Capital Redemption Reserve is a statutory reserve, which means it is mandatory for a company to create such reserve when it decides to redeem its preference shares. Capital Redemption Reserve cannot be utilised for any purpose other than the issue of bonus shares. Now let’s understand the reason behRead more

Capital Redemption Reserve is a statutory reserve, which means it is mandatory for a company to create such reserve when it decides to redeem its preference shares. Capital Redemption Reserve cannot be utilised for any purpose other than the issue of bonus shares.

Now let’s understand the reason behind it.

We know preference shares are those shares that carry some preferential rights:

- Dividend at a fixed rate

- Right to get repaid before equity shareholders in event of winding up of the company

- Other rights as specified in the Articles of Associations.

Also, unlike equity shares, preference shares are redeemable i.e. repaid after a period of time (which cannot be more than 20 years).

Generally, the creditors of a company have the right to be repaid first. So, in event of redemption of preference shares, the preference shareholders are repaid before creditors and the total capital of the company will but the total debt of the company is unaffected.

The gap between the debt and equity of the company will further widen and this will also increase the debt-equity ratio of the company. It will be perceived to be a risky scenario by the creditors and lenders of the company because the

So to protect the creditor and lender, Section 55 of the Companies Act comes to rescue.

Section 55 of the Companies Act ensure that the creditors and lenders of a company do not find themselves in a riskier situation when the company decides to redeem its preference shares by making it mandatory for a company to either

- issue new shares to fund the redemption of preference shares

OR

- create a capital redemption reserve if it uses profits for redemption

OR

- a combination of both

This will fill up the void created by the redemption of preference shares and the debt-equity ratio will remain unaffected. Keeping an amount aside in Capital Redemption Reserve ensures that such amount will not be used for dividend distribution and capital will be restored because it can be only used to issue bonus shares.

In this way the debt-equity ratio remains the same, the interest of the creditors and lenders secured.

Bonus shares are fully paid shares that are issued to existing shareholders at no cost.

Let’s take a numerical example for further understanding:

ABC Ltd wants to redeem its 1,000 9% Preference shares at a face value of Rs 100 per share. It has decided to issue 8,000 equity shares @Rs 10 per share and use the profit and reserves to fund the deficit.

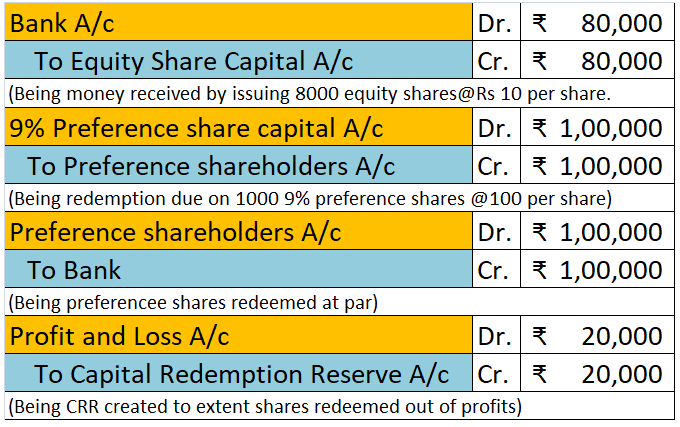

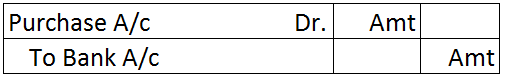

The journal entries will be as follows:

Working note: Rs

9% preference shares due for redemption (1,000 x 10) – 1,00,000

Less: Amount of new shares issued (8,000 x 10) – 80,000

Amount to be transferred to CRR 20,000

Hence, the reduction of total capital by Rs 1,00,000 due to the redemption of preference shares is reversed by issuing equity shares of Rs 80,000 and creating a Capital Redemption Reserve of Rs 20,000.

See less

The word, “deferred” means delayed or postponed and “revenue” in layman’s terms means income. Therefore deferred revenue means the revenue which is yet to be recognised as income. It is actually unearned income. In accrual accounting, income is recognised only when it is accrued or earned. DeferredRead more

The word, “deferred” means delayed or postponed and “revenue” in layman’s terms means income. Therefore deferred revenue means the revenue which is yet to be recognised as income. It is actually unearned income.

In accrual accounting, income is recognised only when it is accrued or earned. Deferred revenue is the income received before the performance of the economic activity to earn it.

Example: A shoe shop owner gives an order to a shoe manufacturer of 1000 pair of shoes which is to be delivered after 4 months. He also gives him a cheque of ₹15,000 in advance, the rest ₹5000 is to be given at the time of delivery.

So, in this case, the ₹15,000 is actually is unearned revenue i.e. deferred revenue. It will be recognised as revenue when the shoe manufacture completes the order and deliver it.

Till then, the deferred revenue is reported as a liability in the balance sheet. Like this:

After recognition as revenue, it will be reported in the statement of profit or loss:

Hence, to summarise, deferred revenue is:

Some examples of deferred revenue are as follows:

Now the question arises why deferred revenue is recognised as a liability. It is due to the fact that the business may not be able to perform the economic activity successfully to earn that revenue.

Taking the above example, suppose the shoe manufacturer is not able to honour its commitment and the shoe shop owner can wait no more, then the advanced money of ₹ 15,000 is to be refunded. That’s why deferred revenue is recognised as a liability because it is a liability if we consider the principle of conservatism (GAAP).

See less