Straight Line Depreciation Journal Entry Straight-line depreciation refers to the diminishing value of assets over the life of the asset. In other words, the cost of the asset spreads evenly over the useful life of the assets. The salvage value or Residual value of an asset means the estimated valueRead more

Straight Line Depreciation Journal Entry

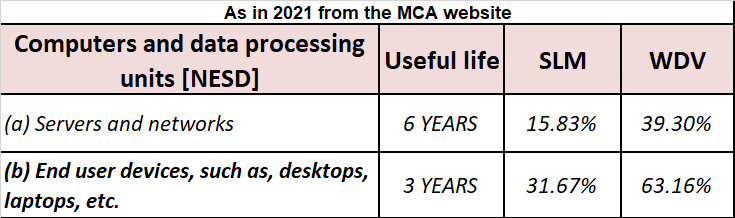

Straight-line depreciation refers to the diminishing value of assets over the life of the asset. In other words, the cost of the asset spreads evenly over the useful life of the assets.

The salvage value or Residual value of an asset means the estimated value of the asset at the end of its useful life.

The depreciation can also be charged with another method like Written Down Value (WDV) Method.

Formula

Depreciation per annum = ( Cost of asset – Salvage Value) / Useful Life

The journal entry for the depreciation is:

|

JOURNAL ENTRIES |

||

| Depreciation on Asset A/C DR. | ||

| To Asset A/C | ||

| (Being depreciation charged on asset) |

Now let us understand this with an example, suppose XYZ Ltd. has an asset of value 90,000 with a useful life of 3 years. The company uses the straight-line method of depreciation to depreciate the asset in its book.

So, the depreciation per annum would be calculated as:-

= 90,000/3

= 30,000

In Year 1, the depreciation will be charged as 30,000 for this year. It will be debited to the depreciation account and credited to the asset account. Thus, the value of the asset at the end of year 1 will be 60,000 (90,000-30,000).

|

JOURNAL ENTRIES |

||||

| DR | CR | |||

| Depreciation on Asset A/C 30,000 | ||||

| To Asset A/C 30,000 | ||||

| (being depreciation charged on asset) |

In Year 2, the depreciation will be charged as 30,000. The entry would be the same as the previous year. The value of the asset at the end of year 2 will be 30,000 (60,000-30,000).

| JOURNAL ENTRIES | ||||

| DR | CR | |||

| Depreciation on Asset A/C 30,000 | ||||

| To Asset A/C 30,000 | ||||

| (being depreciation charged on asset) |

At last in Year 3, the depreciation will be charged 30,000. The entry would be the same. The value of the asset at the end of year 3 will be Nil (30,000- 30,000).

|

JOURNAL ENTRIES |

||||

| DR |

CR |

|||

| Depreciation on Asset A/C 30,000 | ||||

| To Asset A/C 30,000 | ||||

| (being depreciation charged on asset) |

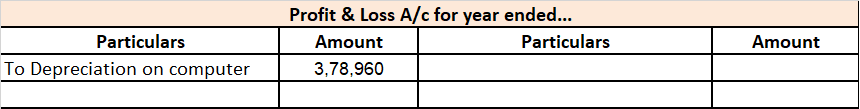

The depreciation will be charged to the profit and loss account for the year as it is an expense for the company.

The entries will be posted into depreciation account as mentioned:

| DEPRECIATION A/C | |||||||

| Date | Particulars | Amount | Date | Particulars | Amount | ||

| Year 1 | To Asset A/C | 30,000 | By Profit and Loss A/C | 30,000 | |||

| 30,000 | 30,000 | ||||||

| Year 2 | To Asset A/C | 30,000 | By Profit and Loss A/C | 30,000 | |||

| 30,000 | 30,000 | ||||||

| Year 3 | To Asset A/C | 30,000 | By Profit and Loss A/C | 30,000 | |||

| 30,000 | 30,000 | ||||||

See less

Starting of the business The starting of the business, in accounting terms, is called the commencement of the business. There are three types of businesses that can be commenced, they are, sole proprietorship, partnership, and joint-stock company. In order to start the business, in companies, commenRead more

Starting of the business

The starting of the business, in accounting terms, is called the commencement of the business. There are three types of businesses that can be commenced, they are, sole proprietorship, partnership, and joint-stock company.

In order to start the business, in companies, commencement is a declaration issued by the company’s directors with the registrar stating that the subscribers of the company have paid the amount agreed. In a sole proprietorship, the business can be commenced with the introduction of any asset such as cash, stock, furniture, etc.

Journal entry

In this entry, “Started business with cash $60,000”

As per the golden rules of accounting, the cash a/c is debited because we bring in cash to the business, and as the rule says “debit what comes in, credit what goes out.” Whereas the capital a/c is credited because “debit all expenses and losses, credit all incomes and gains”

As per modern rules of accounting, cash a/c is debited as cash is a current asset, and assets are debited when they increase. Whereas, on the increment on liabilities, they are credited, therefore, capital a/c is credited.

See less