Debts are of two types one is Good Debt, and another one is Bad debt. Bad Debts The amount which is not recoverable from the debtors is called Bad debt. It is an uncollectable amount from the organization's customers due to the customer's inability to pay the amount of money taken on credit. Read more

Debts are of two types one is Good Debt, and another one is Bad debt.

Bad Debts

The amount which is not recoverable from the debtors is called Bad debt. It is an uncollectable amount from the organization’s customers due to the customer’s inability to pay the amount of money taken on credit.

Example 1

Mr A borrowed $100 from Mr B for his college fee and agrees to pay in 2 months. After the time period is complete Mr A failed to repay the borrowed amount. This is a Bad Debt for Mr B.

Example 2

XYZ Co. had made a credit sale of $50,000. A debtor who has to pay $1000 has been bankrupted. XYZ co. cannot recover the amount from the Debtor, so it records the irrecoverable amount as a bad debt.

Journal Entry

In this entry, “Bad debts are written off of Rs. 2000.”

Bad debt is the amount not recoverable from debtors, which is a loss for the organization.

Modern Rule

The Modern rules of accounting for Expenses are “Debit the increase in expenses and Credit the decrease in expenses.”

Golden Rule

The Golden rules of accounting for expenses and losses are “Debit all expenses and losses, Credit all incomes and gains.”

Bad Debts A/c Dr. 2,000

To Debtor’s A/c 2000

Bad debt is treated as a loss for the organization. As per the rule, this should be debited to the profit and loss account.

Profit and Loss A/c Dr. – 2000

To Bad Debts A/c – 2000

Instead of passing two separate entries for writing off, we can combine the entries and pass one entry.

Profit and Loss A/c Dr. 2000

To Debtor’s A/c 2000

Recovery of Bad debts

Recovery of Bad debt is the amount received for a debt that was written off in the past. It was considered uncollectable.

When we write off bad debt, it is recorded as a loss, but the recovery of bad debts is treated as an income for the business.

It is treated as an income and the recovery of bad debt is shown on the credit side of the Income statement.

Journal Entry for Recovery of Bad debts

Bank/Cash A/c Dr. – Amount

To Bad Debts Recovered A/c – Amount

Rules applied in the Journal entry are as per the Golden rules of accounting,

“Cash/Bank A/C” is a real account therefore debit what comes in and credit what goes out.

“Bad Debts Recovered A/C” is a nominal account therefore debit all expenses and losses, and credit all incomes and gains.

Treatment of “Bad Debt written off of Rs.2ooo.”

In Trial Balance: No effect

In Income Statement: It is shown on the debit side as Rs.2000 (loss)

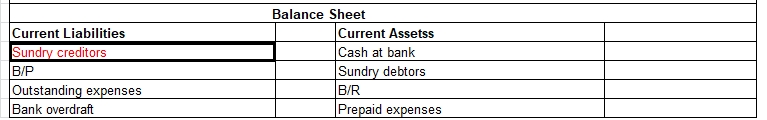

In Balance Sheet: Rs.2000 shall be deducted from the sundry debtor account.

See less

Interest on capital Interest on capital is interest payable to the owner/partners for providing a firm with the required capital to commence the business. It's a fixed return that a business owner is eligible to receive. When the business firm faces a loss, the interest on capital will not be providRead more

Interest on capital

Interest on capital is interest payable to the owner/partners for providing a firm with the required capital to commence the business. It’s a fixed return that a business owner is eligible to receive.

When the business firm faces a loss, the interest on capital will not be provided. It is permitted only when the business earns a profit. Such payment of interest is generally observed in partnership firms. It is provided before the division of profits among the partners in a partnership firm.

If an owner or partner introduces additional capital to the business, it is also taken into account for providing interest on capital.

Sample journal entry

Interest on capital is an expense for business, thus, debited as per the golden rules of accounting, debit the increase in expense, and the owner/partner’s capital a/c is credited as per the rule, credit all incomes and gain.

As per the modern rules of accounting, we debit the increase in expenditure and credit the increase in capital.

As we know, as per the business entity concept, business and owner are two different entities and a business is a separate living entity. Therefore, the capital introduced by the owner/partners is the amount on which they’re eligible to receive a return.

Example:

Tom is the business owner of the firm XYZ Ltd. He has contributed ₹ 10,00,000 to the business with 10% interest provided to Tom at the end of the year.

Solution:

Here interest on capital will be calculated as,

Interest on capital = Amount invested × Rate of interest × Number of Months/12

= 10,00,000 × 10% × 12/12

= ₹ 1,00,000

See less