The correct answer is 4. Not shown in Branch Account. The value of depreciation of fixed assets will be not shown in the branch accounting because the opening value of the asset is recorded at the start of the period on the debit side and the closing value of the asset is shown on the credit side atRead more

The correct answer is 4. Not shown in Branch Account.

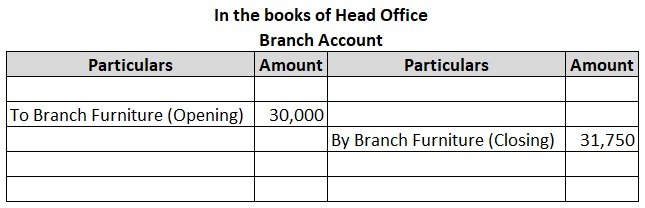

The value of depreciation of fixed assets will be not shown in the branch accounting because the opening value of the asset is recorded at the start of the period on the debit side and the closing value of the asset is shown on the credit side at the end of the period.

The difference between the opening and closing values of the asset is the value of depreciation which is automatically charged. In this case, if depreciation is also shown it will be counted twice.

Example:

XYZ Ltd purchased furniture for one of its branches on 1st January. Following are the details of the purchase:

| Furniture as on 1st January | $30,000 |

| Furniture purchased on 1st June | $5,000 |

Depreciation is provided on furniture at @10% per annum on the straight-line method.

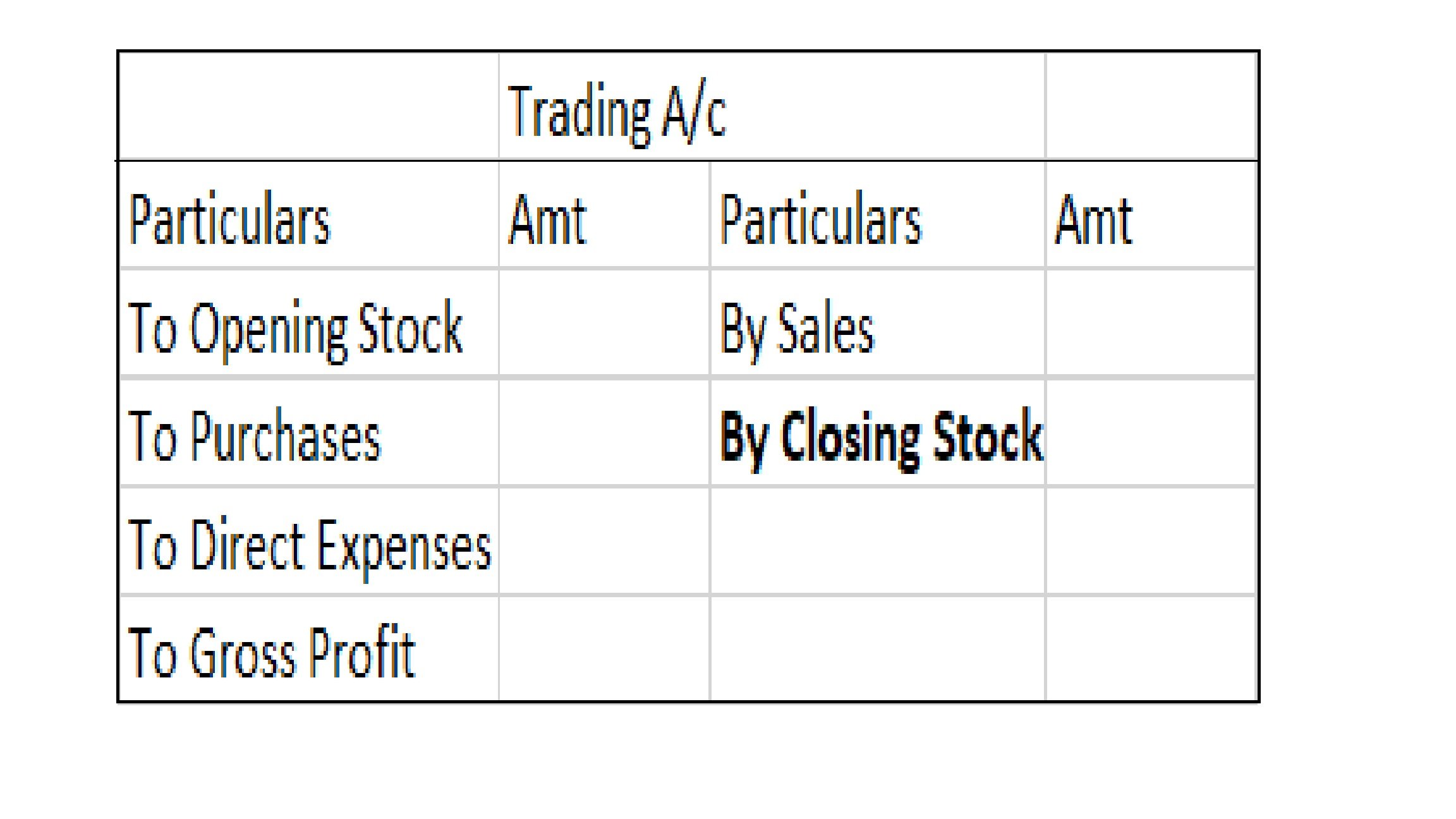

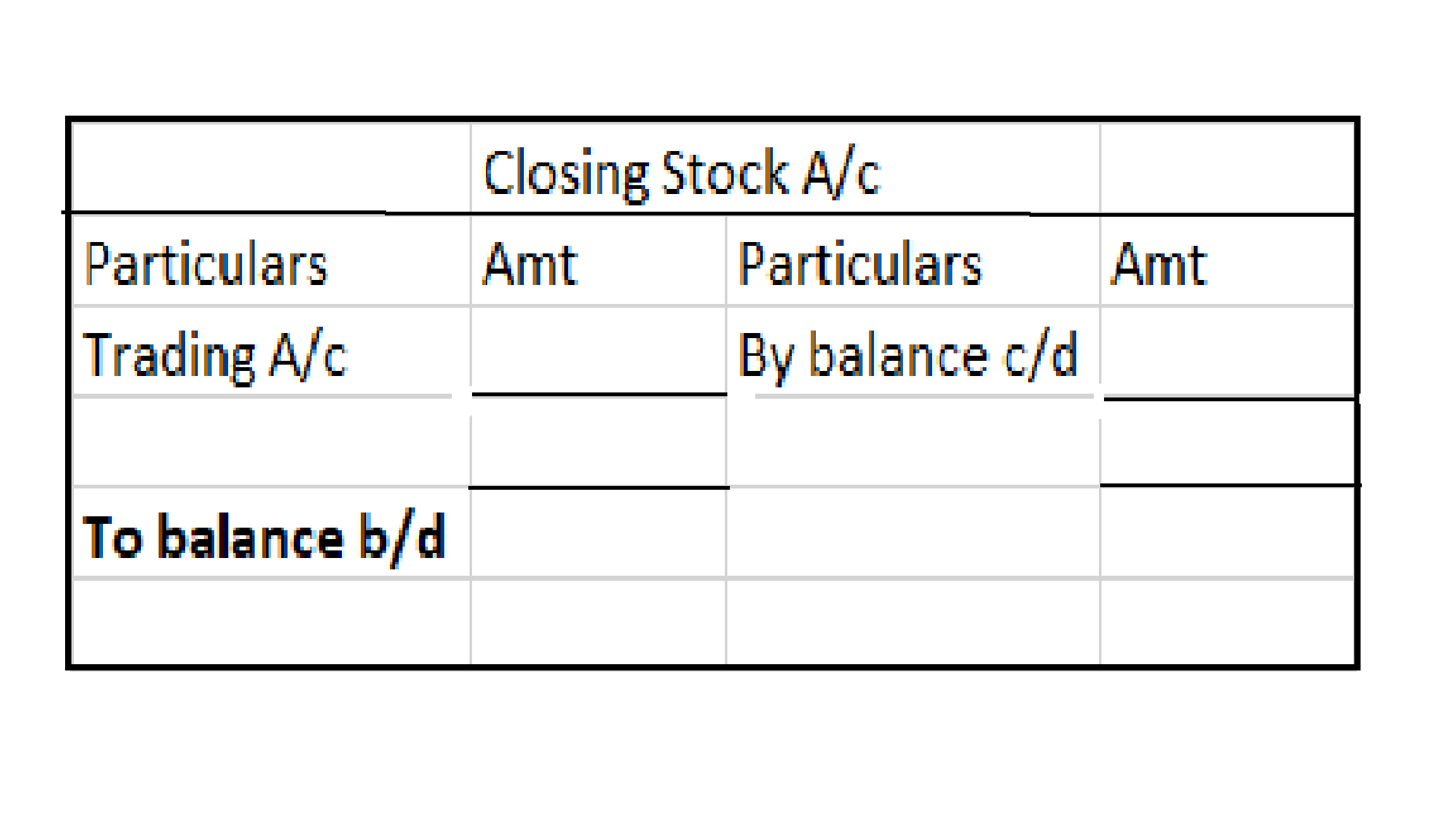

| Woking Notes: | Amt |

| i. Depreciation on furniture: | |

| On $30,000 @10% p.a for full year | 3,000 |

| On $5,000 @10% p.a for 6 months | 250 |

| 3,250 | |

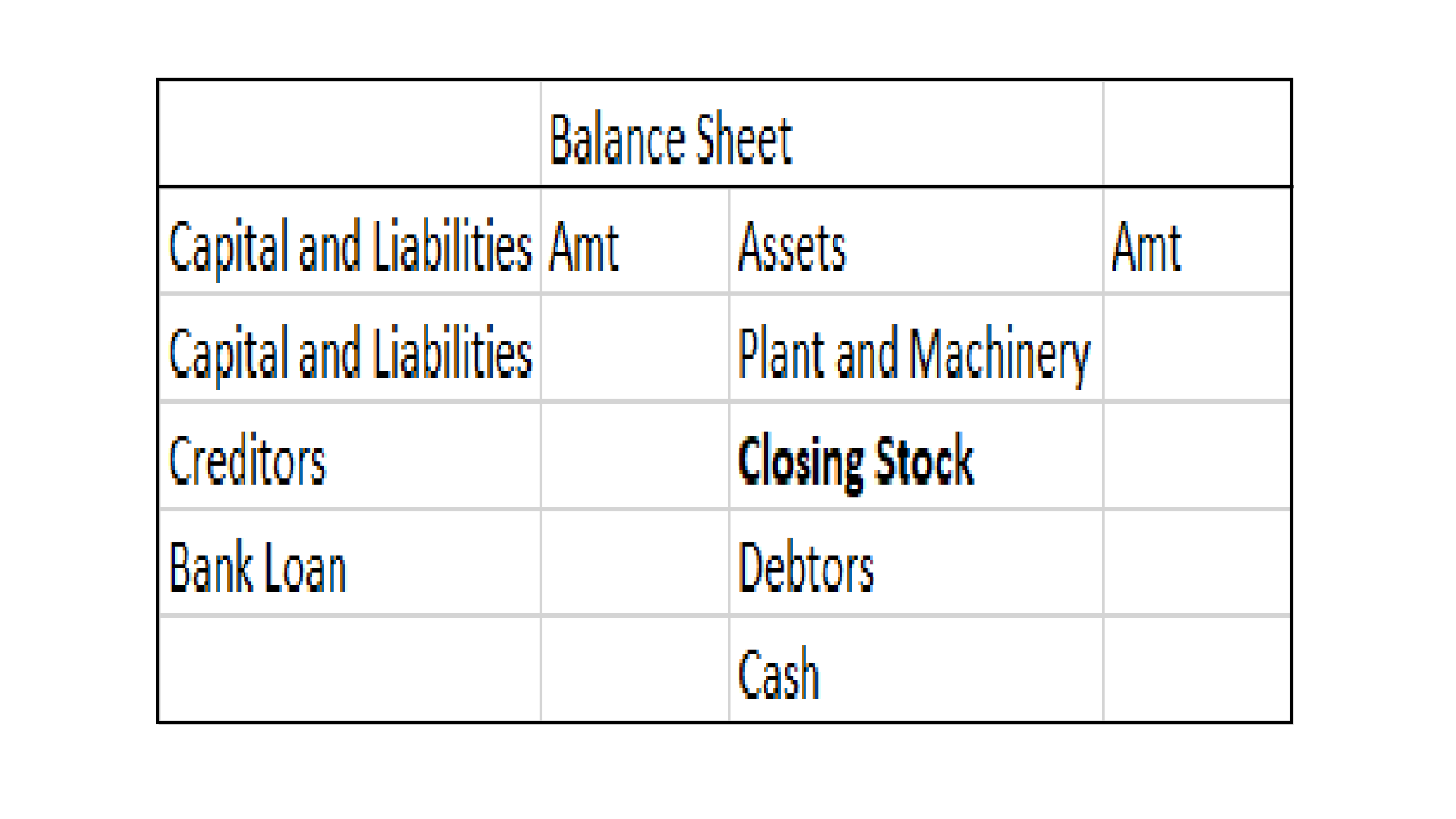

| ii. Branch Furniture as of 31 Dec: | |

| Furniture as of 1 January | 30,000 |

| Add: Addition made during the year | 5,000 |

| 35,000 | |

| Less: Depreciation | (3,250) |

| 31,750 |

As additional furniture was purchased after 6 months, depreciation will be charged on that and the total depreciation of 3,250 will be charged on the furniture of $35,000 ($30,000+$5,000) and the difference will be the closing balance which will be shown in the branch account on the credit side.

The depreciation amount will not be shown in the Branch Account as the difference between the opening and closing values of the furniture reflects the value of depreciation. If depreciation is shown in the account it will be counted twice.

See less

Classified under advance income, Interest received in advance is unearned income that pertains to the following accounting period but is received in the current period. Such interest is not related to the current accounting period and the related benefits for such income are yet to be provided. HencRead more

Classified under advance income, Interest received in advance is unearned income that pertains to the following accounting period but is received in the current period. Such interest is not related to the current accounting period and the related benefits for such income are yet to be provided. Hence, it is a liability for the concern.

The treatment of such advance interest is based on the Accrual concept of accounting.

The journal entry for interest received in advance is:

Now suppose, a firm Star shine receives interest on loan of 5,00,000 @ 7% p.a. extended to another firm. In the current accounting period, Star shine receives 50,000 as interest, excess being advance for the following year. Then the following journal entries should be passed:

Cash received in form of interest is debited (Debit what comes in) and interest account is credited because of an increase in interest income (credit all incomes and gains).

Interest account is debited because we have to decrease the interest income since 15,000 relates to the next accounting year. Interest received in advance is credited because such interest of 15,000 is not yet earned and is a liability for the concern.

See less