What is net credit sales? Net credit sales are those revenues by a business entity, less all sales returns and allowances. Immediate payment in cash is not included in net credit sales. Formula The formula for net credit sales is as follows: Net credit sales = Sales on credit - Sales returns - SalRead more

What is net credit sales?

Net credit sales are those revenues by a business entity, less all sales returns and allowances. Immediate payment in cash is not included in net credit sales.

Formula

The formula for net credit sales is as follows:

Net credit sales = Sales on credit – Sales returns – Sales allowances

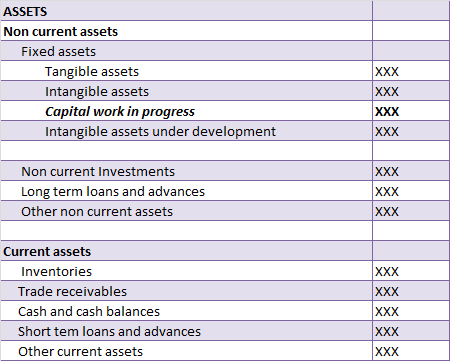

In the balance sheet, you can find credit sales in the “short-term assets “section. It can be calculated from account receivables, bills receivables, and debtors of the balance sheet.

Credit sales = closing debtors + receipts – opening debtors

Steps to calculate net credit sales

- Calculate total sales for the period

- Subtract the Sales Returns

- Subtract the Sales Allowances

- Subtract the Cash Sales ( if any )

Terms relevant to understand before calculation

Sales return: A sales return is when a customer or client returns or sends a product back to the seller. And this can happen due to various reasons, including:

- Excess quantity ordered

- Not upto Customer expectations

- Shipping delays ( product arrived late )

- Accidentally ordered an item and there can be more such reasons.

Sales allowance: A sales allowance is a discount that a seller offers a buyer as an alternative to the buyer for returning the product.

Because of a problem or issue with the buyer’s order or we can say that he is not satisfied with the product.

Cash sales: Cash sales are sales in which the payment is done at once or I can say that buyer has obligation to make payment to the seller.

Cash sales are considered to include bills, checks, credit cards, and money orders as forms of payment.

Example

Now after understanding the terms used in the formula let me explain to you with an example which is as follows:-

-

- First, we will calculate the Total Sales for the Period:- In the month of May, Flipkart company had cash sales of Rs 80,000. The total amount in Accounts Receivables is Rs 150,000, with Rs 30,000 as the carryover from April’s receivables.

-

- Since you only want to know about credit sales in the current period (September), you subtract Rs 30,000 from the total. This means that for the month of September, Flipcart Company had sales totaling Rs 200,000 (80,000 + 120,000).

-

- Second, we will subtract the Sales Returns:- During the month of September, Flipcart Company issued Rs 20,000 in refunds, because several items were damaged during shipment, so the customer could not use them.

-

- This amount would reduce the total number of cash sales if the accounts receivable balance was from a credit customer. This reduces the total sales to Rs 180,000 (Rs 200,000 in total sales – Rs 20,000 in returns).

-

- Thirdly we will subtract the Sales Allowances:- Sales allowances are discounts offered to customers for not asking for full refunds.

-

- For example, an item that had been shipped to a customer was the wrong size, but the customer told that he will agree to keep the item if the price could be adjusted. Flipcart Company issued Rs 10,000 in allowances in May.

-

- After this deduction, the total sales for May are Rs 170,000 (Rs 180,000 – Rs 10,000).

-

- Then at last there are any cash sales then subtract:- After figuring out the total number of sales for September and then subtracting the sales returns and allowances, the cash sales are deducted since you are focusing on net credit sales for the period.

-

- After deducting the Rs 60,000 in cash sales, Flipcart Company has Rs 110,000 as net credit sales.

Why do we need net credit sales?

- Net Credit sales help to calculate the accounts receivable turnover ratio.

- Net credit sales also indicate the amount of credit you offer to your customer.

- Net credit sale is also used to calculate other financial analysis items like days sales outstanding.

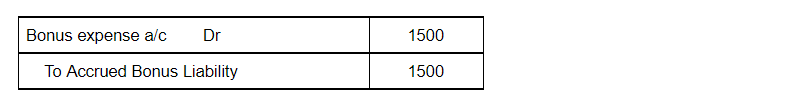

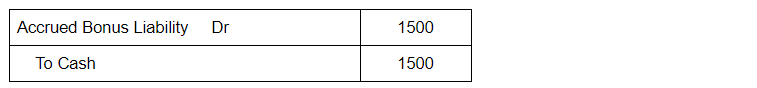

The bonus expense account is debited because according to the modern rule of accounting “Increase in expense is debited”. Accrued bonus liability is credited because according to the rule of accounting, “Increase in liability is credited”.

The bonus expense account is debited because according to the modern rule of accounting “Increase in expense is debited”. Accrued bonus liability is credited because according to the rule of accounting, “Increase in liability is credited”.

Debts are of two types one is Good Debt, and another one is Bad debt. Bad Debts The amount which is not recoverable from the debtors is called Bad debt. It is an uncollectable amount from the organization's customers due to the customer's inability to pay the amount of money taken on credit. Read more

Debts are of two types one is Good Debt, and another one is Bad debt.

Bad Debts

The amount which is not recoverable from the debtors is called Bad debt. It is an uncollectable amount from the organization’s customers due to the customer’s inability to pay the amount of money taken on credit.

Example 1

Mr A borrowed $100 from Mr B for his college fee and agrees to pay in 2 months. After the time period is complete Mr A failed to repay the borrowed amount. This is a Bad Debt for Mr B.

Example 2

XYZ Co. had made a credit sale of $50,000. A debtor who has to pay $1000 has been bankrupted. XYZ co. cannot recover the amount from the Debtor, so it records the irrecoverable amount as a bad debt.

Journal Entry

In this entry, “Bad debts are written off of Rs. 2000.”

Bad debt is the amount not recoverable from debtors, which is a loss for the organization.

Modern Rule

The Modern rules of accounting for Expenses are “Debit the increase in expenses and Credit the decrease in expenses.”

Golden Rule

The Golden rules of accounting for expenses and losses are “Debit all expenses and losses, Credit all incomes and gains.”

Bad Debts A/c Dr. 2,000

To Debtor’s A/c 2000

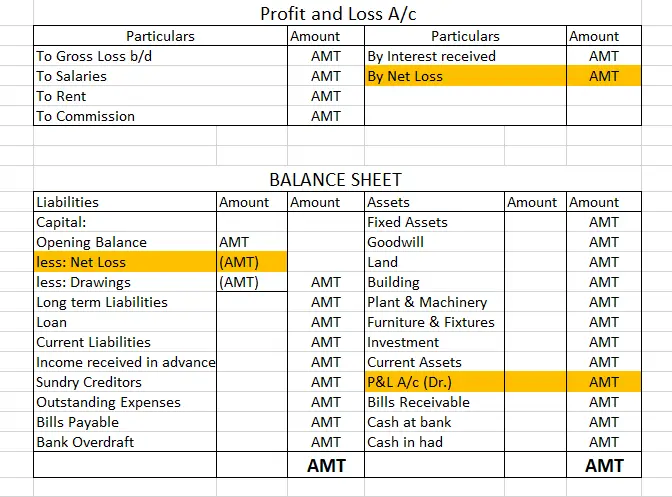

Bad debt is treated as a loss for the organization. As per the rule, this should be debited to the profit and loss account.

Profit and Loss A/c Dr. – 2000

To Bad Debts A/c – 2000

Instead of passing two separate entries for writing off, we can combine the entries and pass one entry.

Profit and Loss A/c Dr. 2000

To Debtor’s A/c 2000

Recovery of Bad debts

Recovery of Bad debt is the amount received for a debt that was written off in the past. It was considered uncollectable.

When we write off bad debt, it is recorded as a loss, but the recovery of bad debts is treated as an income for the business.

It is treated as an income and the recovery of bad debt is shown on the credit side of the Income statement.

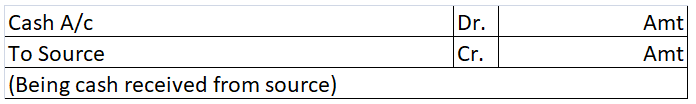

Journal Entry for Recovery of Bad debts

Bank/Cash A/c Dr. – Amount

To Bad Debts Recovered A/c – Amount

Rules applied in the Journal entry are as per the Golden rules of accounting,

“Cash/Bank A/C” is a real account therefore debit what comes in and credit what goes out.

“Bad Debts Recovered A/C” is a nominal account therefore debit all expenses and losses, and credit all incomes and gains.

Treatment of “Bad Debt written off of Rs.2ooo.”

In Trial Balance: No effect

In Income Statement: It is shown on the debit side as Rs.2000 (loss)

In Balance Sheet: Rs.2000 shall be deducted from the sundry debtor account.

See less