Fixed Working Capital Permanent working capital is also known as fixed working capital. Working capital is the excess of the current assets over the current liability and further, it is classified on the basis of periodicity, into two categories, permanent working capital, and variable working capitRead more

Fixed Working Capital

Permanent working capital is also known as fixed working capital.

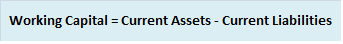

Working capital is the excess of the current assets over the current liability and further, it is classified on the basis of periodicity, into two categories, permanent working capital, and variable working capital.

Permanent working capital means the part of working capital that is permanently locked up in current assets to carry business smoothly and effortlessly. Thus, it’s also known as fixed working capital.

The minimum amount of current assets which is required to conduct a business smoothly during the year is called permanent working capital. The amount of permanent working capital depends upon the nature, growth, and size of the business.

Fixed working capital can further be divided into two categories:

- Regular working capital: It is the minimum amount of capital required by a business to fund its day-to-day operations of a business. E.g. payment of wages, salary, overhead expenses, etc.

- Reserve margin working capital: Apart from day-to-day activities, additional working capital may also be required for contingencies that may arise at any time like strike, business depression, etc.

Whereas, on the other hand, variable working capital, also known as temporary working capital refers to the level of working capital that is temporary and keeps fluctuating.

See less

Introduction A capital reduction account is an account used to pass entries related to the internal reconstruction of a company. During reconstruction, paid-up capital reduced is credited to this account; hence its name is capital reduction account. It is also known as the reconstruction account. TyRead more

Introduction

A capital reduction account is an account used to pass entries related to the internal reconstruction of a company. During reconstruction, paid-up capital reduced is credited to this account; hence its name is capital reduction account. It is also known as the reconstruction account.

Type of account

A capital reduction account is a temporary account open just to carry out internal reconstruction. It represents the sacrifices made by the shareholders, debenture holders and creditors. Also, any appreciation in the value of assets is credited to this account. It is closed to capital reduction when internal reconstruction is completed.

Entries passed through capital reduction account

When paid-up capital is cancelled.

When paid-up capital is cancelled, the share capital account is debited and the capital reduction account is debited as share capital is getting reduced.

When assets and liabilities are revalued

At the time of internal reconstruction, the gain or loss on revaluation is transferred to the capital reduction account instead of the revaluation reserve.

Writing off of accumulated losses and intangible assets

The credit balance of the capital reduction account is used to write off the accumulated losses and intangible assets like goodwill, patents etc which are unrepresented by capital. The capital reduction account is debited and profit and loss account and intangible assets accounts are credited.

Treatment in books of account

The balance in the capital reduction account, whether debit or credit, it is transferred to the capital reduction account. Hence, it doesn’t appear on the balance sheet.

See less