A statutory reserve is any reserve that has to be maintained by an Act or law. When it comes to insurance, a statutory reserve is a reserve that an insurance company is legally bound to maintain to ensure that the company is able to meet its policy obligations. In India, as per the Banking RegulatioRead more

A statutory reserve is any reserve that has to be maintained by an Act or law. When it comes to insurance, a statutory reserve is a reserve that an insurance company is legally bound to maintain to ensure that the company is able to meet its policy obligations. In India, as per the Banking Regulations Act, every banking company has to maintain at least 25% of its net profits as statutory reserves.

The companies are required to maintain such reserves to guarantee the availability of cash when it is required by the customer. Common examples of statutory reserves are Cash reserve ratio (CSR), Statutory Liquidity Ratio (SLR).

Treatment

- Statutory reserves are shown in the Profit and Loss account under the head “appropriations”.

- It is also shown under the head Reserves and Surplus (Schedule 2) in the Balance Sheet.

Method

Rule-Based Approach – The company calculates the amount required by using standard formulas. However, since they are pre-determined formulas, it does not cover all risk determining factors.

Principle-based approach – This method is used to protect customers and ensure that the company stays solvent. They hold a higher amount of reserves than required after predicting all possible risks.

Statutory reserves are different from general reserves as general reserves are maintained voluntarily by the company. A company that does not follow statutory requirements will face financial penalties. These reserves are mostly maintained in the form of cash.

Maintenance of reserves gives confidence to investors that their money is secure. However, funds from these reserves can be used only for specific purposes. They should also maintain such reserves whether or not they earn profits.

See less

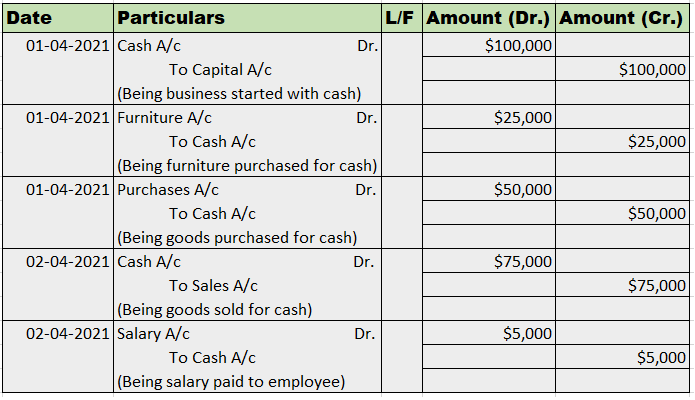

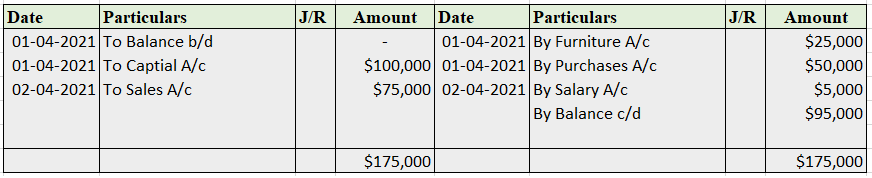

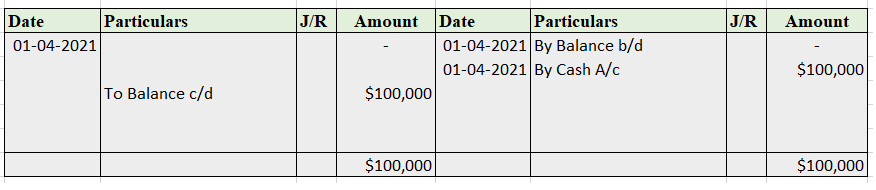

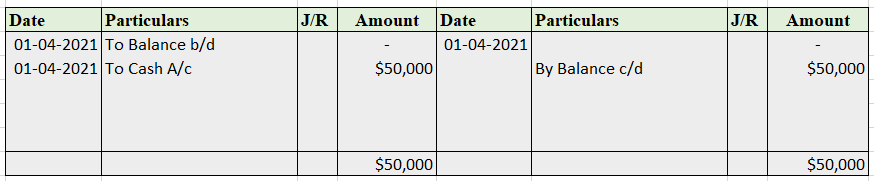

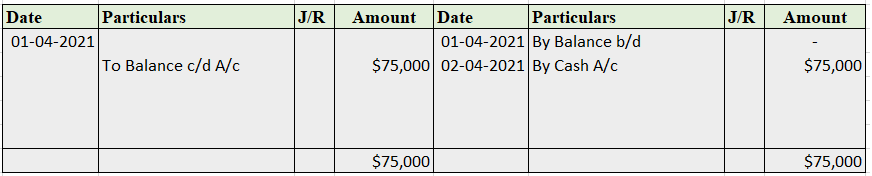

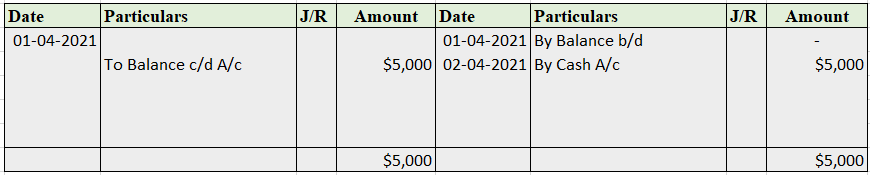

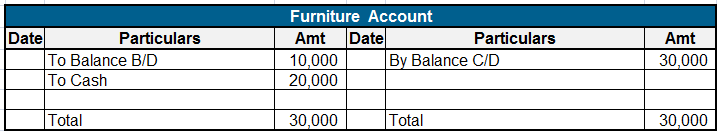

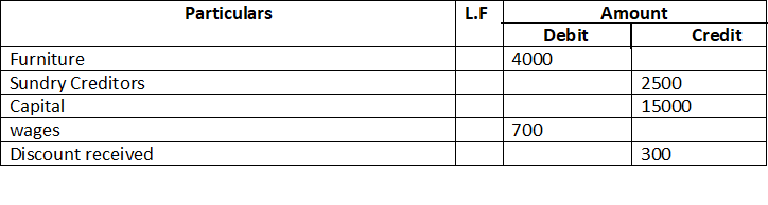

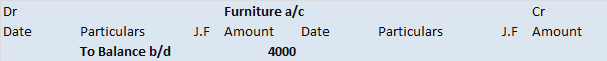

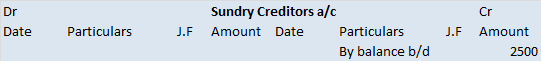

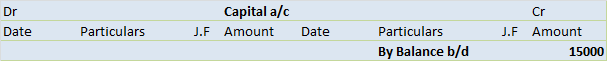

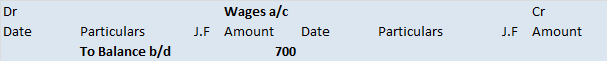

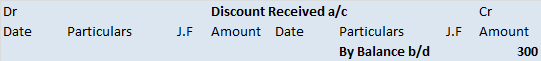

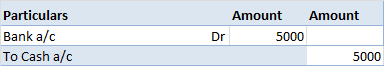

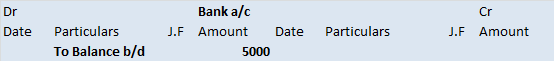

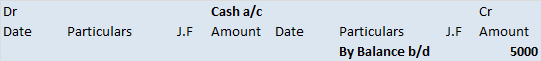

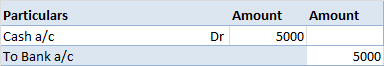

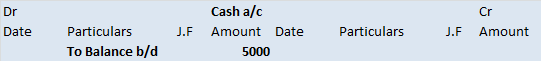

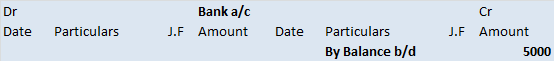

The trial balance shows the opening balance of various accounts. Now posting them in ledger accounts.

The trial balance shows the opening balance of various accounts. Now posting them in ledger accounts.

No, they are not the same. They are both used to measure the short term liquidity of a business but their approach is different. Following are the differences between the two : Let’s take an example. Following is the balance sheet of X Ltd: Hence, as per the following information, Current Ratio = CuRead more

No, they are not the same. They are both used to measure the short term liquidity of a business but their approach is different. Following are the differences between the two :

Let’s take an example.

Following is the balance sheet of X Ltd:

Hence, as per the following information,

Current Ratio = Current Assets / Current Liabilities

= Inventories + Trade debtors + Bills receivables + Cash and bank + Prepaid Expenses / Trade Creditors + Bills Payables + Outstanding Salaries

= ₹85,000 + ₹2,50,000+ ₹95,000 + ₹1,50,000 + ₹10,000/ ₹2,00,000 + ₹75,000 + ₹25,000

= ₹6,00,000 / ₹3,00,000

= 2/1 or 2:1

Quick Ratio = Quick Assets / Current Liabilities

= Trade debtors + Bills receivables + Cash and bank / Trade Creditors + Bills Payables + Outstanding Salaries

= ₹2,50,000+ ₹95,000 + ₹1,50,000 / ₹2,00,000 + ₹75,000 + ₹25,000

= ₹5,05,000/ ₹3,00,000

= 41 / 25 or 1.68 : 1

Let’s discuss both ratios in detail.

1. Current ratio:

The current ratio represents the relationship between current assets and current liabilities

Current ratio = Current Assets/Current Liabilities

It measures the adequacy of the current assets to current liabilities. The main question this ratio tries to answer is: – “Does your business have enough current assets to meet the payment schedule of its current debts with a margin of safety for possible losses in current assets?”

The generally acceptable current ratio is 2:1. But it depends on the characteristics of the assets of a business to judge whether a specific ratio is satisfactory or not.

2. Quick Ratio: Quick ratio is the ratio between quick assets and current liabilities. It is also known as the Acid Test Ratio. By quick assets, we mean cash or the assets that can be quickly converted into cash ( near cash assets)

Quick Assets = Current Assets – Inventories – Prepaid assets

Quick ratio = Quick Assets/Current Liabilities

Inventories are not considered near cash assets.

The quick ratio is a more conservative approach than the current ratio to measure the short term liquidity of a firm.

It answers the question, “If sales revenues disappear, could my business meet its current obligations with the readily convertible quick funds on hands?”

1:1 is considered satisfactory unless the majority of the quick asset are accounts receivable and the receivables turnover ratio is low.

See less