I mean to ask is it real, nominal, or personal and why?

The correct answer is 2. Revenue Expenditure. An honorarium is a voluntary payment paid to a person for the services provided. It is a type of cost incurred for the expenses of guests and volunteers. This is a payment made to the person who is not an employee of the institution. Revenue expendituresRead more

The correct answer is 2. Revenue Expenditure. An honorarium is a voluntary payment paid to a person for the services provided. It is a type of cost incurred for the expenses of guests and volunteers. This is a payment made to the person who is not an employee of the institution.

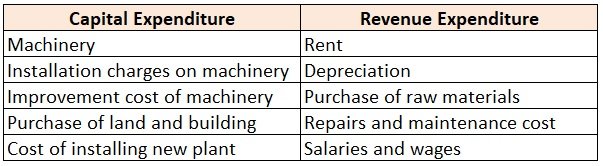

Revenue expenditures are the short-term expenses and consumed within one accounting year and are also known as operating expenses.

Payment of honorarium to the secretary is treated as revenue expenditure because benefits from the expense are derived in the same accounting period. The honorarium is a type of outside expense and any outside expense is revenue in nature. It is a daily allowance incurred to cover the hotel/stay expense.

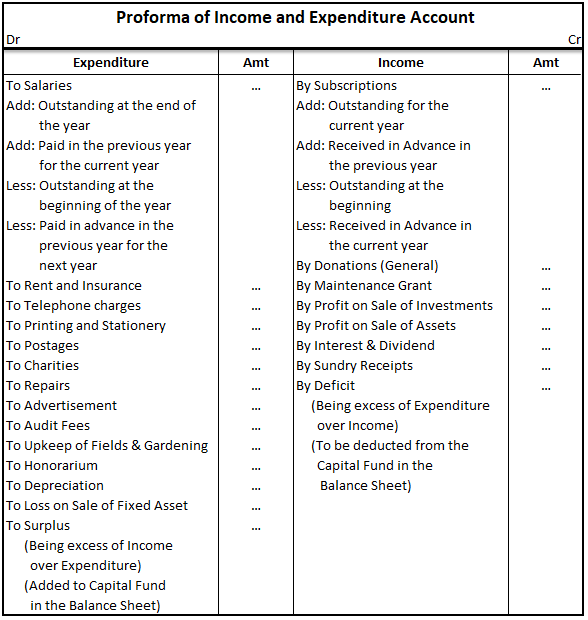

Payment of honorarium to the secretary is shown on the Expenditure side of the Income and Expenditure Account.

Capital Expenditure is the expense incurred on acquiring an asset and honorarium cannot be a capital expenditure as benefits derived from it cannot be carried forward to the next year.

It cannot be treated as cash or credit expense although it is paid in cash or credit. In this case, it will be treated as a revenue expense while preparing financial statements.

Payment of honorarium is mainly a topic of not-for-profit organizations.

See less

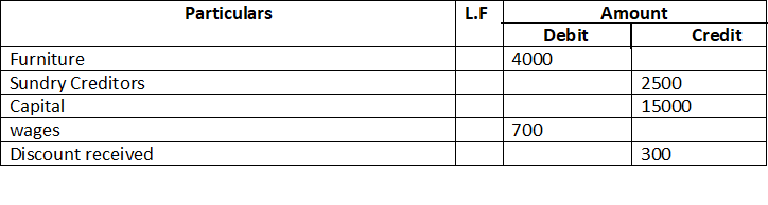

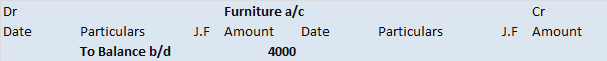

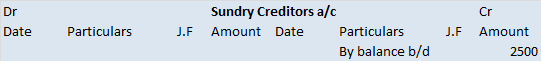

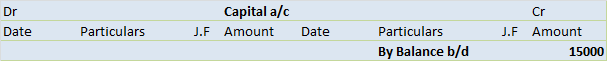

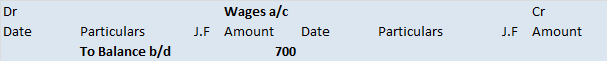

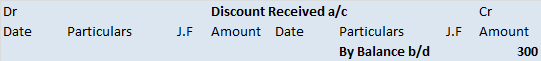

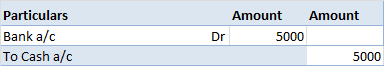

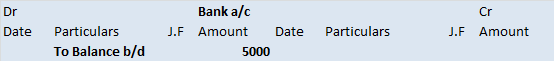

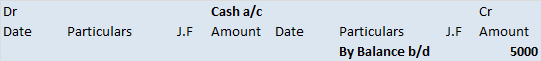

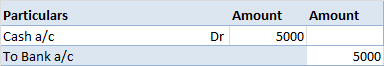

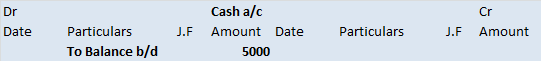

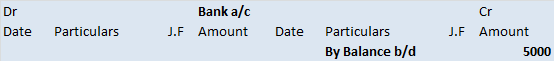

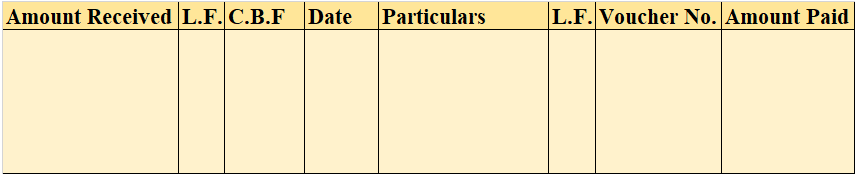

The trial balance shows the opening balance of various accounts. Now posting them in ledger accounts.

The trial balance shows the opening balance of various accounts. Now posting them in ledger accounts.

The correct option is option A. Journal is the book of original entry. It is from the journal, the postings in the ledgers are made. As it is the journal first to record the transactions, it is called the book of original entry. It is from the journal, the postings in the ledgers are made. Ledgers aRead more

The correct option is option A.

Journal is the book of original entry. It is from the journal, the postings in the ledgers are made. As it is the journal first to record the transactions, it is called the book of original entry.

It is from the journal, the postings in the ledgers are made. Ledgers are called the books of principal book of entry.

Option B Duplicate is wrong as there is no such thing as the book of duplicate entry in financial accounting. Journal entries are the first-hand record of business transactions. Hence, it cannot be the book of duplicate entries.

Option C Personal is wrong. This classification of ‘personal’ is a type of account as per traditional rules of accounting, not books of accounts

Option D Nominal is wrong. It is also a type of account as per the traditional rules of accounting.

See less