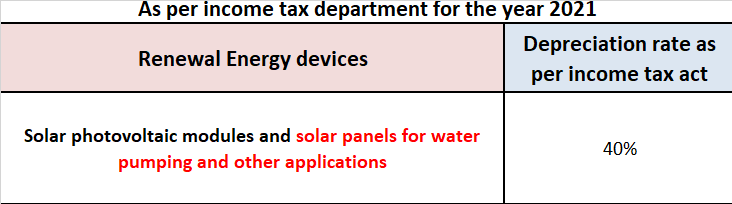

As per the Income-tax act, solar panels are categorized under the heading renewal energy devices. The rate of depreciation for these devices is mentioned below. As per the act, the rate of depreciation for solar panels is given as 40% as per the WDV method. Generally, these devices are treated as inRead more

As per the Income-tax act, solar panels are categorized under the heading renewal energy devices. The rate of depreciation for these devices is mentioned below.

As per the act, the rate of depreciation for solar panels is given as 40% as per the WDV method. Generally, these devices are treated as investments in fixed assets. Therefore they are treated accordingly like other fixed assets and are depreciated periodically in an organized and regular time period. The useful life of such solar devices is taken to be 5 years.

Giving you a small example of the depreciation on solar panels.

Solar panels were purchased by Agro Farm ltd. for installing them to be used for electricity generation. These panels were bought for Rs 2,00,000. Therefore depreciation to be charged as per income tax act over its useful life of 5 years is as follows:

Depreciation as per WDV = (Cost of an asset – salvage value)* rate of depreciation

Depreciation for 1st year = (2,00,000 – 0)* 40% = Rs 80,000

WDV at the end of 1st year = (2,00,000 – 80,000) = Rs 1,20,000

Depreciation for 2nd year = (1,20,000 – 0)* 40% = Rs 48,000

the same process will continue till the useful life of an asset.

The depreciation amount will be written off from the book value as shown below:

| Useful life | Value at the beginning of the year | Depreciation amount | Value at the end of the period |

| 1 | 2,00,000 | 80,000 | 1,20,000 |

| 2 | 1,20,000 | 48,000 | 72,000 |

| 3 | 72,000 | 28,800 | 43,200 |

| 4 | 43,200 | 17,280 | 25,920 |

| 5 | 25,920 | 10,368 | 15,552 |

See less

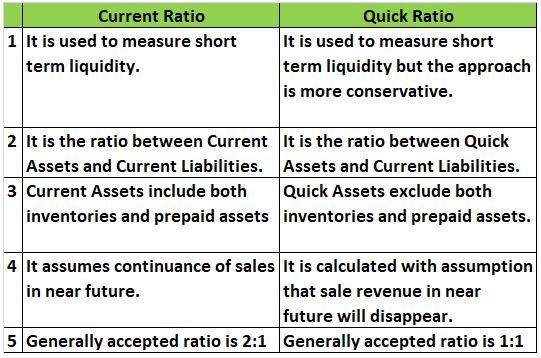

Current assets are all the assets of the company which are expected to be used, sold, or consumed within one year. Current assets are those assets that can be converted into cash easily. For example - Inventory, Accounts Receivable, Cash, and Cash Equivalents. Loose tools are parts of machinery or sRead more

Current assets are all the assets of the company which are expected to be used, sold, or consumed within one year. Current assets are those assets that can be converted into cash easily.

For example – Inventory, Accounts Receivable, Cash, and Cash Equivalents.

Loose tools are parts of machinery or spare parts of machinery. Loose can be classified on the nature of use whether it is a fixed asset or a current asset. If loose tools are used regularly or within one accounting year, it is classified as a current asset.

Loose tools are usually classified as a current asset, however, there is one exception i.e it is excluded from the current ratio.

They are excluded from the current ratio because the current ratio takes into account only current assets, and the nature of loose tools is either a fixed asset or a current asset and can’t be converted into cash easily.

The current ratio is calculated to check the liquidity of the company.

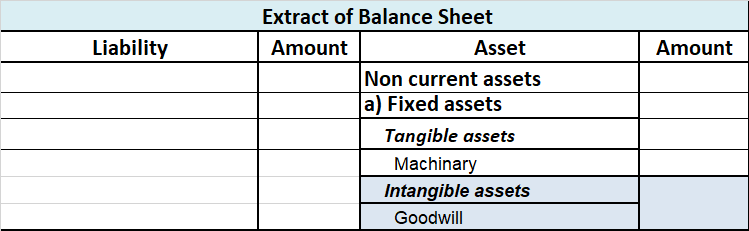

Loose tools appear in the Asset Side of the Balance Sheet under the head Current Asset, subhead Inventories.

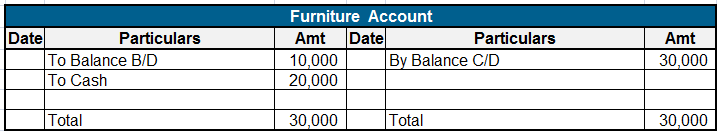

The extract of the Balance Sheet is as follows:

When the balance sheet prepared under Schedule III loose tools is shown under notes to accounts under sub-head Inventories on the asset side.

When the balance sheet is in a T format loose appears as a current asset after recording fixed assets on the asset side.

See less