Debtors and Creditors Points of Distinction Debtors Creditors Meaning A debtor is a person or entity that owes money to the other party (the other party is also known as the creditor). A creditor is a person or entity to whom money is owed or who lends money. Nature The debtors will have a debit balRead more

Debtors and Creditors

| Points of Distinction | Debtors | Creditors |

| Meaning | A debtor is a person or entity that owes money to the other party (the other party is also known as the creditor). | A creditor is a person or entity to whom money is owed or who lends money. |

| Nature | The debtors will have a debit balance. | The creditors will have a credit balance. |

| Receipt of payment | The payment or amount owed is received from the debtor. | The payment of the amount owed is made to the creditors. |

| Nature of account | Debtors are account receivables. | Creditors are accounts payable. |

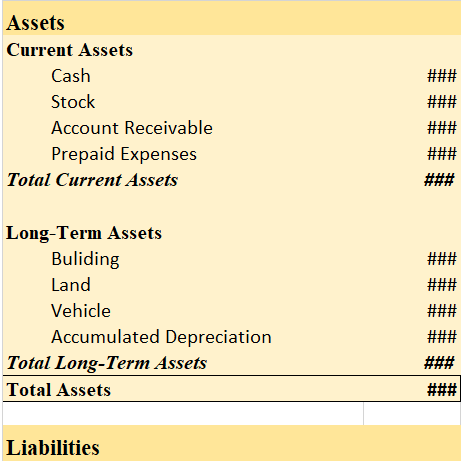

| Status | They are shown under assets in the balance sheet under the head current assets. They are shown as an asset because the amount is receivable from them. | They are shown under liabilities in the balance sheet under the head current liabilities. They are shown as a liability because the amount is payable to them. |

| Credit / Loan period | Debtors are the one who takes a loan or purchase goods on credit and has to pay the money in the agreed time period, with or without interest. | Creditors are the ones who provide loans or extend the duration of the credit period. |

| Discounts | They are the ones who receive discounts. | They can offer discounts to debtors. |

| Provision for doubtful debts | Provision for doubtful debts is created for debtors. | No such provision is created for creditors. |

Example:

Mr. A purchases raw materials from its supplier Mr. D on credit.

Here for Mr. D, Mr. A will be a debtor because the amount is receivable from him.

Similarly, for Mr. A, Mr. D will be his creditor because the amount is payable to him.

Profit and Gain

| Points of Distinction | Profit | Gain |

| Meaning | The excess of revenue of a period over its expenses is termed as profit.

Profit = Total Income-Total Expenses |

Gain means profit that arises from incidental events and transactions, such as capital gain. |

| Generation | It is generated within the operations of a business. | It is generated outside the business operation. |

| Nature of account | Profit calculated will appear in the Profit and Loss A/c. | The gain will appear in the income statement. |

| Types | Gross profit

Net profit Operating profit |

Capital gain Long term capital gain Short term capital gain

|

Example: A company’s sales for the period are $60,000 and expenses incurred are $40,000. Here the profit calculated will be $20,000 because revenue exceeds expenses.

Profit = Total Income-Total Expenses

= 60,000 – 40,000

= $20,000

Mr. X owned land worth $10,00,000 and after 10 years he sold it at a current market value of $14,00,000. So the gain he earned is $4,00,000. This gain of $4,00,000 will be termed as a capital gain since land is a capital asset.

See less

To begin with, let me first give you a small explanation of what Contingent assets are A contingent asset is a potential asset or economic benefit that does not exist currently but may arise in the near future. Such an asset arises from an uncertain and unpredictable event. To make it clear with anRead more

To begin with, let me first give you a small explanation of what Contingent assets are

A contingent asset is a potential asset or economic benefit that does not exist currently but may arise in the near future. Such an asset arises from an uncertain and unpredictable event.

To make it clear with an example: String Co. filed a lawsuit against a competitor company Weave Tech Co. for infringing on company ABC’s patent. Even if it is probable (but not certain) that Strings Co. will win the lawsuit, it is a contingent asset.

As such, it will not be recorded in Strings Co. general ledger accounts until the lawsuit is settled.

At most the Strings Co. can do is, prepare a note disclosing the fact that it has filed the lawsuit the outcome of which is uncertain.

Disclosing Contingent Assets

For Example, The court orders for reimbursement to Strings Co. say 1,00,000 for the damages, but it has not yet received the money. Although it is virtually certain that the company will receive the money in the near future, it will be treated as an asset and can be disclosed in the balance sheet on the assets side.

For Example, Strings Co. filed a lawsuit against a competitor company Weave Tech for infringing on Strings Co. patent. Even if it is probable (but not certain) that Strings Co. will win the lawsuit, it is a contingent asset.

As such, it will not be recorded in Strings company’s general ledger until the lawsuit is settled.

At most the Strings Co. can do is, prepare a note disclosing the fact that it has filed the lawsuit the outcome of which is uncertain.

In this case, the disclosure of it is not permitted.

See less