Therefore, 2) Asset is the correct option. Explanation The petty cash book is managed and made by not an accountant but the petty cashier and is done to record small incomes and expenditures that are not recordable in the cash book. Therefore, the desired result we obtain from the deduction oRead more

Therefore, 2) Asset is the correct option.

Explanation

The petty cash book is managed and made by not an accountant but the petty cashier and is done to record small incomes and expenditures that are not recordable in the cash book. Therefore, the desired result we obtain from the deduction of the total expenditure and total cash receipt is the closing balance of the petty cash book.

Petty cash refers to the in-hand physical cash that a business holds to pay for small and unplanned expenses.

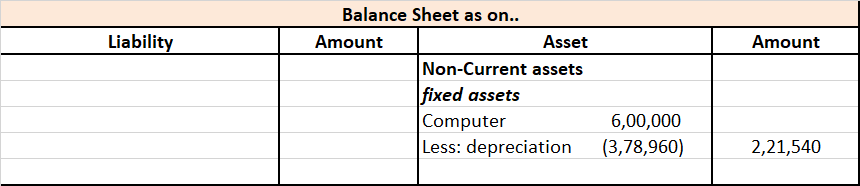

Asset: The closing balance of the petty cash book is considered an asset because the petty cash book is a type of cash book. The petty cash book also deals in outflow and inflow of the cash, it also maintains and records income and expenditure that are similar to the cash book.

The petty cash book since being a part of the cash book, which records all the inflow and outflow of cash in a business, which is an asset, thus petty cash book’s closing balance is considered an asset. Also, the balance of the petty cash book is never closed. Their closing balance is carried forward to the next year.

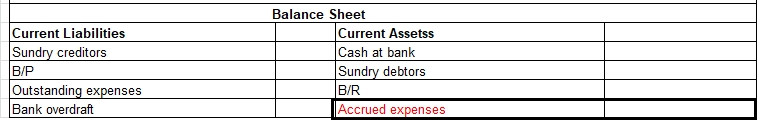

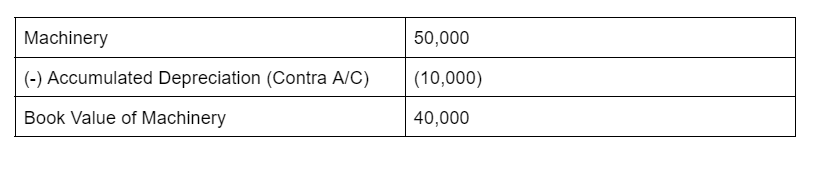

Liability: The closing balance of the petty cash book is not considered a liability because that closing balance of the petty cash book doesn’t create a liability for the business. In fact, the closing of the petty cash book is placed under the head current asset in the balance sheet as mentioned above, it’s a part of the cash book which records the transactions of cash a/c which is an asset itself.

Expenses or Income: It is not an expense because the closing balance of the petty cash book is calculated by deducting the total expenditure from the total cash receipt.

That is an asset and it is considered to be a current asset, neither an income nor an expense. It is used for paying out petty expenses.

Therefore, the closing balance of the petty cash book is considered an asset.

See less

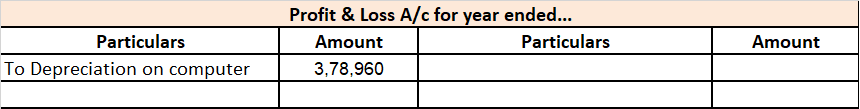

Journal entry for commission earned but not received Commission earned but not received is called accrued income. As we know there are two types of accounting, cash basis of accounting, in which the transaction is recorded only when cash is received or paid, and accrual basis of accounting, in whichRead more

Journal entry for commission earned but not received

Commission earned but not received is called accrued income. As we know there are two types of accounting, cash basis of accounting, in which the transaction is recorded only when cash is received or paid, and accrual basis of accounting, in which even if money is yet to be accepted or paid, the transactions are still recorded.

E.g of accrual income- rent earned but not collected, interest on the investment earned but not received, etc.

Journal entry

Simplifying with an example

If the rent earned was $1,000 and it’s yet to be received, we’ll be passing this entry-

When it’s received, this entry is passed

See less