The term ‘bad debt’ and ‘write off’ are often used together in a sentence but they have different meanings. First, we will discuss them in brief to understand the differences between them. Bad debts We know, debtors for a business are their assets because the business has the right to receive moneyRead more

The term ‘bad debt’ and ‘write off’ are often used together in a sentence but they have different meanings. First, we will discuss them in brief to understand the differences between them.

Bad debts

We know, debtors for a business are their assets because the business has the right to receive money from the debtors due to the goods supplied to them.

But if due to circumstances, there appears no probability that the amount due to one or more debtors will be realised to the business, then such debts are categorised as bad debts.

In short, bad debts refer to the amount of money that will not be received from some debtors of the business due to some circumstances like insolvency of debtor etc.

Bad debt is deducted from debtors account by the following journal entry:

| Bad debts A/c | Dr. | Amt |

| To Debtors A/c | Cr. | Amt |

| (Being bad debts written off from debtors) |

As bad debts are losses to a business, it is ultimately written off from the profit and loss account.

| Profit and loss A/c | Dr. | Amt |

| To Bad debts A/c | Cr. | Amt |

| (Being bad debts written off to profit and loss account) |

Write off

In layman terms, write off means to deduct something out from something. In accounting, write off means to deduct or reduce value of assets by crediting it to a liability account which is usually a reserve account or the profit and loss account.

It also refers to the elimination of an item from the books of accounts particularly losses and expenses.

Generally, writing off is associated with the following:

- Bad debts.

- Damaged Inventories.

- Loss on issue or redemption of debentures.

- Preliminary expenses.

- Bad loans and advances.

Write off can be done in one of the following methods:

- Direct write-off: The write off is directly done by crediting asset account or loss account and debiting the reserve or P/L account.

- Indirect write-off: Here, an intermediate account is involved between the asset account and liabilities account. A common example is writing off of bad debts where the bad debts account is the intermediate account.

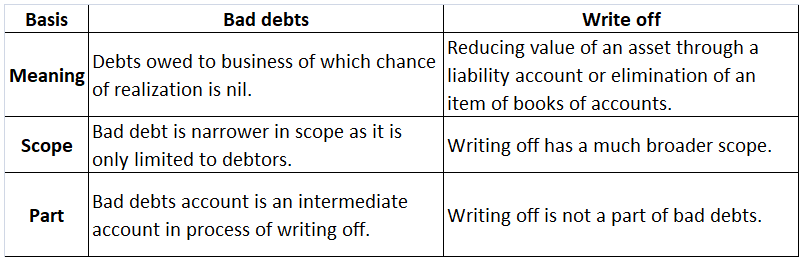

Hence, the following differences can be observed between bad debts and write off or writing off:

Return inwards in simple terms means sending back goods by the customer to the seller. Simply speaking when your customer purchases items from your business but is not satisfied with the items so received they return those items back to you. Some of the reasons for sending back the items are statedRead more

Return inwards in simple terms means sending back goods by the customer to the seller. Simply speaking when your customer purchases items from your business but is not satisfied with the items so received they return those items back to you. Some of the reasons for sending back the items are stated below:

In such a case, the return is initiated by the buyer and a credit note is issued to the buyer, and the same is recorded in the books of accounts. Also, this return inward is deducted from the total sales.

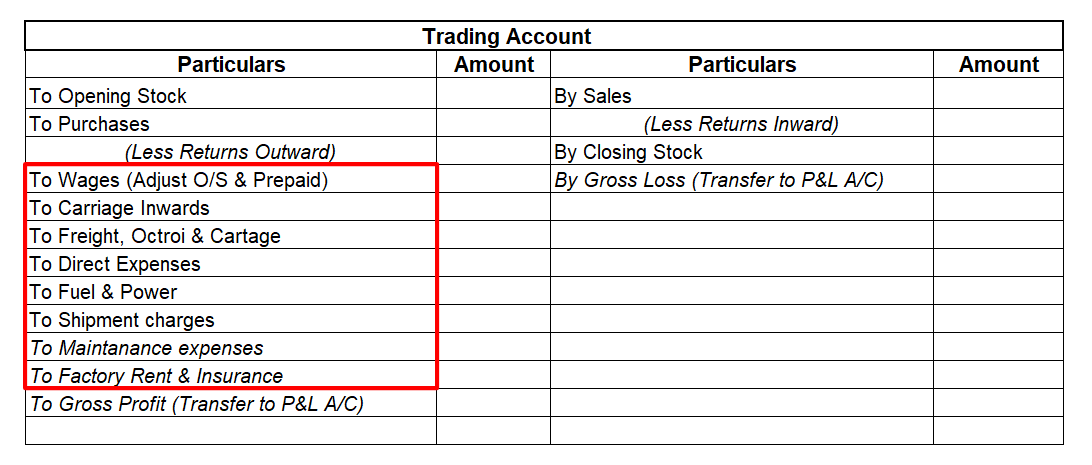

Example: M/s Pest ltd sold 4 units of fertilizers spraying tools of Rs 10,000 each to Mr. Zen. On inspection, he found 1 unit worth Rs 10,000 so received to be defective. Therefore the return of Rs 10,000 was initiated and goods were returned to the seller. A credit note of Rs 10,000 will be raised by the seller (M/s Pest ltd) to the buyer (Mr. Zen). The following adjustment will be shown in the trading account.

Return outwards means returning the goods by the buyer to the supplier. In layman language, when you purchase items for your business and you are not happy with the items then you may decide to return them.

In this case, a debit note is issued to the seller and is recorded in the books of accounts, and the same is reduced from the total purchases in the trading account so prepared.

Example: Suppose you are dealing in a business of clothing. You purchased 20 shirts for Rs.10,000 from a wholesale market. When you sold these shirts, you found 10 shirts worth Rs 5,000 to be defective which were returned by your customer. Therefore you will return these shirts to the wholesale market from where you purchased them. The following adjustment will be shown in the trading account.

See less