payable, loans, outstanding expenses, partner’s wife’s loan, etc.

EXCEPTION (not included)

- Partner’s loan (internal liability and a separate account is created for it)

- Undistributed Profits (like General reserve, Credit balance of P&L A/c, etc. because they belong to partners and are distributed among them. Also, they can’t be sold)

2. SALE OF ASSETS

Assets can be sold for cash or taken by the Partner. The amount received from the sale of assets is recorded on the credit side of the Realisation account as “Credit all incomes and gains”.

Also, if any asset is given to the creditors in part or full payment of his dues, then the agreed amount is deducted from the creditor’s claim and no other entry is passed.

3. LOSS ON REALISATION:

There is a loss, if the Dr. side> Cr. side, which means Expenses > Incomes. This loss is also distributed among the Partners.

See less

Unrecorded Assets are the assets that are completely written off but still physically available in the company or assets that are not shown in the books of the company. Unrecorded assets are generally recorded or recognized at the event of admission, retirement, death of a partner when all the assetRead more

Unrecorded Assets are the assets that are completely written off but still physically available in the company or assets that are not shown in the books of the company.

Unrecorded assets are generally recorded or recognized at the event of admission, retirement, death of a partner when all the assets and liabilities are revalued or dissolution of the firm.

Since Accounting Standards require firms to record all the assets and liabilities in their books, it is therefore mandatory to record such unrecorded assets.

There can be two cases for treatment of such unrecorded assets:

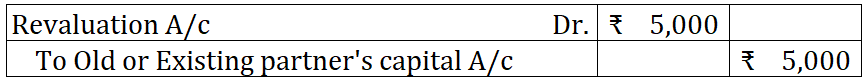

The unrecorded asset is now debited since it has to be recorded in the books now and Revaluation Account is credited since it is again for the business which will eventually be transferred to Partners’ Capital Account.

If a partner decides to take over an unrecorded asset then his account is credited with that amount and since cash paid by the partner comes into business Cash Account is debited.

When an unrecorded asset is discovered during the dissolution of the firm, such an asset is sold directly to the outsider and as a result, cash A/c is debited since the cash is entering the business. The entry is made through the Revaluation A/c and it is hence credited.

Example:

At the time of revaluation, firms find a typewriter that has not been recorded in the books and is valued at Rs 10,000. The journal entry to record that typewriter will be:

See less