Cash Book is called a journalized ledger because it is considered to be both a journal as well as a ledger. As you know Cash Book is a subsidiary book. But like a journal, the transactions in the Cash Book are recorded in it for the first time from the source documents/vouchers. Hence it is considerRead more

Cash Book is called a journalized ledger because it is considered to be both a journal as well as a ledger.

As you know Cash Book is a subsidiary book. But like a journal, the transactions in the Cash Book are recorded in it for the first time from the source documents/vouchers. Hence it is considered to be a journal for all cash transactions.

Cash Book can also be viewed as a Cash A/c because all transactions involving cash are recorded in it. It provides a summary of cash transactions. Hence it is considered to be a ledger account for cash transactions.

Since Cash Book is both a journal and ledger, you can very well call it a ‘journalized ledger’.

See less

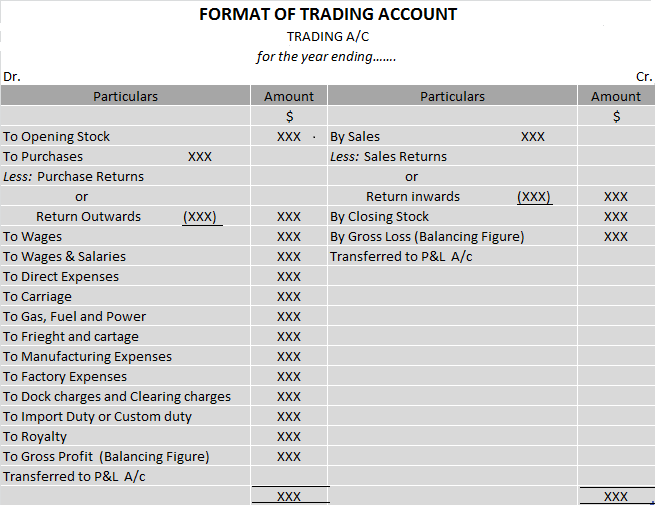

Return inwards in simple terms means sending back goods by the customer to the seller. Simply speaking when your customer purchases items from your business but is not satisfied with the items so received they return those items back to you. Some of the reasons for sending back the items are statedRead more

Return inwards in simple terms means sending back goods by the customer to the seller. Simply speaking when your customer purchases items from your business but is not satisfied with the items so received they return those items back to you. Some of the reasons for sending back the items are stated below:

In such a case, the return is initiated by the buyer and a credit note is issued to the buyer, and the same is recorded in the books of accounts. Also, this return inward is deducted from the total sales.

Example: M/s Pest ltd sold 4 units of fertilizers spraying tools of Rs 10,000 each to Mr. Zen. On inspection, he found 1 unit worth Rs 10,000 so received to be defective. Therefore the return of Rs 10,000 was initiated and goods were returned to the seller. A credit note of Rs 10,000 will be raised by the seller (M/s Pest ltd) to the buyer (Mr. Zen). The following adjustment will be shown in the trading account.

Return outwards means returning the goods by the buyer to the supplier. In layman language, when you purchase items for your business and you are not happy with the items then you may decide to return them.

In this case, a debit note is issued to the seller and is recorded in the books of accounts, and the same is reduced from the total purchases in the trading account so prepared.

Example: Suppose you are dealing in a business of clothing. You purchased 20 shirts for Rs.10,000 from a wholesale market. When you sold these shirts, you found 10 shirts worth Rs 5,000 to be defective which were returned by your customer. Therefore you will return these shirts to the wholesale market from where you purchased them. The following adjustment will be shown in the trading account.

See less