Depletion Amortization Depression

An asset is an item of property owned by a company/business. It may be for a longer or shorter period of time. Assets are classified into two broad heads: Non-Current Assets Current Assets The asset may be sold for several reasons such as: An asset is fully depreciated. It should be sold becaRead more

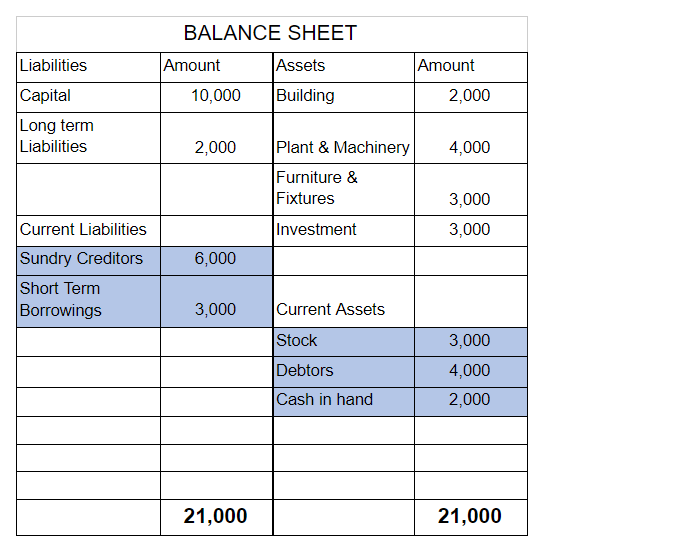

An asset is an item of property owned by a company/business. It may be for a longer or shorter period of time. Assets are classified into two broad heads:

- Non-Current Assets

- Current Assets

The asset may be sold for several reasons such as:

- An asset is fully depreciated.

- It should be sold because it is no longer needed.

- It is removed from the books due to unforeseen circumstances.

The journal entry for profit on the sale of assets will be:

| Cash / Bank A/c | Debit |

| To Asset A/c | Credit |

| To Profit on Sale of Asset A/c | Credit |

| (Being sale of an asset made with a gain) |

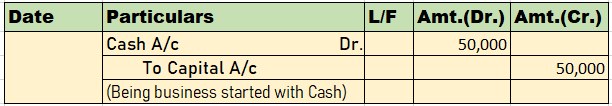

According to the golden rules of accounting, in the above entry “Cash/Bank A/c” it is a Real Account and the rule says “Debit what comes in” and so is debited.

“Asset A/c” is a real account and the rule says “Credit what goes out” and so is credited. Any Gain on sale of an asset goes to the Nominal account and according to the rule “Credit, all incomes and gains” and so is credited.

The journal entry for loss on sale of the asset will be:

| Cash / Bank A/c | Debit |

| Loss on Sale of Asset A/c | Debit |

| To Asset A/c | Credit |

| (Being sale of an asset made and loss incurred) |

In the above entry, “Loss on Sale of Asset” is debited because according to Nominal account rules “Debit all losses and expenses” and so is debited.

According to modern rules of accounting, “Debit entry” increases assets and expenses, and decreases liability and revenue, a “Credit entry” increases liability and revenue, and decreases assets and expenses.

| Cash / Bank A/c | Debit | Increases Asset |

| Loss on Sale of Asset A/c | Debit | Increases Expenses |

| To Asset A/c | Credit | Decreases Asset |

| To Profit on Sale of Asset A/c | Credit | Increases Expenses |

For example, Mr. A sold furniture for $2,500 and incurred a loss on the sale which amounted to $2,500.

According to modern rules, the journal entry will be:

| Particulars | Amt | Amt | |

| Cash / Bank A/c | 2,500 | Increase in asset | |

| Loss on Sale of Asset A/c | 2,500 | Increase in expenses | |

| To Asset A/c | 5,000 | Decrease in asset | |

| (Being sale of an asset made and loss incurred) |

The correct option is 2. Amortization. Depreciation in spirit is similar to Amortization because both depreciation and amortization have the same characteristics except that depreciation is used for tangible assets and amortization for intangible assets. To make it clear, intangible assets are thoseRead more

The correct option is 2. Amortization.

Depreciation in spirit is similar to Amortization because both depreciation and amortization have the same characteristics except that depreciation is used for tangible assets and amortization for intangible assets.

To make it clear, intangible assets are those assets that cannot be touched i.e. they are not physically present. For example, goodwill, patent, trademark, etc. Hence, these assets are amortized over their useful life and not depreciated.

Example for Amortizing intangible assets: A manufacturing company buys a patent for Rs 80,000 for 8 years. Assuming that the residual value of the patent after 8 years to be zero.

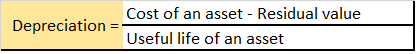

The depreciation to be written off will be

Yearly Depreciation = Cost of the patent – Residual value / Expected life of the asset.

= 80,000 – 0 / 8

= Rs 10,000 every year.

Whereas, tangible assets are those assets that can be touched i.e. they are physically present. For example, building, plant & machinery, furniture, etc. Hence, these assets are depreciated over their useful life and not amortized.

Example of Depreciating tangible asset: A manufacturing company bought machinery for Rs 8,10,000 and its estimated life is 8 years, scrap value being Rs 10,000.

The depreciation to be written off will be

Yearly Depreciation = Cost of machinery – Scrap value / Expected life of the asset.

= 8,10,000 – 10,000 / 8

= 8,00,000 / 8

= Rs 1,00,000 every year.

See less