Generally, Assets are classified into two types. Non-Current Assets Current Assets Non-Current Asset Noncurrent assets are also known as Fixed assets. These assets are an organization's long-term investments that are not easily converted to cash or are not expected to become cash within an acRead more

Generally, Assets are classified into two types.

- Non-Current Assets

- Current Assets

Non-Current Asset

Noncurrent assets are also known as Fixed assets. These assets are an organization’s long-term investments that are not easily converted to cash or are not expected to become cash within an accounting year.

In general terms, In accounting, fixed assets are assets that cannot be converted into cash immediately. They are primarily tangible assets used in production having a useful life of more than one accounting period. Unlike current assets or liquid assets, fixed assets are for the purpose of deriving long-term benefits.

Unlike other assets, fixed assets are written off differently as they provide long-term income. They are also called “long-lived assets” or “Property Plant & Equipment”.

Examples of Fixed Assets

- Land

- Land improvement (e.g. irrigation)

- Building

- Building (work in progress)

- Machinery

- Vehicles

- Furniture

- Computer hardware

- Computer software

- Office equipment

- Leasehold improvements (e.g. air conditioning)

- Intangible assets like trademarks, patents, goodwill, etc. (non-current assets)

Valuation of Fixed asset

fixed assets are recorded at their net book value, which is the difference between the “historical cost of the asset” and “accumulated depreciation”.

“Net book value = Historical cost of the asset – Accumulated depreciation”

Example:

Hasley Co. purchases Furniture for their company at a price of 1,00,000. The Furniture has a constant depreciation of 10,000 per year. So, after 5 years, the net book value of the computer will be recorded as

1,00,000 – (5 x 10,000) = 50,000.

Therefore, the furniture value should be shown as 50,000 on the balance sheet.

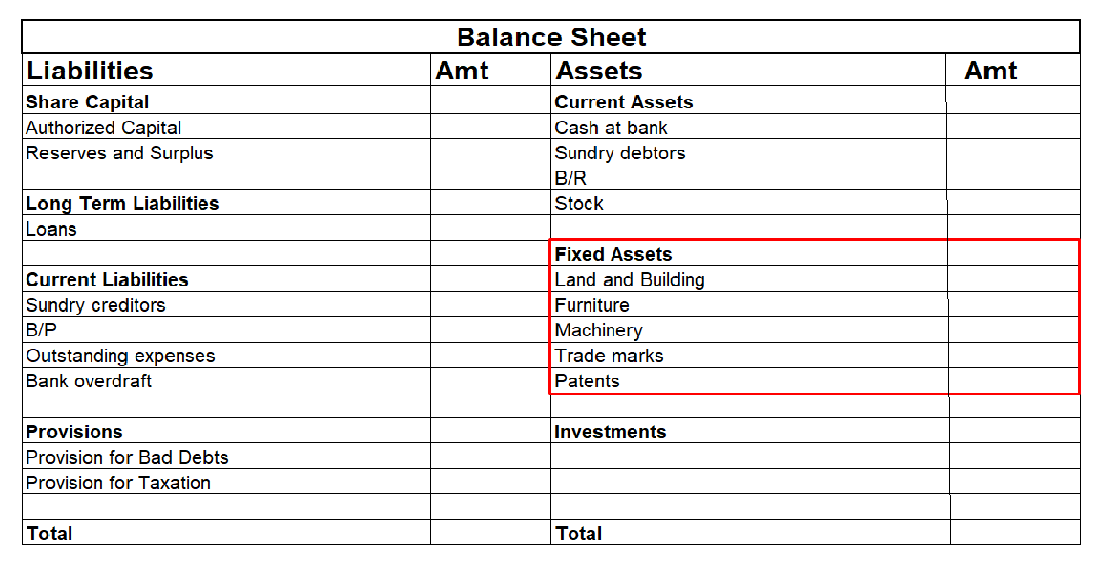

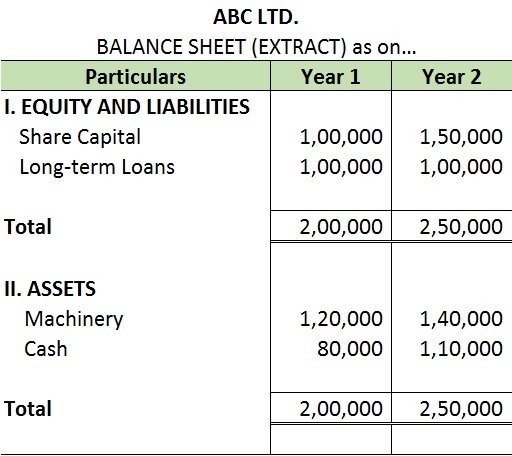

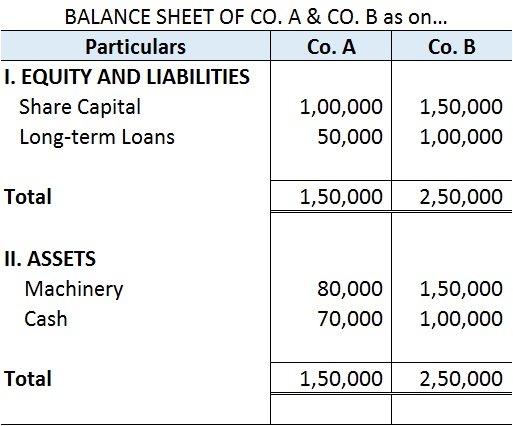

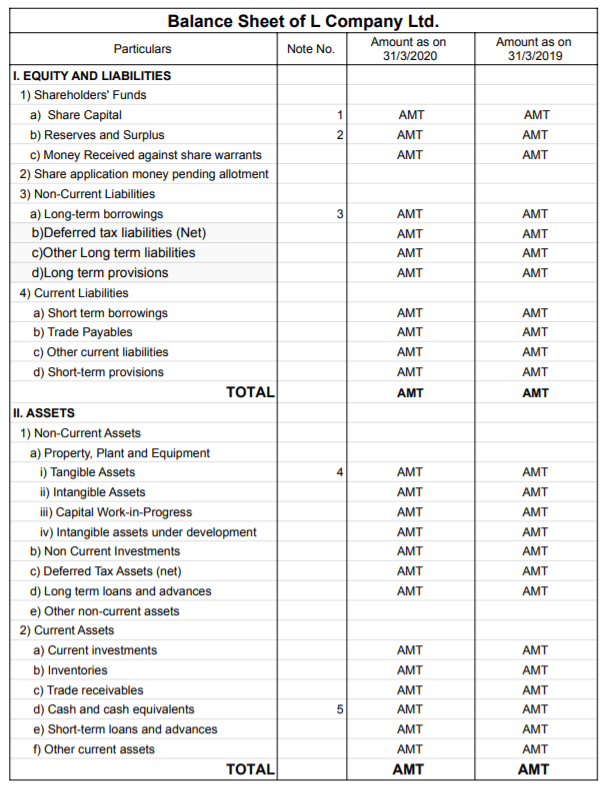

Presentation in the Balance Sheet

Both current assets and non-current assets are shown on the asset side(Right side) of the balance sheet.

Difference between Current Asset and Non-Current Asset

Current assets are the resources held for a short period of time and are mainly used for trading purposes whereas Fixed assets are assets that last for a long time and are acquired for continuous use by an entity.

The purpose to spend on fixed assets is to generate income over the long term and the purpose of the current assets is to spend on fixed assets to generate income over the long term.

At the time of the sale of fixed assets, there is a capital gain or capital loss but at the time of the sale of current assets, there is an operating gain or operating loss.

The main difference between the fixed asset and current asset is, although both are shown in the balance sheet fixed assets are depreciated every year and it is valued by (the cost of the asset – depreciation) and current asset is valued as per their current market value or cost value, whichever is lower.

See less

Non-debt capital receipts As we're aware, there are two main sources of the government’s income — revenue receipts and capital receipts. Revenue receipts are all those receipts that neither create any liability nor cause any reduction in assets for the government, whereas, capital receipts are thoseRead more

Non-debt capital receipts

As we’re aware, there are two main sources of the government’s income — revenue receipts and capital receipts. Revenue receipts are all those receipts that neither create any liability nor cause any reduction in assets for the government, whereas, capital receipts are those money receipts of the government that either create a liability for a government or cause a reduction in assets.

Revenue receipts comprise both tax and non-tax revenues while capital receipts consist of capital receipts and non-debt capital receipts. Non-debt capital receipt is a part of capital receipt.

Definition

Non-debt capital receipts, also known as NDCR, are the taxes and duties levied by the government forming the biggest source of its income. Those receipts of the government lead to a decrease in assets, and not an increase in liabilities. It accounts for just 3% of the central government’s total receipts.

The union government usually lists non-debt capital receipts in two categories:

For Example – Disinvestment and recovery of loans are non-debt creating capital receipts.

See less