Yes, sure! But lets us first understand what a revaluation account is. A revaluation account is prepared to recognise the change in the book value of assets and liabilities of an entity. These changes happen when assets and liabilities are revalued to present their fair value. It is a nominal accounRead more

Yes, sure! But lets us first understand what a revaluation account is.

A revaluation account is prepared to recognise the change in the book value of assets and liabilities of an entity. These changes happen when assets and liabilities are revalued to present their fair value.

It is a nominal account because it represents gain or loss in value of assets and liabilities. However such gain or loss is unrealised because the assets and liabilities are not sold or discharged.

After revaluation of assets and liabilities, the balance of the revaluation account can be debit or credit. The debit balance means ‘loss on revaluation’ and credit balance means ‘gain on revaluation’.

The balance of revaluation is transferred to the capital account.

Journal Entries related to Revaluation Account

1. Increase in value of an asset upon revaluation:

| Asset A/c | Dr. | Amt |

| To Revaluation A/c | Cr. | Amt |

| (Being asset value increased upon revaluation) |

2. Decrease in value of an asset upon revaluation:

| Revaluation A/c | Dr. | Amt |

| To Asset A/c | Cr. | Amt |

| (Being asset value decreased upon revaluation) |

3. Increase in value of liabilities upon revaluation:

| Revaluation A/c | Dr. | Amt |

| To Liabilities A/c | Cr. | Amt |

| (Being liabilities value increased upon revaluation) |

4. Decrease in value of liabilities upon revaluation:

| Liabilities A/c | Dr. | Amt |

| To Revaluation A/c | Cr. | Amt |

| (Being liabilities value decreased upon revaluation) |

5. Transfer or distribution of the balance of revaluation account

| Revaluation A/c | Dr. | Amt |

| To Capital/ Partners’ capital A/c | Cr. | Amt |

| (Being profit on revaluation transferred to capital account. |

or

| Capital/ Partners’ capital A/c | Dr. | Amt |

| To Revaluation A/c | Cr. | Amt |

| (Being loss on revaluation transferred to capital account. |

Numerical example

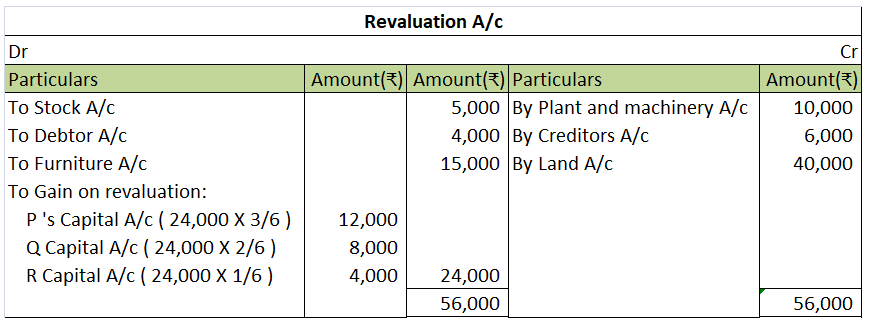

P, Q and R are partners of the firm ‘PQR Trading’. They share profits and losses in the ratio 3:2:1. On 1st May 20X1, they decided to admit S for 1/6th share in profits and losses of the firm. Upon the revaluation:

- Plant and machinery increased from Rs 1,20,000 to Rs. 1,30,000

- The stock decreased by Rs 5000

- Debtors and creditors both decreased by Rs 4,000 and Rs 6,000 respectively.

- Furniture decreased from Rs 25,000 to Rs 10,000

- Land increased by Rs 40,000.

Let’s prepare the revaluation account.

Bad debts mean the money owed by customers who have gone bankrupt or the likelihood of who's ever returning the money is significantly low. Bad debt is a nominal account. A nominal account is an account that records the business transactions belonging to a certain category of income, expense, profitRead more

Bad debts mean the money owed by customers who have gone bankrupt or the likelihood of who’s ever returning the money is significantly low. Bad debt is a nominal account.

A nominal account is an account that records the business transactions belonging to a certain category of income, expense, profit or loss. The balances on nominal accounts are normally written off at the end of each financial year. For example, sales A/c, purchases A/c, interest income, loss from the sale of assets etc.

Why are bad debts A/c classified as a nominal account?

First of all, let us understand the other two types of accounts – personal accounts and real accounts.

Personal accounts deal with the records of the business’ transactions with a particular person or entity. For example Mukesh A/c, Mahesh A/c, Reliance A/c, Suresh and Co. A/c etc.

Real accounts deal with transactions and records related to assets. The balance in these accounts is normally carried forward from one period to another. For example “Furniture A/c “, ” Building A/c ” etc.

Now that we have understood the basic definitions of all three types of accounts, we can discuss the reason behind the classification of bad debts as nominal accounts.

A bad debt is a loss that the company has incurred. It may be due to bankruptcy of customers, customer fraud etc. The company isn’t going to receive that money. The bad debts are written off at the end of the year by transferring them to profit and loss A/c.

Thus, bad debts relate to loss and are normally not carried forward from one period to another. Hence, they are classified as nominal accounts.

Treatment of Bad Debts

Bad debts are written off at the end of each year by debiting them to the profit and loss A/c. The amount of bad debts is reduced from the amount of debtors that the company has.

A company may also choose to create a provision for bad debts for the balance amount of debtors that the company has after adjusting for bad debts. This provision represents a rough estimate of the amount due to debtors that the business expects to not receive. In other words, it is an estimate of customer bankruptcy that the business expects.

Conclusion

We can conclude that

- There are primarily three types of accounts – real, personal and nominal.

- Bad debts are a nominal account.

- Bad debts is a loss that the business has incurred

- It may be due to bankruptcy of customers, fraud etc

- Bad debts are written off each year by transferring them to the income statement

See less