Capital Redemption Reserve is a statutory reserve, which means it is mandatory for a company to create such reserve when it decides to redeem its preference shares. Capital Redemption Reserve cannot be utilised for any purpose other than the issue of bonus shares. Now let’s understand the reason behRead more

Capital Redemption Reserve is a statutory reserve, which means it is mandatory for a company to create such reserve when it decides to redeem its preference shares. Capital Redemption Reserve cannot be utilised for any purpose other than the issue of bonus shares.

Now let’s understand the reason behind it.

We know preference shares are those shares that carry some preferential rights:

- Dividend at a fixed rate

- Right to get repaid before equity shareholders in event of winding up of the company

- Other rights as specified in the Articles of Associations.

Also, unlike equity shares, preference shares are redeemable i.e. repaid after a period of time (which cannot be more than 20 years).

Generally, the creditors of a company have the right to be repaid first. So, in event of redemption of preference shares, the preference shareholders are repaid before creditors and the total capital of the company will but the total debt of the company is unaffected.

The gap between the debt and equity of the company will further widen and this will also increase the debt-equity ratio of the company. It will be perceived to be a risky scenario by the creditors and lenders of the company because the

So to protect the creditor and lender, Section 55 of the Companies Act comes to rescue.

Section 55 of the Companies Act ensure that the creditors and lenders of a company do not find themselves in a riskier situation when the company decides to redeem its preference shares by making it mandatory for a company to either

- issue new shares to fund the redemption of preference shares

OR

- create a capital redemption reserve if it uses profits for redemption

OR

- a combination of both

This will fill up the void created by the redemption of preference shares and the debt-equity ratio will remain unaffected. Keeping an amount aside in Capital Redemption Reserve ensures that such amount will not be used for dividend distribution and capital will be restored because it can be only used to issue bonus shares.

In this way the debt-equity ratio remains the same, the interest of the creditors and lenders secured.

Bonus shares are fully paid shares that are issued to existing shareholders at no cost.

Let’s take a numerical example for further understanding:

ABC Ltd wants to redeem its 1,000 9% Preference shares at a face value of Rs 100 per share. It has decided to issue 8,000 equity shares @Rs 10 per share and use the profit and reserves to fund the deficit.

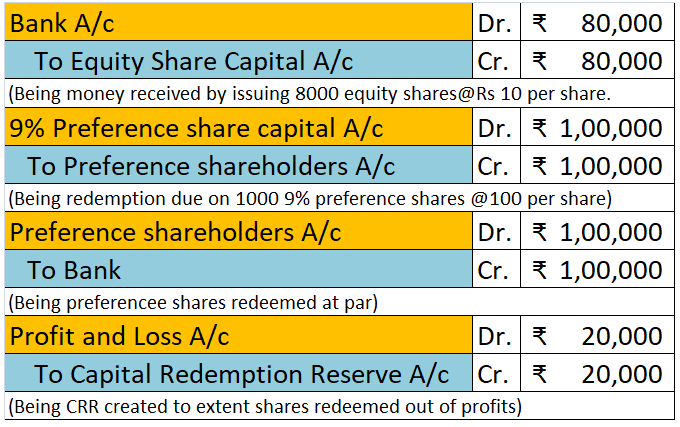

The journal entries will be as follows:

Working note: Rs

9% preference shares due for redemption (1,000 x 10) – 1,00,000

Less: Amount of new shares issued (8,000 x 10) – 80,000

Amount to be transferred to CRR 20,000

Hence, the reduction of total capital by Rs 1,00,000 due to the redemption of preference shares is reversed by issuing equity shares of Rs 80,000 and creating a Capital Redemption Reserve of Rs 20,000.

See less

To begin with, let me give you a brief explanation of both the terms i.e. Accounting policies and accounting principles- In order to maintain the financial statements, the company’s management adopts various Accounting Policies of its own. This generally includes the rules, the directions as to howRead more

To begin with, let me give you a brief explanation of both the terms i.e. Accounting policies and accounting principles-

In order to maintain the financial statements, the company’s management adopts various Accounting Policies of its own. This generally includes the rules, the directions as to how the financial statements will be prepared or how the valuation of depreciation would be done, and so on. These are flexible in nature and vary from company to company.

For Example 1, Johnson Co. uses FIFO (first in first out) method to value the inventory. That is to say that, while selling its product, it sells those goods or products which it has acquired or produced first.

It does not consider the LIFO or weighted average cost. The other company may adopt the other method as per its wish.

Example 2, Johnson Co. uses the straight-line method of depreciating an asset, whereas the other company can opt for a written down value method depending upon the need of the company.

So what I am trying to explain from this is that the accounting policies are flexible and can be adopted as per the needs of the company.

Accounting Principles are the rules which the accountants adopt universally for recording and reporting the financial data. It brings uniformity in accounting throughout the practice of accounting. These are generally less flexible in nature.

For Example, “Cost” is a principle. According to this accounting principle, an asset is recorded in the books at the price paid to acquire it and this cost will be the basis for all the subsequent accounting for the asset. However, asset market value may change over time, but for the accounting purpose, it continues to be shown at its book value i.e. at which it is acquired.

Some more examples would be of Matching principle, Consistency principle, Money measurement principle, etc.

Differences

Conclusion

The point is Accounting Principles are the broad direction to reach a goal and to reach that goal helps the accounting policies.

See less