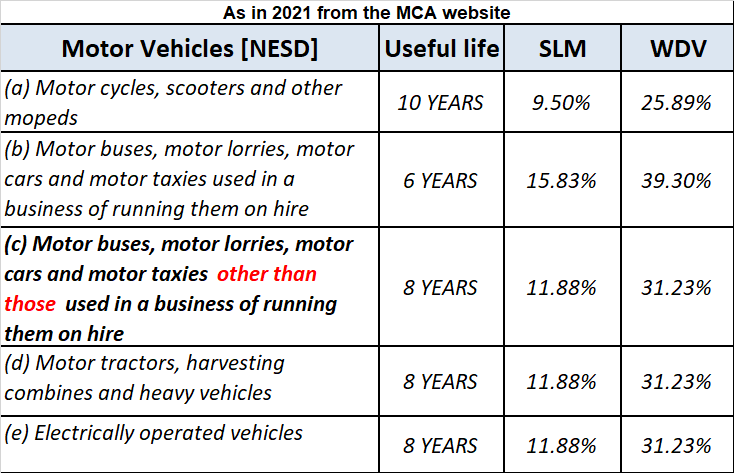

Depreciation refers to that portion of the value of an asset that is written off over the useful life of the asset due to wear and tear. Now, when we talk about depreciation, there are multiple methods to calculate depreciation such as: Straight Line Depreciation Method Diminishing Balance Method OrRead more

Depreciation refers to that portion of the value of an asset that is written off over the useful life of the asset due to wear and tear.

Now, when we talk about depreciation, there are multiple methods to calculate depreciation such as:

- Straight Line Depreciation Method

- Diminishing Balance Method Or Written Down Value Method

- Sum of Years’ Digits Method

- Double Declining Balance Method

- Sinking Fund Method

- Annuity Method

- Insurance Policy Method

- Discounted Cash Flow Method

- Use Based Methods

- Output Method

- Working Hours Method

- Mileage Method

- Other Methods

- Depletion Method

- Revaluation Method

- Group or Composite Method

The most commonly used methods are discussed below:

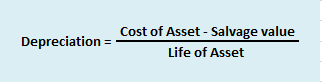

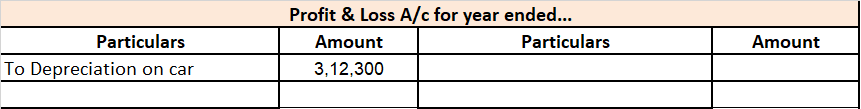

1. Straight Line Depreciation Method: This is the simplest method for calculating depreciation where a fixed amount of depreciation is charged over the useful life of the asset.

Formula:

Suppose a company Bear Ltd purchases machinery costing 8,00,000 with useful life of 10 years and salvage value 1,00,000. Then depreciation charged to the machinery each year would be:

Depreciation = (8,00,000 – 1,00,000)/10 = 7,00,000/10 = 7,000 p.a.

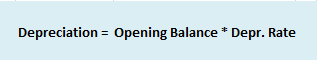

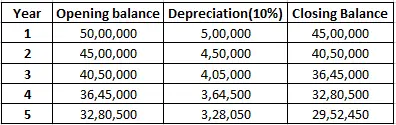

2. Diminishing Balance Method Or Written Down Value Method: Under this method, a fixed rate of depreciation is charged every year on the opening balance of the asset which is the difference between the previous year’s opening balance and the previous year’s depreciation. Here the book value of asset reduces every year and so does the depreciation amount.

Formula:

Suppose a company Moon ltd purchases a building for 50,00,000 with a useful life of 5 years and decides to depreciate it @ 10% p.a. on Diminishing Balance Method. Then depreciation charged to the machinery would be:

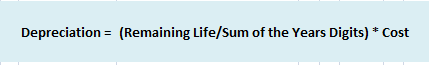

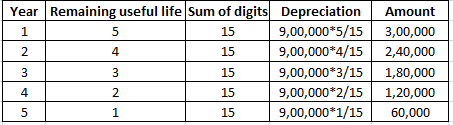

3. Sum of Years’ Digits Method: In this method, the life of asset is divided by the sum of years and multiplied by the cost of the asset to determine the depreciating expense. This method allocates higher depreciation expense in the early years of the life of the asset and lower depreciation expense in the latter years.

Formula:

Suppose a company Caps Ltd purchases machinery costing 9,00,000 having a useful life of 5 years. Then the depreciation cost would be:

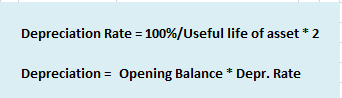

4. Double Declining Balance method: This method is a mixture of straight-line method and diminishing balance method. A fixed rate of depreciation is charged on the reduced value of the asset at the beginning of the year. This rate is double the rate charged under straight-line method.

Formula:

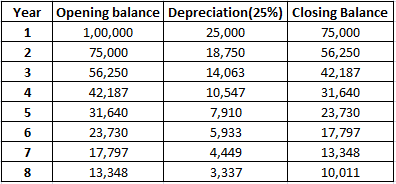

Suppose a company Paper Ltd purchases machinery for 1,00,000 with an estimated useful life of 8 years. Then the depreciation rate would be:

Straight line = 100%/8 = 12.5%

Double declining method = 2*12.5% = 25%

5. Sinking Fund Method: Under this method, the amount of depreciation keeps on accumulating till the asset is completely worn out. Depreciation is the same every year. Profits equal to the amount of depreciation is invested each year outside the company. At the time of replacement of the asset the investments and sold and the proceeds thereof are used to purchase the new asset.

6. Annuity Method: This method calculates depreciation by calculating its internal rate of return (IRR). Depreciation is calculated by multiplying the IRR with an initial book value of the asset, and the result is subtracted from the cash flow for the period.

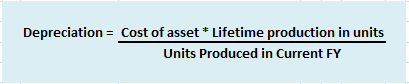

7. Use Based Methods: Depreciation, under these methods, is based on the total estimated machine hours or total estimated units produced during the life of the machine. It is calculated by dividing the cost of the machine by the estimated total machine hours or estimated lifetime production in units and multiplying by the units produced or machine hours worked.

Formula:

Suppose a company Box Ltd purchases machinery for 25,000 (estimated life 5 years) whose estimated life production is 5,000 units. If it produces 700 units in the first year of operation then depreciation cost would be:

Depreciation = 25,000/5,000*700 = 3,500

See less

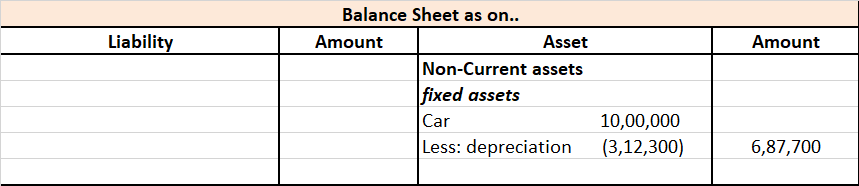

Accrual accounting is an accounting method where revenue or expenses are recorded when a transaction occurs vs. when payment is received or made. The most common accrual accounting examples are sales on credit, purchases on credit, rent paid, electricity expense, depreciation, audit fees, and otherRead more

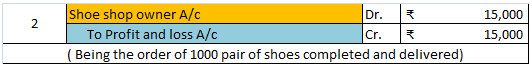

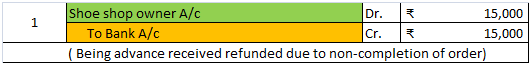

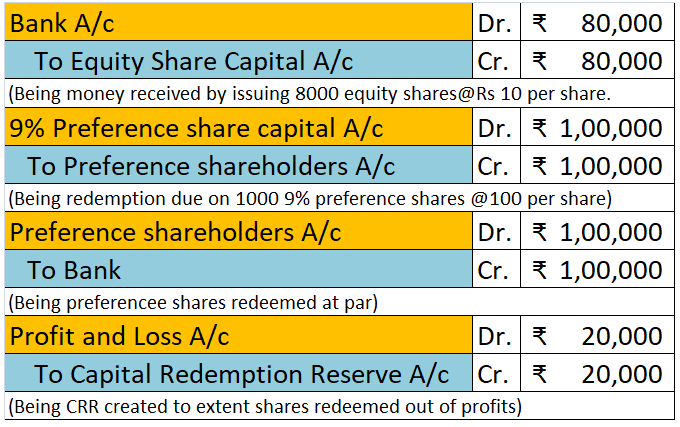

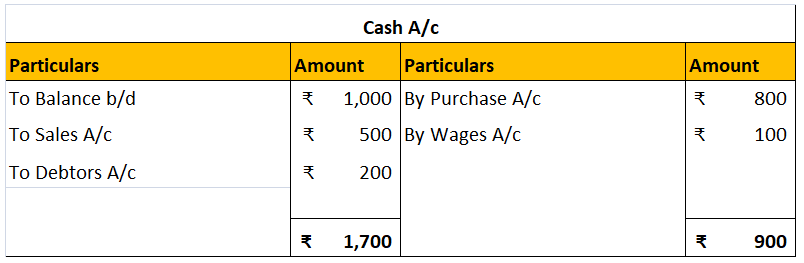

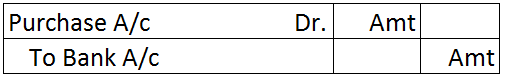

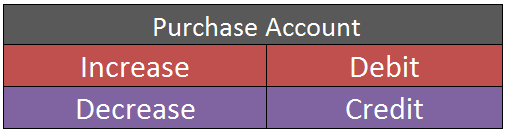

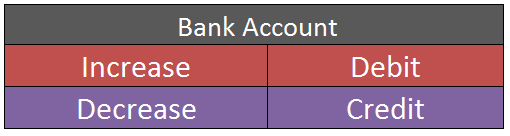

Accrual accounting is an accounting method where revenue or expenses are recorded when a transaction occurs vs. when payment is received or made. The most common accrual accounting examples are sales on credit, purchases on credit, rent paid, electricity expense, depreciation, audit fees, and other such things.

See less