Whenever the proprietor/owner of a business withdraws cash or goods from the business for his/her personal use, we call it drawings. For example, Alex, proprietor of a soap manufacturing company, takes 50 pack of soaps costing 30 each for his personal use. So, 1,500 (50*30) will be considered as draRead more

Whenever the proprietor/owner of a business withdraws cash or goods from the business for his/her personal use, we call it drawings. For example, Alex, proprietor of a soap manufacturing company, takes 50 pack of soaps costing 30 each for his personal use. So, 1,500 (50*30) will be considered as drawings of Alex. One important thing to note here is whenever goods are withdrawn for personal use they are valued at cost.

Drawings are not an asset/liability/expense/income to the business. The drawings account is a contra-equity account. A contra-equity account is a capital account with a negative balance i.e. debit balance. It reduces the owner’s equity/capital.

Drawings being a contra-equity account has a debit balance, reducing the owner’s capital in the business. This is because withdrawals for personal use represent a reduction of the owner’s equity in the business.

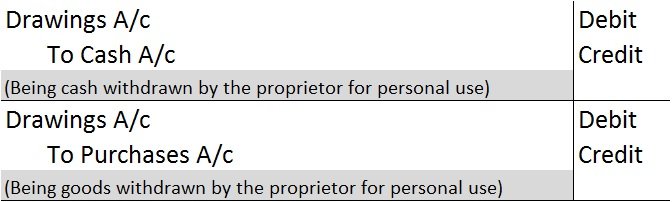

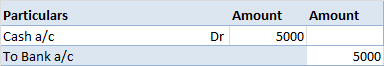

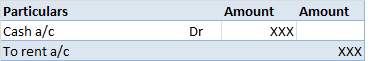

Drawings are not shown in the Income Statement as they are neither an expense nor an income for the business. However, the following journal entries are passed to record drawings for the year:

Drawings A/c is debited because it reduces the owner’s capital. Cash/Purchases A/c is debited as a withdrawal reduces the assets of the business.

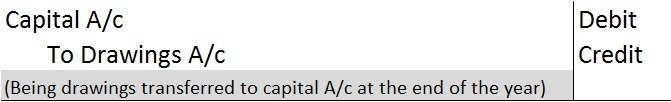

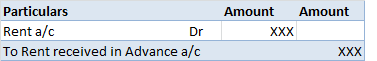

At the end of the year, drawings A/c are closed by transferring it to the owner’s capital A/c. We post the following entry to close the drawings A/c at the end of the year:

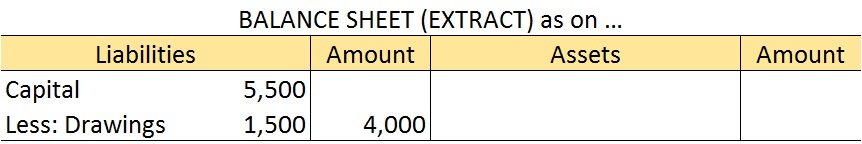

In the balance sheet, drawings are shown by deducting it from the owner’s capital A/c.

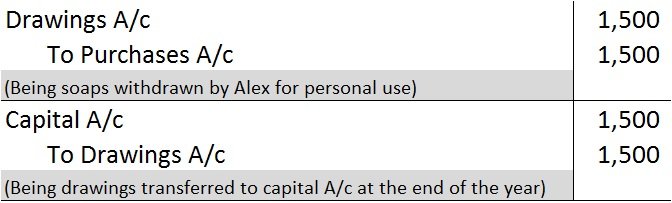

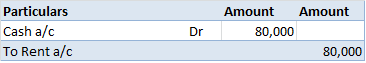

Let us take our earlier example of Alex. He withdrew soaps worth 1,500. At the end of the year, his capital was worth 5,500. The journal entry for recording the drawings is as follows:

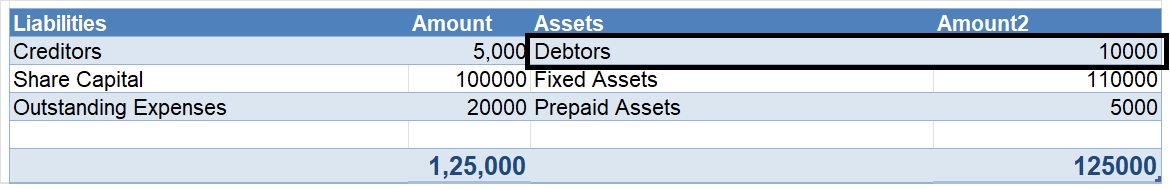

In the balance sheet, drawings worth 1,500 are shown as follows:

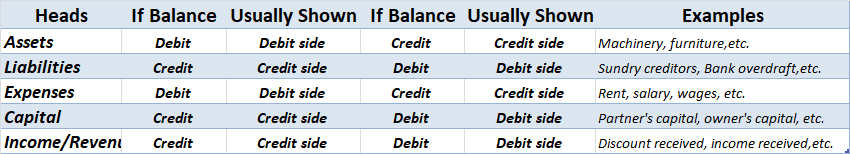

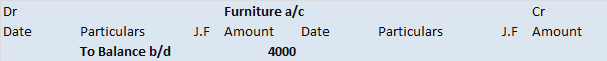

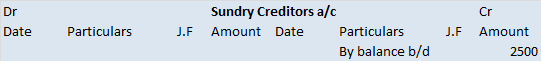

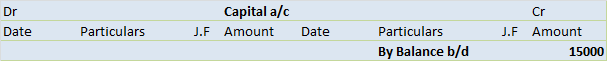

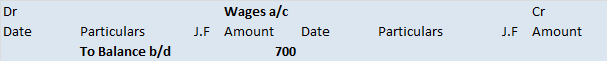

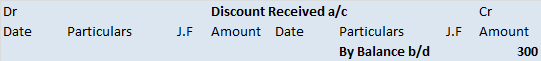

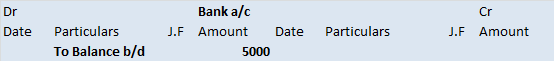

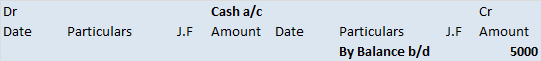

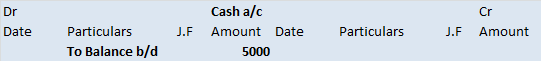

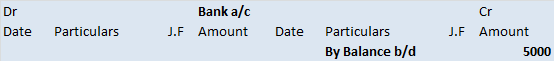

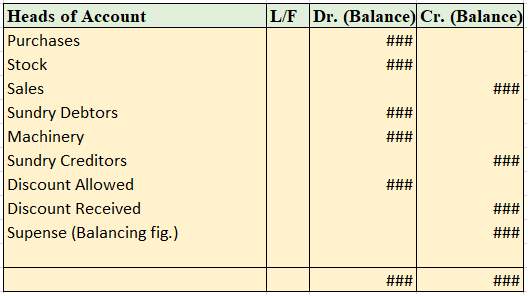

The trial balance shows the opening balance of various accounts. Now posting them in ledger accounts.

The trial balance shows the opening balance of various accounts. Now posting them in ledger accounts.

When a company issues shares to shareholders at a price over the face value (at a premium), that amount is termed as securities premium. This amount is transferred to what we call the securities premium reserve. The company is required to maintain a separate reserve for securities premium. UtilizatiRead more

When a company issues shares to shareholders at a price over the face value (at a premium), that amount is termed as securities premium. This amount is transferred to what we call the securities premium reserve. The company is required to maintain a separate reserve for securities premium.

Utilization

Securities premium reserve can be used for the following reasons:

Since it is not a free reserve, it can only be used for a few specific purposes. The amount received as securities premium cannot be used to transfer dividends to shareholders

Treatment

When a company issues shares at a premium, the securities premium reserve account is credited along with share capital as an increase in capital is credited according to the modern rule of accounting.

For example,

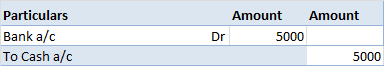

Sonly Ltd. issues 1,000 shares of $10 face value at $15. Here, the amount of premium would be $5 (15 – 10) per share. Therefore, the journal entry would show:

Bank a/c (15 x 1,000) Dr 15,000

To Share Capital (10 x 10,000) 10,000

To Securities Premium Reserve a/c (5 x 10,000) 5,000

From the above example, we can see that the company receives $15,000, but transfers $10,000 to share capital and the excess $5,000 to securities premium reserve.

In the balance sheet, this securities premium reserve is shown under the title “Equity and Liabilities” under the head ‘‘Reserves and Surplus”.

See less