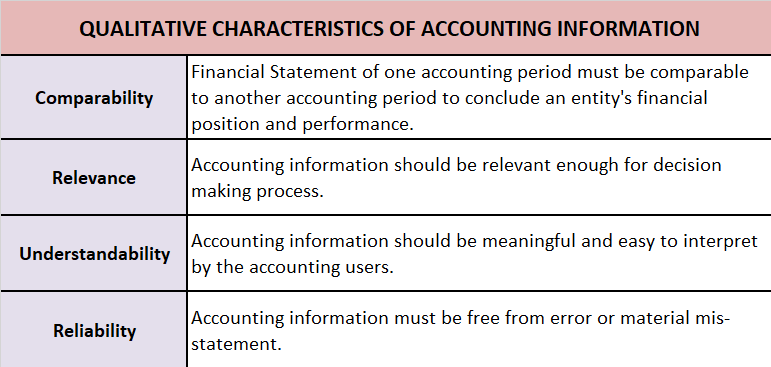

QUALITATIVE CHARACTERISTICS OF ACCOUNTING INFORMATION ARE AS FOLLOWS: 1. COMPARABILITY: Comparison of financial statements is one of the most frequently used and effective tools of financial analysis. It helps the users of accounting information to compare, analyze and take decisions accordingly. CoRead more

QUALITATIVE CHARACTERISTICS OF ACCOUNTING INFORMATION ARE AS FOLLOWS:

1. COMPARABILITY: Comparison of financial statements is one of the most frequently used and effective tools of financial analysis. It helps the users of accounting information to compare, analyze and take decisions accordingly. Comparability enables inter-firm and intra-firm comparisons. It helps to ascertain the growth and progress of the business over time and in comparison to other businesses.

For example, managers of ITC ltd want to know which business of his is performing well and which needs progress so they would compare the financial statement of its different businesses and make the decision accordingly.

2. RELEVANCE: It generally means that the essential information should be easily and readily available and any irrelevant information should be avoided. The user of accounting information needs relevant accounting information for a good decision-making process, planning, and predicting future circumstances.

For example, a firm is expected to provide the total amount owed by the debtors in the balance sheet, whereas the total number of debtors is not important.

3. UNDERSTANDIBILITY: The financial statement should be presented so that every user can interpret the information without any difficulty in a meaningful and appropriate manner. To be more precise it should be complete, concise, clear, and organized.

For example, mentioning note number in the financial statement for any items which needs disclosure. This helps the users of accounting to interpret the financial statement without any difficulty.

4. RELIABILITY: This means the accounting information must be free from material error and bias. All accounting information is verifiable and can be verified from the source documents basically, information should not be vague or false.

For example, any significant matters like amount due, damages, losses, etc. which impact the financial stability shall be mentioned as disclosure since it is useful for all the users of accounting to be aware of such facts and not to be misguided by incomplete information.

As per Wiki, it is also called construction in progress. Capital work in progress is a non-current asset of an entity. It is also known as CWIP in short. CWIP is the work which is not yet completed but the amount for which has already been paid. Suppose, at the time of preparing a balance sheet, ifRead more

As per Wiki, it is also called construction in progress. Capital work in progress is a non-current asset of an entity. It is also known as CWIP in short.

CWIP is the work which is not yet completed but the amount for which has already been paid.

Suppose, at the time of preparing a balance sheet, if an asset is not completed, all the costs incurred on that asset up to the balance sheet date are to be transferred to an account called capital work in progress.

Example 1: A machinery under installation.

There are several expenses incurred while installing machinery, expenses such as labor charges, Initial delivery and handling costs, Assembly and installation cost, etc are included in CWIP and when the asset is completed and is ready to use, all the costs are transferred to the relevant accounts.

To make it simpler, let me show journal entries relating to this example.

When an expense is incurred/paid:

When an asset is complete and put to use:

Example 2: A Contractor is constructing a building. The following expenditures are being incurred to date:

i) Raw materials – 5,00,000

ii) Payment to Architect – 3,50,000

iii) Advance for Equipments – 1,50,000

Following accounting entries will be passed to record the expenditure on CWIP assets:

The following accounting entry will be passed once assets are ready to use:

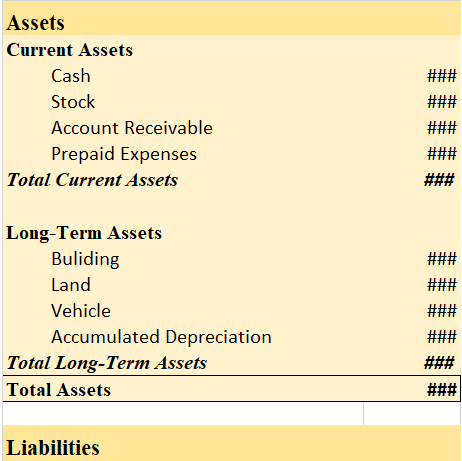

Disclosure in the Balance sheet

CWIP account is shown separately in the balance sheet below the fixed asset.

we cannot depreciate capital work in progress. It can only be depreciated when the asset is put to use.

See less