Expenses are of two types, are Direct Expenses Indirect Expenses Direct Expenses Direct expenses are those expenses are which are directly related to the manufacturing or production of the final goods. These expenses are also known as Manufacturing expenses. Manufacturing or production of gooRead more

Expenses are of two types, are

- Direct Expenses

- Indirect Expenses

Direct Expenses

Direct expenses are those expenses are which are directly related to the manufacturing or production of the final goods. These expenses are also known as Manufacturing expenses.

Manufacturing or production of goods indicates the conversion of Raw material into finished goods. the expenses incurred in the stage of conversion are treated as Direct expenses or Manufacturing expenses.

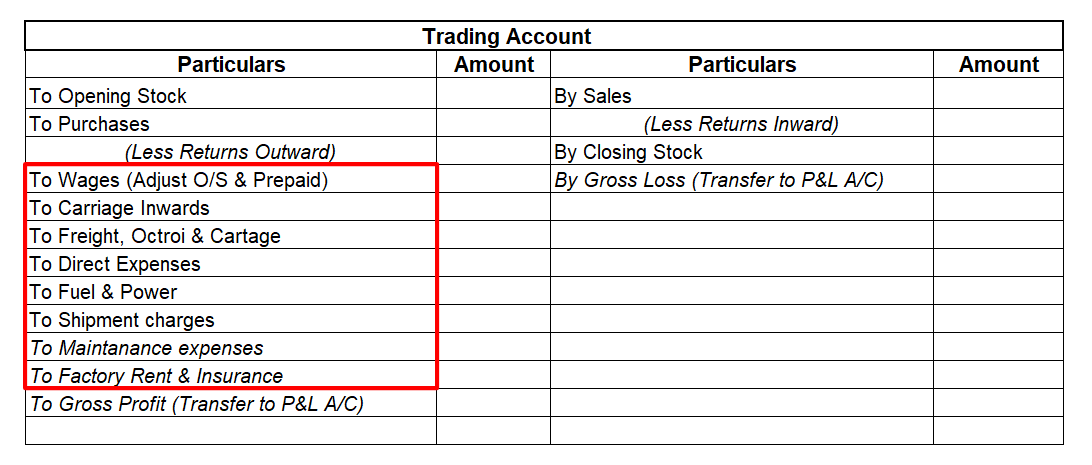

Direct expenses are shown on the Debit side of the Trading Account.

Indirect Expenses

Indirect expenses are those expenses that are incurred to run a business day-to-day and maintenance of the company. In other words, they are not directly related to making a product or service or buying a wholesale product to resell.

Indirect expenses are classified into three types, which are

- Factory Expenses

- Administrative Expenses

- Selling & Distribution Expenses

Indirect Expenses are shown on the Debit side of the Profit and Loss Account.

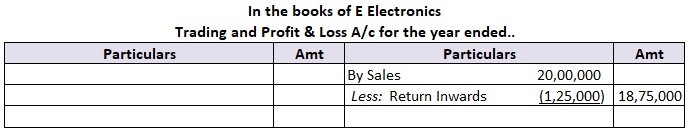

Presentation of Direct Expenses in Trading Account

Examples of Direct Expenses

- Gas, water, and Fuel: Gas, water, and fuel are the essentials to run a factory and are used in machinery to manufacture its final goods.

- Wages: Wages are the daily payments to the workers or Labours working in the factory premises on a daily or weekly payment basis.

- Freight and Carriage: Freight and Carriage are the expenses related to the importing of raw materials from the godown or from the outsiders to the Factory.

- Factory Rent: Rent paid for the factory area or any payment related to the place of the factory is known as factory rent.

- Factory Lighting: The expenses related to the uniform distribution of light over the working plane are obtained in the factory premises.

- Factory Insurance: The payment of insurance related to the factory will come under direct expenses.

- Manufacturing Expenses: Any other expenses related to the manufacturing process of finished goods are manufacturing expenses.

- Cargo Expenses: These are the expenses related to goods or freight being shipped or carried by the ocean, air, or land from one place to another.

- Upkeep and Maintenance: These are the expenses related to the maintenance of the factory for smooth running.

- Repairs on Machinery: The expenses related to any repair on machinery which is used in the production.

- Coal, Oil, and Grease: Coal, oil, and grease are the essentials to run machinery which results in the conversion of raw material to finished goods.

- Custom Charges: The expenses related to the payment of any Customs duty for the material imported.

- Clearing Charges: A clearing charge is a charge assessed on securities transactions by a clearing house for completing transactions using its own facilities.

- Depreciation on Machinery: Generally it is a nonmonetary expense but recorded in the trading account as a direct expense as per the accrual accounting.

- Import duty: any payment related to the importing of any machinery or any material from other countries is known as import duty.

- Octroi: this is the tax levied by a local political unit, normally the commune or municipal authority, on certain categories of goods as they enter the area.

- Shipping expenses: any expense related to the shipment charges of the raw material is known as shipping expenses.

- Motive power: Motive Power basically means any power, such as electricity or steam energy, etc, used to impart motion to any source of mechanical energy.

- Dock dues: a payment that a shipping company must pay for the use of a port.

The accounting equation for a non-profit organisation is almost the same as in the case of the profit-oriented organisation. Let's first briefly understand what accounting equation and non-profit organisation are: Accounting Equation Accounting equation is an equation that depicts the relationship bRead more

The accounting equation for a non-profit organisation is almost the same as in the case of the profit-oriented organisation. Let’s first briefly understand what accounting equation and non-profit organisation are:

Accounting Equation

Accounting equation is an equation that depicts the relationship between assets, liabilities and capital of an entity.

Assets = Liabilities + Capital

As per this equation, the total assets of an entity are equal to the sum of its total liabilities and total capital. This equation holds good in every situation.

Non-Profit Organisation

A Non-Profit Organisation is an entity which exists for purposes other than for profit. Such organizations exist and operate for charitable purposes, promotion of culture and sports and welfare of society. The accounting for Non-profit organisation is slightly different from For-profit organisations. In the case of a non-profit organisation, the capital account is known as the capital fund.

Accounting Equation for non-profit organisations

The Accounting equation for a non-profit organisation is as follows:

Assets = Liabilities + Capital fund.

The difference is only in name. In the case of non-profit organizations, the capital is known as a capital fund. Rest everything is the same. The accounting equation will be prepared as normally prepared for business concerns.

See less