The term ‘contra’ means opposite or against. In financial accounting, we encounter the term ‘contra’ in: Contra accounts Contra entries The meaning of contra in the above mention terms is also the same as their general meaning. Contra accounts mean the account which is opposite of the account it corRead more

The term ‘contra’ means opposite or against. In financial accounting, we encounter the term ‘contra’ in:

- Contra accounts

- Contra entries

The meaning of contra in the above mention terms is also the same as their general meaning. Contra accounts mean the account which is opposite of the account it corresponds to.

Contra entries are entries of the debit and credit aspects related to the same parent account. Let’s discuss them in detail.

Contra accounts

Any account which is created with the purpose of reducing or offsetting the balance of another account is known as a contra account.

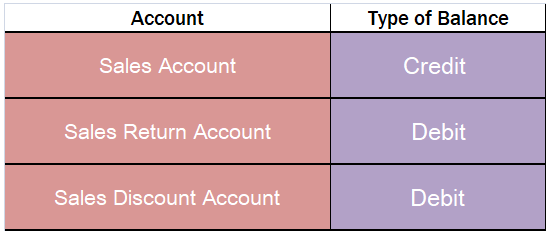

A contra account is just the opposite of the account to which it relates. The most common examples are the sales discount account and sales return account which is the contra account of the sales account. They are just the opposite of the sales accounts.

Contra Entries

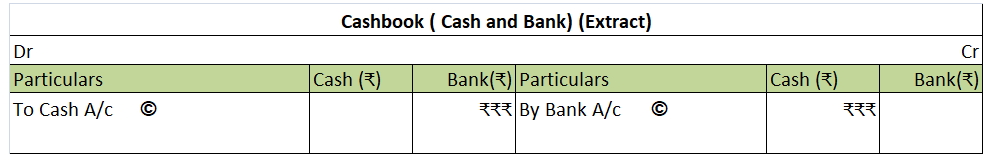

Contra entries refer to the entries which show the movement of the amount within the same parent account. Here, the debit and credit entry is posted on the debit and credit side respectively of a single parent account. Mainly, contra entries are the entries involving cash and bank accounts.

The following transactions are recorded as contra entries:

- Cash to Bank transactions: Deposit of cash into the bank account by the entity.

- Bank to Cash transactions: Withdrawal of cash from the bank.

- Cash to cash transactions: Transfer of cash to the petty cash account.

- Bank to Bank transactions: Transfer of amounts from one bank account to other bank accounts of the same entity.

Contra entries are marked by the letter ‘C’ beside the postings in the ledger. Deposit of cash in to bank will be posted in cashbook as below:

The principal book of accounting is “Ledger”. It records all types of transactions relating to a real, personal or nominal account. It records transactions relating to an income, expense, asset or a liability. A ledger classifies a transaction which is recorded in journal to their respective accountRead more

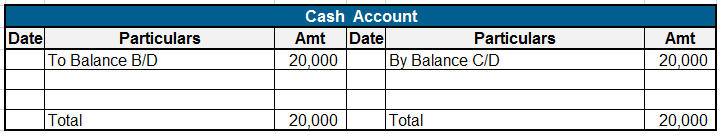

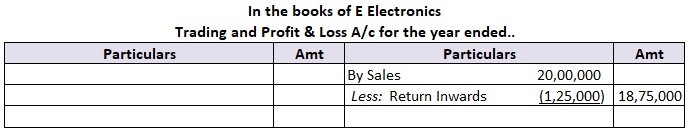

The principal book of accounting is “Ledger”. It records all types of transactions relating to a real, personal or nominal account. It records transactions relating to an income, expense, asset or a liability.

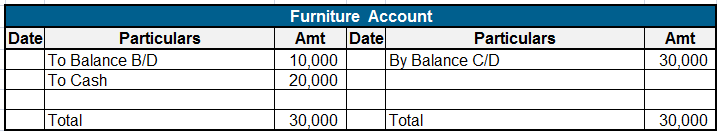

A ledger classifies a transaction which is recorded in journal to their respective accounts, and in the end calculates a closing balance for the same account. The closing balance is further transferred to the financial statements, and hence ledger is called the books of final entry as it gives true and fair picture of an account.

Template of Ledger:

For example, ABC Ltd purchased machinery for cash amounting to Rs 1,00,000 on 1st January. This transaction will include a machinery account and a cash account. The amount will be recorded in the respective accounts for that period.

The reason being ledger is called a principal book of accounting is, it helps a business in preparation of trial balance and financial statements.

See less