A. For a certain given period B. At a particular point of time C. After a fixed date D. None of the above

Interest on Investment is to be shown on the Credit side of a Trial Balance. Interest on investment refers to the income received on investment in securities. These securities can be shares, debentures etc. of another company. When one invests in securities, they are expected to receive a return onRead more

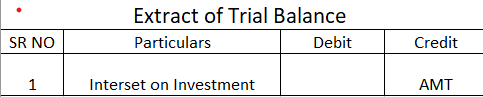

Interest on Investment is to be shown on the Credit side of a Trial Balance.

Interest on investment refers to the income received on investment in securities. These securities can be shares, debentures etc. of another company. When one invests in securities, they are expected to receive a return on investment (ROI).

Since interest on investment is an income, it is shown on the credit side of the Trial Balance. This is based on the accounting rule that all increase in incomes are credited and all increase in expenses are debited. A Trial Balance is a worksheet where the balances of all assets, expenses and drawings are shown on the debit side while the balances of all liabilities, incomes and capital are shown on the credit side.

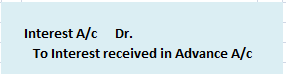

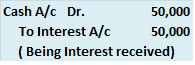

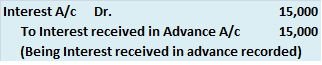

For example, if Jack bought Corporate Bonds of Amazon, worth $50,000 with a 10% interest on investment, then the accounting treatment for interest on investment would be

Cash/Bank A/C Dr 5,000

To Interest on Investment in Corporate Bonds (Amazon) 5,000

As per the above entry, since interest on investment is credited, it will show a credit balance and hence be shown on the credit side of the Trial Balance. Interest on investment account is not to be confused with an Investment account. Investment is an asset whereas interest on investment is an income.

See less

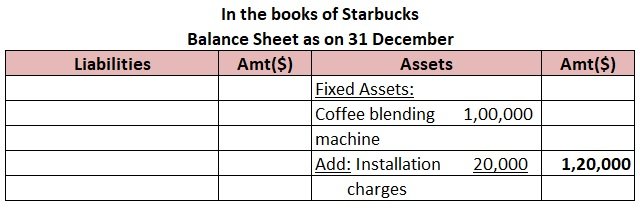

The correct option is Option (b) at a particular point of time. A balance sheet discloses the financial position of an entity at a particular point of time. The particular point of time is generally the last date of an accounting year. Most of the business concerns follow an accounting year ending oRead more

The correct option is Option (b) at a particular point of time.

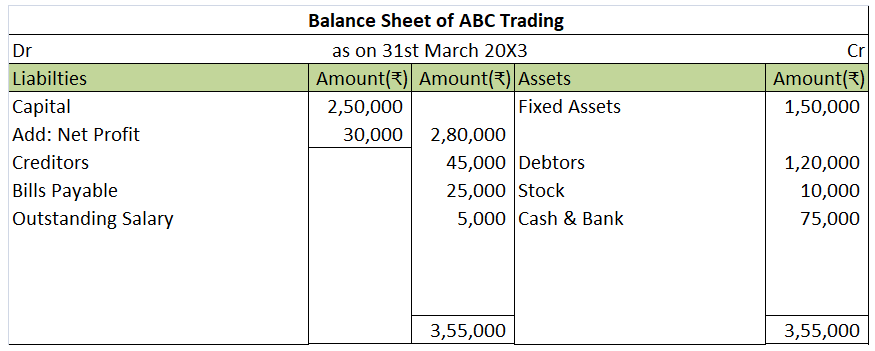

A balance sheet discloses the financial position of an entity at a particular point of time. The particular point of time is generally the last date of an accounting year. Most of the business concerns follow an accounting year ending on 31st March and prepare their balance sheet as at 31st March.

By financial position, it means the value of assets and liabilities of the entity. As an entity may enter into monetary transactions every day, the values of the assets and liabilities may also vary every day. Hence, to prepare the balance sheet of an entity, a particular point of time is to be chosen which is generally the last date of an accounting year

Option (a) for a given period of time is incorrect.

It is because the values of assets and liabilities of concern may differ daily, a balance sheet cannot be prepared to disclose the financial position of an entity for a given period of time.

The statement of profit or loss is prepared for a given period of time as it discloses the overall performance of an entity for a given period of time.

Option (c) after a fixed date is also incorrect.

The phrase, “after a fixed date” does not indicate a particular point of time. It may mean any day after a fixed date. For example, if there is an instruction to prepare a balance sheet that discloses the financial position of a concern after 30th March, it may mean 31st March, 1st April or any day thereafter.

As we know that a balance can be prepared for a particular point of time, this option seems wrong.

Option (d) None of these is incorrect too as Option (b) is the correct one.

See less