Revenue also called income is nothing but the income generated by individuals or businesses from the sale of goods or investing capital or assets. Some examples of revenue are as follows:- Sales revenue Dividend received Interest earned Rent received Commission 1. SALES REVENUE Sales revenueRead more

Revenue also called income is nothing but the income generated by individuals or businesses from the sale of goods or investing capital or assets. Some examples of revenue are as follows:-

- Sales revenue

- Dividend received

- Interest earned

- Rent received

- Commission

1. SALES REVENUE

Sales revenue is the income received by the individual or business by selling its product or provision of services. the words “sale” and “revenue” are used interchangeably to mean the same thing. It is to be noted that revenue does not necessarily mean it has been received in cash, it can be partly in cash or partly on credit also.

How to calculate sales revenue?

SALES REVENUE = NO. OF UNITS SOLD * AVERAGE PRICE PER UNIT

For example:- Amazon sold 4000 units of shirts @ 500 each. Therefore sales revenue for amazon is

Sales revenue = 4000 * 500

= 20,00,000

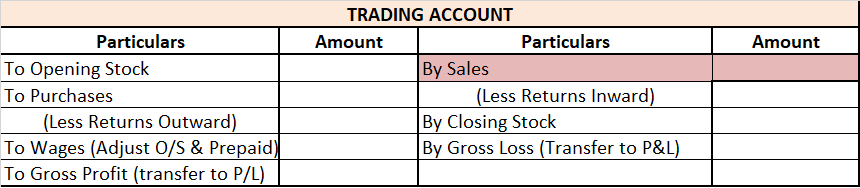

Treatment of sales revenue in the financial statement, since sales are part of a trading account and appear on the credit side of the trading account.

2. DIVIDEND RECEIVED

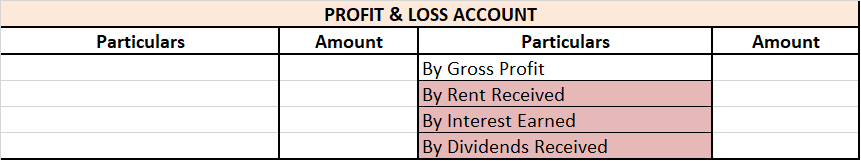

Naina, this can be explained in simple terms. Suppose you own shares of a company which declares dividend so the dividend received is income for you. Since it does not reduce the assets of a company nor creates a liability it is shown as income and posted on the credit side of profit & loss A/c.

Let me give you a short example of a dividend received, suppose you own 1000 shares of ABC.ltd. the company at the quarter-end calculate its earnings and decides to declare a dividend of Rs 5 per share. Therefore you would receive 1000* 5 i.e Rs 5000 as dividend income.

3. INTEREST INCOME EARNED

Interest income is the earnings the entity receives on any investments made. To be more precise it is money earned by an individual or business for lending their fund either by putting them as deposit in the bank. It is shown on the credit side of the profit & loss A/c.

A very simple example for interest earned is when a business or an individual deposits money in the bank as savings and decided not to touch it for the coming years then such a depositor will gain interest on such savings by the bank. such type of income so received is treated as interest received and shown as income in the profit & loss A/c.

3. RENT RECEIVED

When money is received by the business for exchange of use of assets of the business by the other person, then it will be called rent received. Rent can be received by the business firm in respect of land, building, machinery, etc. As rent received is income for the business firm, it is shown on the credit side of profit & loss A/c.

For example, X. ltd received Rs 20,000 via cash on one of its properties to Mr. Z. Then rent so received shall be treated as income in the books of ABC. ltd and same shall be treated as income and shown in the profit & loss statement.

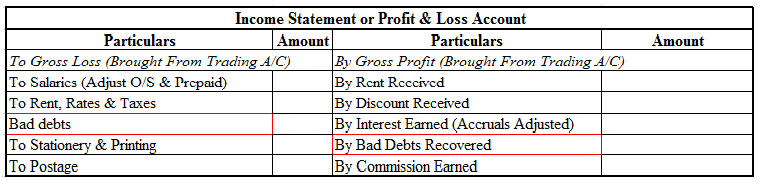

Summarised extract of profit & loss account is shown below for dividend received, Rent received and interest earned.

Definition Current assets are defined as cash and other assets that are expected to be converted into cash or consumed in the production of goods or rendering of services in the normal course of business. Or in other words, we can say that the expected realization period is less than the operating cRead more

Definition

Current assets are defined as cash and other assets that are expected to be converted into cash or consumed in the production of goods or rendering of services in the normal course of business.

Or in other words, we can say that the expected realization period is less than the operating cycle period although it is more than the period of 12 months from the date of the balance sheet.

For example, goods are purchased with the purpose to resell and earn a profit, debtors exist to convert them into cash i.e., receive the amount from them, bills receivable exist again for receiving cash against it, etc.

List of current assets

The list of current assets is as follows:-

Now here are a few definitions for the above list of current assets which are as follows:-

Cash in hand

Cash comprises cash on hand and demand deposits with banks.

Cash equivalents

Cash equivalents are short-term, highly liquid investments that are readily convertible into known amounts of cash and which are subject to an insignificant risk of changes in value.

Bills receivables

It means a bill of exchange accepted by the debtor, the amount of which will be received on the specific date.

Sundry debtors

A debtor is a person or entity who owes an amount to an enterprise against credit sales of goods and/or services rendered.

Prepaid expenses

Expense that has been paid in advance and benefit of which will be available in the following years or year.

Accrued income

Income that has been earned in the accounting period but in respect of which no enforceable claim has become due in that period by the enterprise.

Closing stock

Stock or inventory at the end of the accounting period which is shown in the balance sheet and which is valued on the basis of the “ cost or net realizable value, whichever is lower “ principle is called closing stock.

Short term investment

Investments that are also known as marketable securities and are held for a temporary period of time i.e, for less than 12 months, and can be easily converted into cash are called short-term investments.

Criteria for classification

Now let us see the classification of assets in the case of companies as per Schedule III of the Companies act 2013.

An asset is a current asset if it satisfies any one of the following criteria which are as follows:-

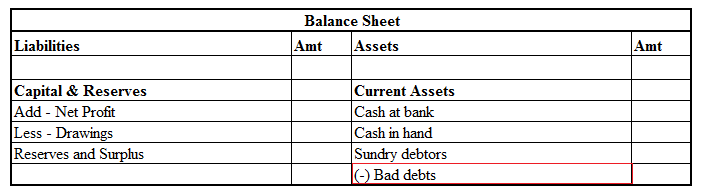

Here is an extract of the balance sheet showing current assets

See less