Ledger posting The process of entering all transactions from journal to ledger is called ledger posting. Each ledger account contains an individual asset, person, revenue, or expense. As we're aware the journal records all the transactions of the business. Posting to the ledger account not only helpRead more

Ledger posting

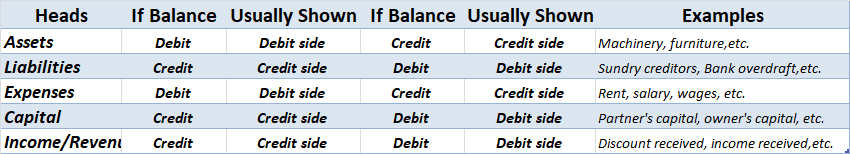

The process of entering all transactions from journal to ledger is called ledger posting. Each ledger account contains an individual asset, person, revenue, or expense. As we’re aware the journal records all the transactions of the business.

Posting to the ledger account not only helps the proper maintenance of the ledger book but also helps in reflecting a permanent summary of all the journal accounts. In the end, all the accounts that are entered and operated in the ledger are closed, totaled, and balanced.

Balancing the ledger means finding the difference between the debit and credit amounts of a particular account, it’s done on the day of closing of the accounting year. Sometimes journal entries are made and maintained monthly. Therefore, the balancing of the ledger’s date depends on the business’ closing date and the way a business maintains its books of accounts.

Example

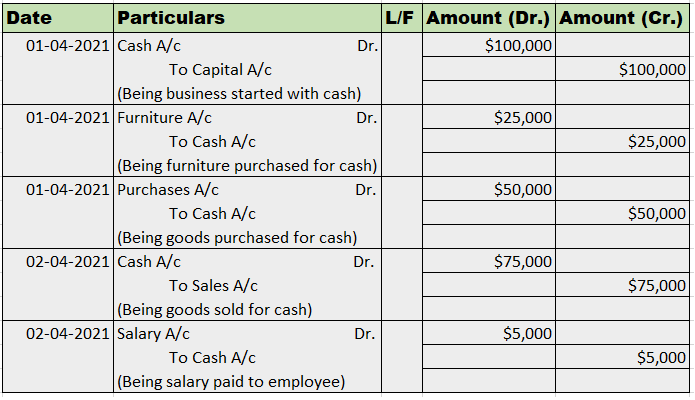

Mr. Jack Sparrow decided to start a new clothing business. On 1st April 2021, He started the business with a total sum of $100,000 cash. He purchased furniture, including desks and shelves for $25,000. Mr. Sparrow then decided to start with women’s clothing and purchased a complete range of clothes from the wholesale market for $50,000. On the next day, he sold all the stock for $75,000. He also hired a worker for $5,000.

We need to journalize these transactions and post them into the ledger account.

Journal Entries

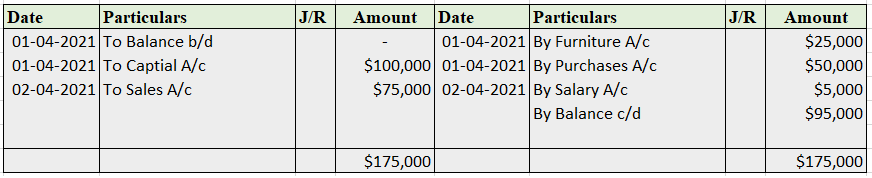

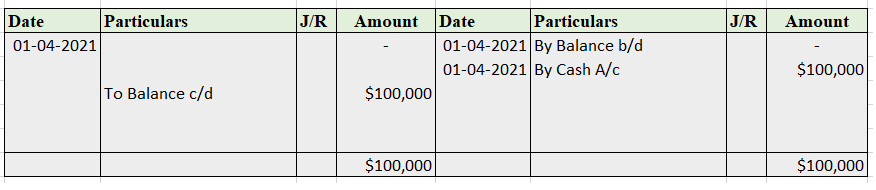

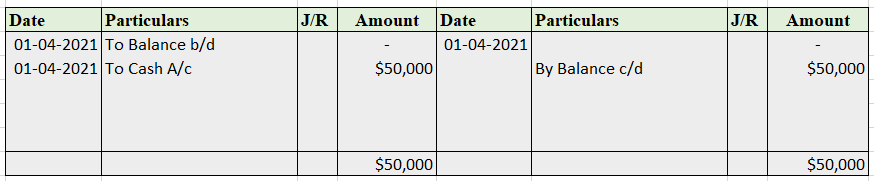

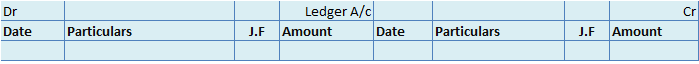

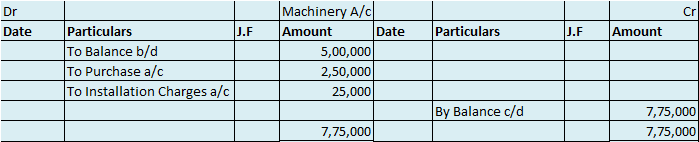

Ledger Accounts

Cash A/c

Capital A/c

Purchases A/c

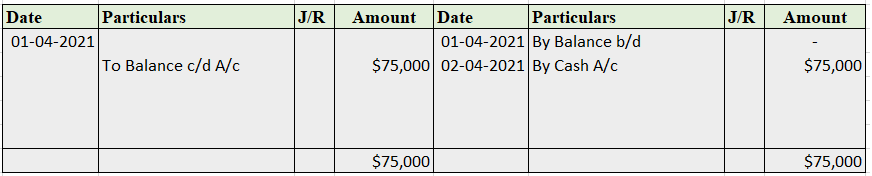

Sales A/c

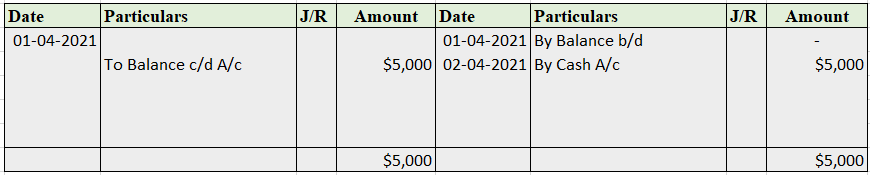

Salary A/c

Drawings mean the certain sum of amount or goods withdrawn by owners from the business for personal use. The drawings account is not an asset/liability/expense/income account, it is a contra account to the owner's equity or capital account. Drawings A/c will always have a debit balance. Drawings A/cRead more

Drawings mean the certain sum of amount or goods withdrawn by owners from the business for personal use. The drawings account is not an asset/liability/expense/income account, it is a contra account to the owner’s equity or capital account. Drawings A/c will always have a debit balance.

Drawings A/c debit balance is contrary to the Capital A/c credit balance because any withdrawal from the business for personal use will reduce the capital.

Effect on Trial Balance: Drawings will be shown in the debit column of the trial balance.

Effect on Financial Statements: The owner’s drawings will affect the company’s balance sheet by decreasing the asset that is withdrawn, and a corresponding decrease in the owner’s equity or capital invested.

Example:

Mr.B a sole proprietor withdraws $100 each month for personal use. At the end of the year Drawings A/c had a debit balance of $1,200.

Mr.B records drawings of $100 each month and debits drawings a/c and credits cash a/c. At the end of the year, he will transfer the balance and will debit capital a/c and credit drawings a/c by $1,200.

He will show a balance of $1,200 ($100*12) in the trial balance in the debit column. Assuming closing capital of $50,000.

In the financial statement, the balance of drawings a/c will be deducted from the owner’s capital because it is a contra account and this will reduce the owner’s capital for the year.

See less