The "Income and Expenditure" account lists all the income and expenses incurred by the entity throughout the year. This account is very identical to the profit and loss account and is generally prepared on an accrual basis irrespective of whether the amount is received or paid. Non-profit organizatiRead more

The “Income and Expenditure” account lists all the income and expenses incurred by the entity throughout the year. This account is very identical to the profit and loss account and is generally prepared on an accrual basis irrespective of whether the amount is received or paid. Non-profit organizations (NPO) prepare this type of account to ascertain surplus earned or deficit incurred by them during the period.

Talking about the format of income and expenditure accounts we generally see that all the expenses are recorded on the debit side while all incomes are recorded on the credit side. One important thing to note is that items so recorded are revenue items while capital nature items are generally ignored because only current period items are recorded in this statement.

Since it is a Nominal account, we follow the golden rules to prepare this, stating “debit all expenses and losses and credit all incomes and gains”. The closing balance at the end shows the surplus or deficit for the year. If the balancing figure appears on the debit side it is surplus and if the balancing figure appears on the credit side it is a deficit for the entity.

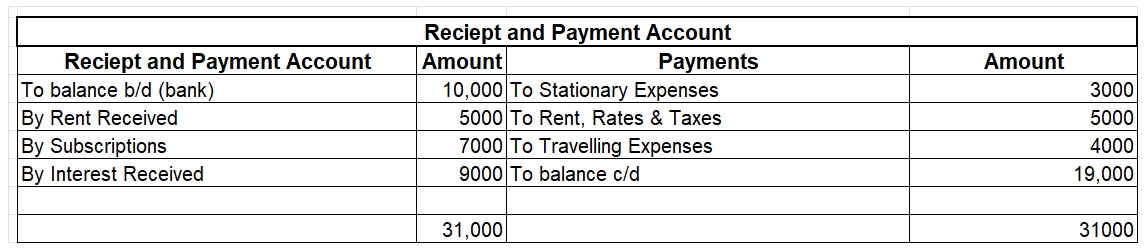

Following is the format of income and expenditure account

See less

Definition Not-for-profit organizations are also known as non-profit organizations set up to further cultural, educational, religious, professional, or public service objectives. Its aim is not to earn profit Accounting done by non-profit organizations is fund based. Type of accounting Non-pRead more

Definition

Not-for-profit organizations are also known as non-profit organizations set up to further cultural, educational, religious, professional, or public service objectives. Its aim is not to earn profit

Accounting done by non-profit organizations is fund based.

Type of accounting

Non-profit organizations do Fund Based Accounting.

Donations received or funds set aside for specific purposes are credited to a separate fund account and are shown on the liabilities side of the balance sheet.

The income from or donations for these funds are credited to the respective fund account. On the other hand, expenses or payments out of these funds are debited.

Accounting when done on this basis is known as Fund Based Accounting.

Let me explain to you with an example :

The sports fund has a balance of Rs 100000 which is invested as a fixed deposit in a bank earning 8% interest. A further donation of Rs 10000 is received towards it. Expenses incurred towards prizes are Rs 7000; Rs 3000 towards trophies and Rs 4000 distribution of cash prizes. The accounts are shown as follows :

Categories of funds

In the case of non-profit organizations, funds may be classified under the following heads :

Unrestricted fund :

The unrestricted fund does not carry any restriction with respect to its use. In other words, management can use the amounts in the funds as it deems appropriate, but to carry out the purpose for which the organization exists.

This is known as the general fund or the capital fund to which the surplus for the year is added and in case of deficit, deducted.

Restricted fund :

A restricted fund is a fund, the use of which is restricted either by the management or by the donor for a specific purpose.

Examples of such funds are endowment funds, annuity funds, loan funds, prize funds, sports funds, etc.

- Prize funds: it is a fund set up to use for distribution as prizes say for achievements or contributions to the welfare of society.

See less