The correct answer is 4. Not shown in Branch Account. The value of depreciation of fixed assets will be not shown in the branch accounting because the opening value of the asset is recorded at the start of the period on the debit side and the closing value of the asset is shown on the credit side atRead more

The correct answer is 4. Not shown in Branch Account.

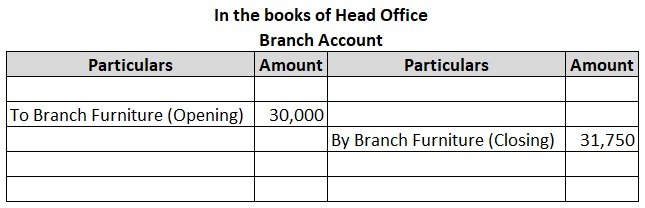

The value of depreciation of fixed assets will be not shown in the branch accounting because the opening value of the asset is recorded at the start of the period on the debit side and the closing value of the asset is shown on the credit side at the end of the period.

The difference between the opening and closing values of the asset is the value of depreciation which is automatically charged. In this case, if depreciation is also shown it will be counted twice.

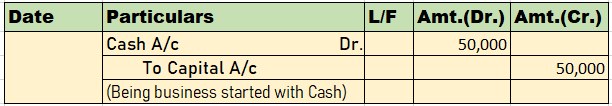

Example:

XYZ Ltd purchased furniture for one of its branches on 1st January. Following are the details of the purchase:

| Furniture as on 1st January | $30,000 |

| Furniture purchased on 1st June | $5,000 |

Depreciation is provided on furniture at @10% per annum on the straight-line method.

| Woking Notes: | Amt |

| i. Depreciation on furniture: | |

| On $30,000 @10% p.a for full year | 3,000 |

| On $5,000 @10% p.a for 6 months | 250 |

| 3,250 | |

| ii. Branch Furniture as of 31 Dec: | |

| Furniture as of 1 January | 30,000 |

| Add: Addition made during the year | 5,000 |

| 35,000 | |

| Less: Depreciation | (3,250) |

| 31,750 |

As additional furniture was purchased after 6 months, depreciation will be charged on that and the total depreciation of 3,250 will be charged on the furniture of $35,000 ($30,000+$5,000) and the difference will be the closing balance which will be shown in the branch account on the credit side.

The depreciation amount will not be shown in the Branch Account as the difference between the opening and closing values of the furniture reflects the value of depreciation. If depreciation is shown in the account it will be counted twice.

See less

Current assets are all the assets of the company which are expected to be used, sold, or consumed within one year. Current assets are those assets that can be converted into cash easily. For example - Inventory, Accounts Receivable, Cash, and Cash Equivalents. Loose tools are parts of machinery or sRead more

Current assets are all the assets of the company which are expected to be used, sold, or consumed within one year. Current assets are those assets that can be converted into cash easily.

For example – Inventory, Accounts Receivable, Cash, and Cash Equivalents.

Loose tools are parts of machinery or spare parts of machinery. Loose can be classified on the nature of use whether it is a fixed asset or a current asset. If loose tools are used regularly or within one accounting year, it is classified as a current asset.

Loose tools are usually classified as a current asset, however, there is one exception i.e it is excluded from the current ratio.

They are excluded from the current ratio because the current ratio takes into account only current assets, and the nature of loose tools is either a fixed asset or a current asset and can’t be converted into cash easily.

The current ratio is calculated to check the liquidity of the company.

Loose tools appear in the Asset Side of the Balance Sheet under the head Current Asset, subhead Inventories.

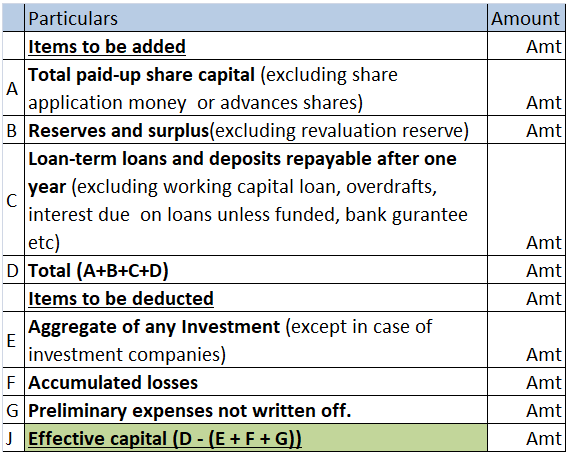

The extract of the Balance Sheet is as follows:

When the balance sheet prepared under Schedule III loose tools is shown under notes to accounts under sub-head Inventories on the asset side.

When the balance sheet is in a T format loose appears as a current asset after recording fixed assets on the asset side.

See less