A balance sheet is a financial statement that reports the position or value of assets, liabilities and equity at a particular date, which is usually the closing date of a financial year. Formats of balance sheet A balance sheet may be presented in two formats: T-form or Horizontal format This formatRead more

A balance sheet is a financial statement that reports the position or value of assets, liabilities and equity at a particular date, which is usually the closing date of a financial year.

Formats of balance sheet

A balance sheet may be presented in two formats:

T-form or Horizontal format

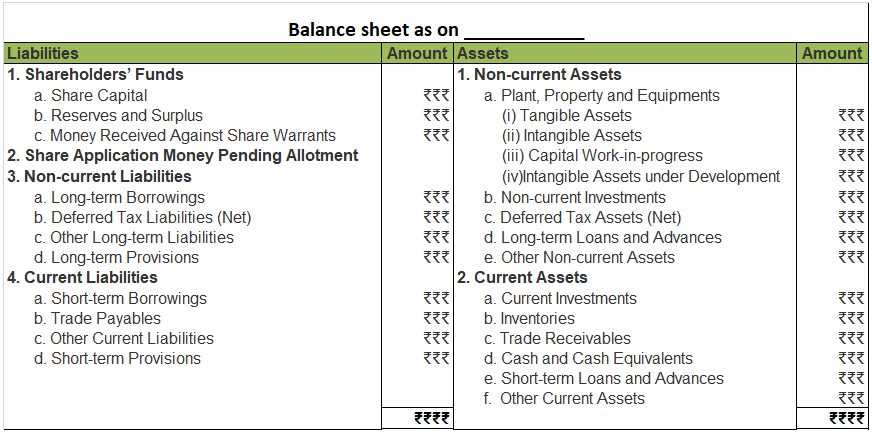

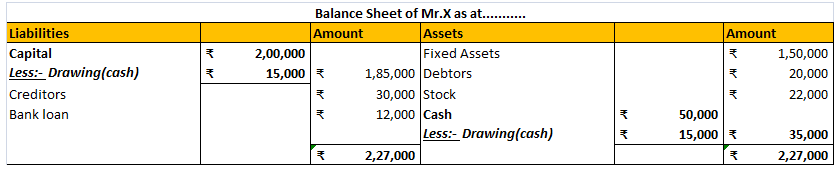

This format is the same as the format of ledger accounts. There are two columns with the headings ‘Liabilities’ for the left column and ‘Assets’ for the right column and columns adjacent to both columns for amounts. The liabilities and equity (capital) are shown on the liabilities side because they both have credit balance and assets are shown on the asset side. Most of the non-corporates prepare their balance as per this format. The T-form balance sheet looks as given below:

Vertical format

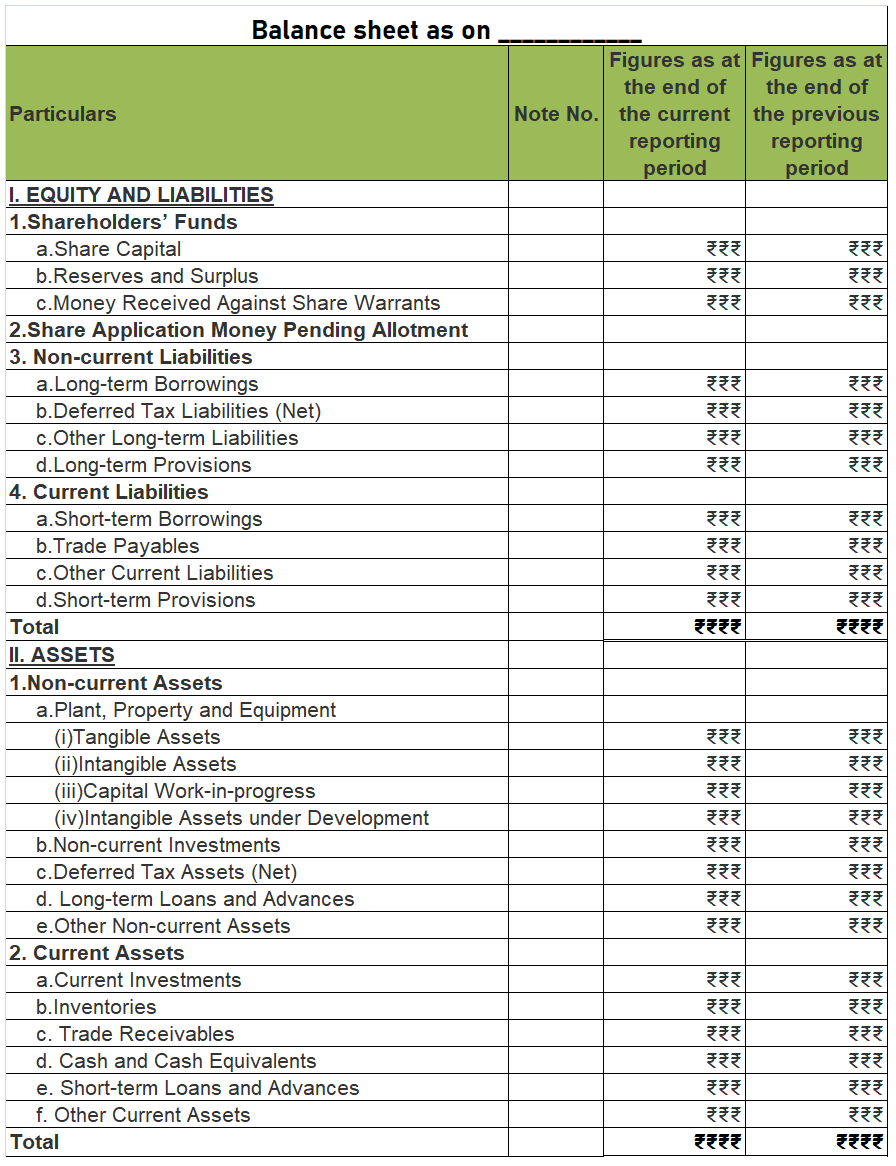

The vertical format of the balance sheet is mostly prepared by corporate entities. Here, the liabilities and assets are shown in the same column as compared to two separate columns in the horizontal format. This results in having a longer shape. Hence, it is called a ‘vertical’ balance sheet. Generally, companies prepare their balance sheet as per this format.

Also, many times, there are two columns for the amount in this format presenting the amount of both the current year and the previous year. This format looks like as given below:

Grouping and marshalling

Beside the structure of the balance sheet i.e. horizontal and vertical, the grouping and marshalling of the items inside the balance sheet are also very important.

Grouping refers to the presenting of similar items under a heading or group. This is done in order to present the balance sheet in a concise manner. This is very important to do. For example, a business can have numerous creditors, but they are all presented under one ‘Creditors’ heading or two or more heading specifying different types of creditors.

The assets of a business are grouped under the heading such as Plant, Property and equipment, Current assets, Non-current investments etc.

Marshalling means the arranging of items as per a particular order. We know that a balance sheet consists of many items and to make the statement more useful and easy to comprehend, the items are arranged in one of the following orders:

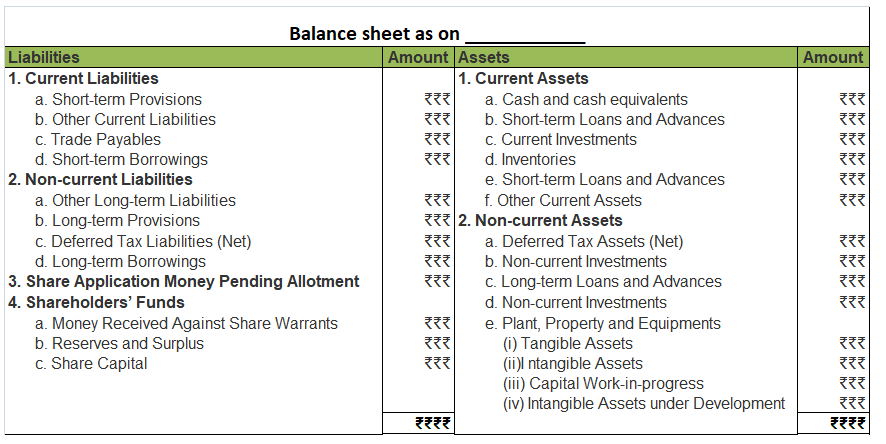

- Order of Liquidity: The items which are more liquid i.e which can be easily converted into cash are kept at the top. Like in assets, cash is the most liquid asset and requires no conversion. Then items like current investment, inventories (in case of fast-moving goods) are placed under and so on. At the near bottom, items that require a long time of conversion into cash are placed such as land, plant and machinery.

In case of liabilities, the items which are due for repayment soon are kept at the top, like bank overdraft etc. The items which are due for repayment after a long time or at the time of winding capital are kept at the bottom, like long term loans and capital funds. Given below is a format of horizontal balance sheet in which the items are marshalled in order of liquidity:

- Order of permanence: This type of arrangement is just the opposite of the order of liquidity. Here the items which are least liquid are placed at the top and the more liquid items are placed at the bottom. Like in the case of assets, cash appears at the bottom and non-current assets at the top. On the liabilities side, equity and non-current liabilities are at the top while current liabilities are at the bottom. Mostly all balance sheets are marshalled in order of permanence.

The debts that have a higher chance of not being paid are called doubtful debts. They are a part of the regular dealing of the company and may arise due to disputes or treachery on the part of debtors. Bad debts refer to the doubtful debts that no longer seem to be recoverable from the business. WriRead more

The debts that have a higher chance of not being paid are called doubtful debts. They are a part of the regular dealing of the company and may arise due to disputes or treachery on the part of debtors.

Bad debts refer to the doubtful debts that no longer seem to be recoverable from the business.

Written off means an expense, income, asset, liability is no more recorded in the books of accounts because they no longer hold relevance for the business.

When doubtful debts turn into bad debt, they are written off from the books after a stipulated time as they no longer seem recoverable.

If any cash is received against such bad debts that were written off, it is known as cash received against bad debts written off. Cash is received against bad debts usually when the debtor is declared insolvent and money is recovered from its estate.

Bad debts recovered are considered an income for the company as they were previously written off as a loss and any cash received against it is considered as income.

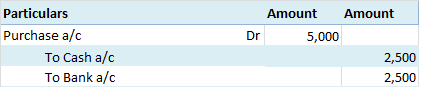

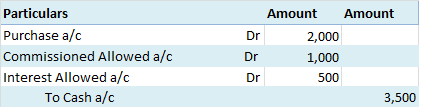

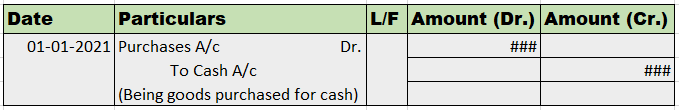

Journal entry for such situation is:

Cash or Bank A/c (Dr.)

To Bad Debts Recovered A/c

We debit the increase in assets, and since cash is coming into the business it is debited.

We credit the income, and since bad debts recovered is an income to the business it is credited.

See less