No, drawings are not shown in the statement of profit or loss. By drawings, we mean the withdrawal of cash or goods by the owner of the business for his personal use. Drawings are actually shown in the balance sheet as a deduction from the capital account. Let’s take an example, Mr X runs a tradingRead more

No, drawings are not shown in the statement of profit or loss. By drawings, we mean the withdrawal of cash or goods by the owner of the business for his personal use.

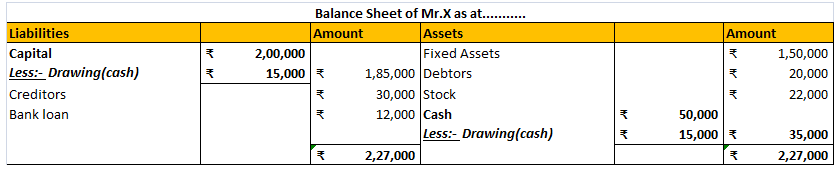

Drawings are actually shown in the balance sheet as a deduction from the capital account.

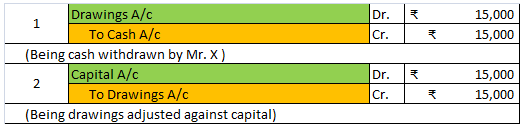

Let’s take an example, Mr X runs a trading business. For meeting his personal expense we withdrew cash from his business cash of amount Rs. 15,000. It shall be reported like this:

Journal Entries:

Balance sheet:

Profit and loss account reports only the nominal accounts i.e. incomes and expenses. That’s why drawings are not shown in the statement of profit or loss because it is neither an expense nor an income.

It represents the owner’s withdrawal of capital from business for personal use. Hence, the drawings account is a personal account. Drawings lead to a simultaneous reduction in capital and cash or stock of a business which has nothing to do with Profit and loss A/c.

Therefore it is reported in the balance sheet only.

See less

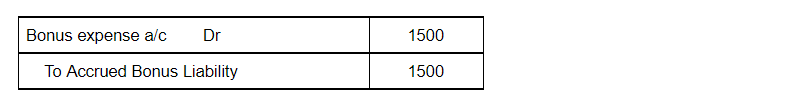

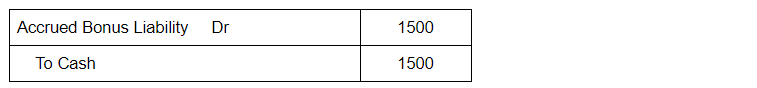

The bonus expense account is debited because according to the modern rule of accounting “Increase in expense is debited”. Accrued bonus liability is credited because according to the rule of accounting, “Increase in liability is credited”.

The bonus expense account is debited because according to the modern rule of accounting “Increase in expense is debited”. Accrued bonus liability is credited because according to the rule of accounting, “Increase in liability is credited”.

The entry for a loan (taken for any purpose) and a car loan are quite different. When you take a bank loan, you'll receive the money from the bank and subsequently, you'll start paying interest on it. In the case of a car loan, you don't receive the money from the bank. Once the car has been purchasRead more

The entry for a loan (taken for any purpose) and a car loan are quite different. When you take a bank loan, you’ll receive the money from the bank and subsequently, you’ll start paying interest on it.

In the case of a car loan, you don’t receive the money from the bank. Once the car has been purchased you’ll make the down payment and the remaining amount will be paid by the bank on your behalf. This car loan should then be paid to the bank in installments.

The following journal entry is posted to record the car loan taken for office use:

Car A/c is debited as there is an increase in the asset. Bank A/c is credited as the down payment for the car is made which reduces the assets. Car Loan A/c is credited as it increases liability.

The following entry is recorded for the repayment of the loan (first installment) to the bank.

Let me explain this with an example,

Kumar purchased a car for 25,00,000 for his office use. He made a down payment of 2,00,000 and took a car loan from HDFC Bank for 23,00,000. The following entry will be made to record this transaction.

See less