Debtors are treated as an asset. A debtor is a person or an entity who owes an amount to an enterprise against credit sales of goods and/or services rendered. When goods are sold to a person on credit that person is called a debtor because he owes that much amount to the enterprise. Debtors are consRead more

Debtors are treated as an asset.

A debtor is a person or an entity who owes an amount to an enterprise against credit sales of goods and/or services rendered.

When goods are sold to a person on credit that person is called a debtor because he owes that much amount to the enterprise.

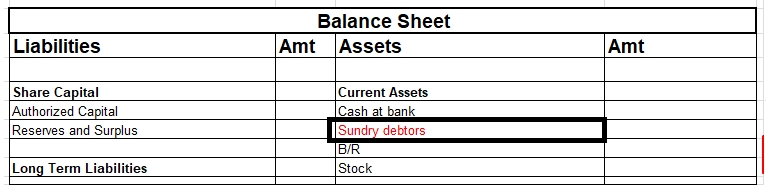

Debtors are considered assets in the balance sheet and are shown under the head of current assets.

For example – Ram Sold goods to Sam on credit, Sam did not pay for the goods immediately, so here Sam is the debtor for Ram because he owes the amount to Ram. This amount will be payable at a later date.

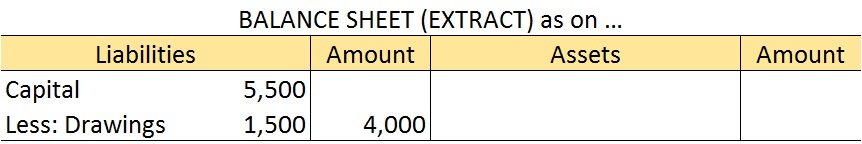

Liabilities Vs Assets

Liabilities

It means the amount owed (payable) by the business. Liability towards the owners ( proprietor or partners ) of the business is termed internal liability. For example, owner’s capital, etc

On the other hand, liability towards outsiders, i.e., other than owners ( proprietors or partners ) is termed as an external liability.

For example creditors, bank overdrafts, etc.

Assets

An asset is a resource owned or controlled by a company. The benefit from the asset will accrue to the business in current and future periods. In other words, it’s something that a company owns or controls and can use to generate profits today and in the future.

For example – machinery, building, etc.

Current assets are defined as cash and other assets that are expected to be converted into cash or consumed in the production of goods or rendering of services in the normal course of business. They are readily realizable into cash.

In other words, we can say that the expected realization period of current assets is less than the operating cycle period.

For example, goods are purchased with the purpose to resell and earn a profit, debtors exist to convert them into cash i.e., receive the amount from them, bills receivable exist again for receiving cash against it, etc.

Why debtors are treated as assets?

Now let me explain to you why debtors are treated as assets and not as liabilities because of the following characteristics :

- We can say that the expected realization period is less than the operating cycle period.

- Expected to be converted into cash in the normal course of business.

- In the business, debtors are treated as current assets which we can see on the asset side of the balance sheet.

- Debtors have a debit balance.

Conclusion

Now after the above discussion, I can conclude that debtors are considered to be an asset and not a liability.

See less

Partnership Firm Persons who have entered into a partnership with one another to carry on a business are individually called “Partners“; collectively called a “Partnership Firm”; and the name under which their business is carried on is called the “Firm Name” In simple words, A partnership is an agreRead more

Partnership Firm

Persons who have entered into a partnership with one another to carry on a business are individually called “Partners“; collectively called a “Partnership Firm”; and the name under which their business is carried on is called the “Firm Name”

In simple words, A partnership is an agreement between two or more people who comes together to run a business on a partnership deed, which is called a Partnership firm. A Partnership Deed is a written agreement between partners who are willing to form a Partnership Firm. It is also called a Partnership Agreement.

It has no separate legal entity which cannot be separated from the members. It is merely a collective name given to the individuals composing it. This means, a partnership firm cannot hold property in its name, and neither it can sue nor be sued by others.

Contents of a Partnership Deed

A Partnership Deed shall mainly include the following contents:

Types of Partners

The following are the various types o partners

Types of Partnership Firms

There are four types of partnership which are as below.

Essential characteristics of a partnership firm

See less