A cash discount is a discount allowed to customers when they make payments for the items they purchased. This type of discount is generally based on time. The early the payment is made by the debtors, the more discount they earn. To be more precise cash discount is given to simulate or encourage earRead more

A cash discount is a discount allowed to customers when they make payments for the items they purchased. This type of discount is generally based on time. The early the payment is made by the debtors, the more discount they earn. To be more precise cash discount is given to simulate or encourage early payment by the debtors.

Trade discount is a discount allowed by traders on the list price of the goods to the customer at specified rate. Unlike cash discount, trade discount is based on number of sale i.e, more the sale more the discount earned. This is mainly given on bulk orders by the customers.

To understand trade discount and cash discount let me give you simple example

Mr. X purchased goods from Mr. Y of list price Rs 10,000. Mr. Y allowed a 10% discount to Mr.X on the list price for purchasing goods in bulk quantity. Further, he was provided with cash discount of Rs 500 for making an immediate payment. Therefore the entry for the above transaction in the books of Mr. X would be

| Purchase A/c ……Dr | 9,000 | |

| To Cash A/c | 8,500 | |

| To Discount received | 500 | |

| (Being goods purchased from Mr. Y worth Rs. 10,000@ 10% trade discount and cash discount of Rs. 500) |

Definition Gross profit is the excess of the proceeds of goods and services rendered during a period over their cost, before taking into account administration, selling, distribution, and financial expenses. Gross profit and net profit are gross profit estimates of the profitability of a company. WhRead more

Definition

Gross profit is the excess of the proceeds of goods and services rendered during a period over their cost, before taking into account administration, selling, distribution, and financial expenses.

Gross profit and net profit are gross profit estimates of the profitability of a company.

When the result of this computation is negative it is referred to as gross loss

Formula :

Total Revenues – Cost Of Goods Sold

Net profit is defined as the excess of revenues over expenses during a particular period.

Net profit is to show the performance of the company.

When the result of this computation is negative it is called a net loss.

Net profit may be shown before or after tax.

Formula :

Total Revenues – Expenses

Or

Total Revenues – Total Cost ( Implicit And Explicit Cost )

Examples

Now let me explain to you by taking an example which is as follows :

In a business organization there were the following data given as purchases made Rs 73000, inventory, in the beginning, was Rs 10000, direct expenses made were Rs 7000, closing inventory which was Rs 5000, revenue from operation during the period was Rs 100000.

Then,

COST OF GOODS SOLD = Purchases + Opening Inventory + Direct Expenses – Closing Inventory.

= Rs ( 73000 + 10000+ 7000- 5000)

= Rs 85000

GROSS PROFIT = REVENUE – COST OF GOODS SOLD

= Rs ( 100000 – 85000 )

= Rs 15000

Now from the above question keeping the gross profit same if the indirect expenses of the organization are Rs 2000 and the other income is Rs 1000.

Then,

NET PROFIT = GROSS PROFIT – INDIRECT EXPENSES + OTHER INCOMES

= Rs ( 15000 – 2000 + 1000)

= Rs 14000

Treatment

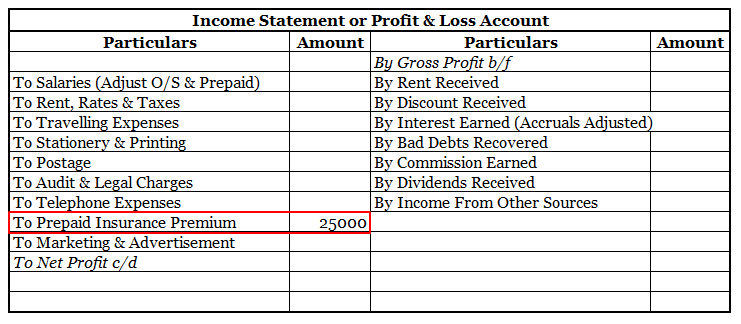

Treatment of gross profit and net profit is given as follows :

Gross profit

• Gross profit appears on the credit side of the trading account.

• Gross profit is located in the upper portion beneath revenue and cost of goods sold.

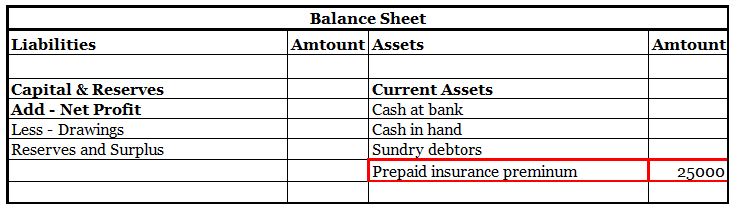

Net profit

• Net profit appears on the credit side of the profit and loss account.

• It is treated directly in the balance sheet by adding or subtracting from the capital.

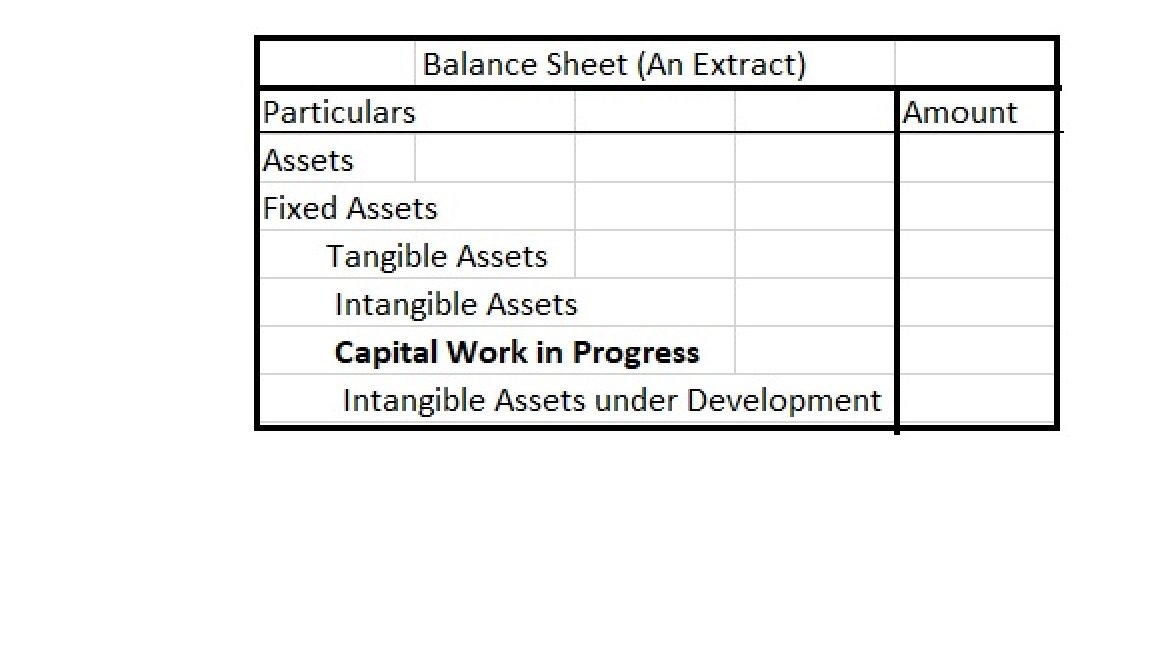

Here is an extract of the trading and profit/loss account and balance sheet showing GROSS PROFIT & NET PROFIT :

See less