No, the building is not a current asset. Explanation Current assets are those in a business that is reasonably expected to be sold, consumed, cashed, or exhausted within one year of accounting through normal day-to-day business operations. Examples: Cash and cash equivalent, stock, liquid assets, etRead more

No, the building is not a current asset.

Explanation

Current assets are those in a business that is reasonably expected to be sold, consumed, cashed, or exhausted within one year of accounting through normal day-to-day business operations.

Examples: Cash and cash equivalent, stock, liquid assets, etc.

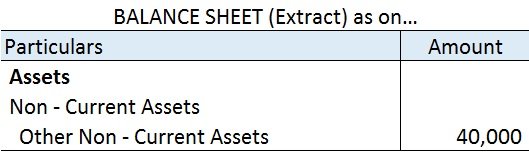

The building is expected to have a valuable life for more than a year and is bought for a longer term by a company. The building is a fixed asset/non-current asset, those assets which are bought by the company for a long term and aren’t supposed to be consumed within just one accounting year.

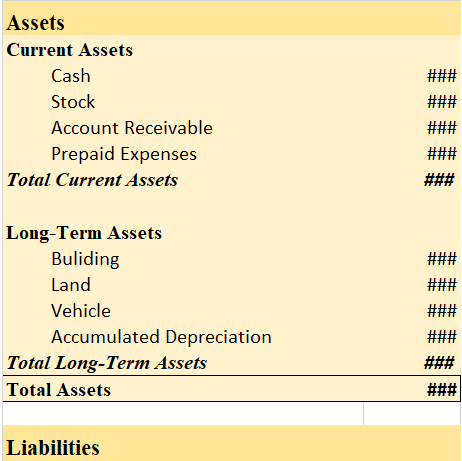

In order to understand it more clearly, let’s see the two types of assets in the classification of the assets on the basis of convertibility:

In the classification of the assets on the basis of their convertibility, they are classified either as current assets or fixed assets. Also referred to as current assets/ non-current assets or short-term/ long-term assets.

- Current Assets – As explained above, those assets in a business that is reasonably expected to be sold, consumed, cashed, or exhausted within one year of accounting.

- Fixed Assets – Those assets which are not likely to be converted into cash quickly and are bought by the business for a long term.

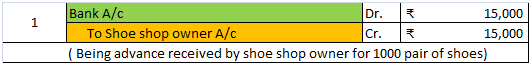

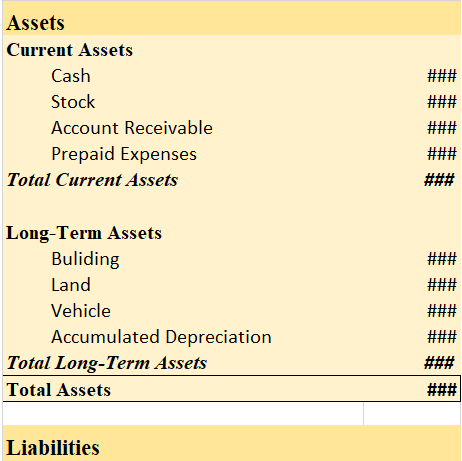

Building in the balance sheet

Let us take a look at the balance sheet’s asset side and see where building and current assets are shown

Balance Sheet (for the year ending…)

As we can see, the building is shown on the long-term assets side and not in the current assets.

Therefore, the building is not a current asset.

See less

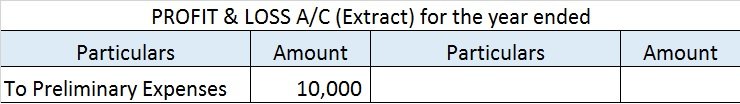

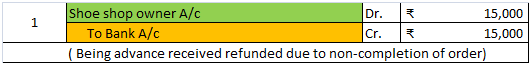

Firstly, let’s understand the meaning of both terms. Revenue receipts: The term 'revenue' suggests these are the amounts received by a business due to its operating activities. These receipts arise in a recurring manner in a business. Such receipts don’t affect the balance sheet. They are shown inRead more

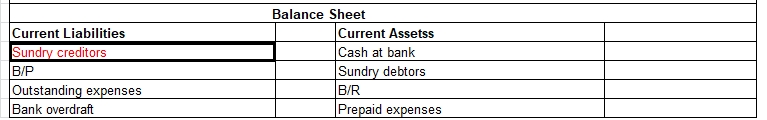

Firstly, let’s understand the meaning of both terms.

Revenue receipts: The term ‘revenue‘ suggests these are the amounts received by a business due to its operating activities. These receipts arise in a recurring manner in a business. Such receipts don’t affect the balance sheet. They are shown in the statement of profit or loss. Such receipts are essential for the survival of the business.

Examples of revenue receipts are as follows:

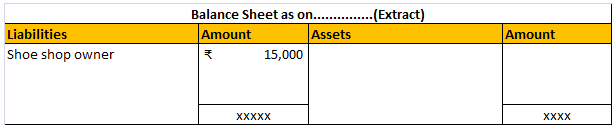

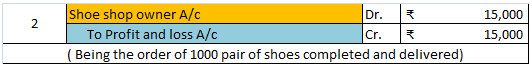

Capital receipts: The term ‘capital’ that such receipts are do not arise due to operating activities, hence not shown in the Profit and loss statement. These are the money received by a business when they sell any asset or undertake any liability. These receipts do not arise in a recurring manner in a business. They don’t affect the profit or loss of the business. They are not essential for the survival of the business.

Examples of capital receipts are as follows:

I have given a table below for more understanding:

See less