Ledger posting As we know, a business records all of its transactions in the journal. After the transactions are recorded in the journal, they are posted in the principal book called ‘Ledger’. Transferring the entries from journals to respective ledger accounts is called ledger posting or posting toRead more

Ledger posting

As we know, a business records all of its transactions in the journal. After the transactions are recorded in the journal, they are posted in the principal book called ‘Ledger’. Transferring the entries from journals to respective ledger accounts is called ledger posting or posting to the ledger accounts. Balancing of ledgers is carried out to find differences at the year’s end.

Posting to the ledger account means entering information in the ledger, and respective accounts from the journal for individual records. The accounts that are credited are posted to the credit side and vice versa.

Ledger maintenance is done at the end of an accounting period and it’s maintained to reflect a permanent summary of all the journal accounts. In the end, all the accounts that are entered and operated in the ledger are closed, totaled, and balanced. Balancing the ledger means finding the difference between the debit and credit amounts of a particular account.

While posting to the ledger account, suppose goods were bought for cash. While passing the journal entry, we’ll be debiting the purchases a/c and crediting the cash a/c by stating it as, ‘To Cash A/c’.

Now, this entry will be affecting both the purchases account and the cash account. In the cash account, we’ll be debiting purchases. Whereas in the purchases account, we’ll be crediting the cash. That’s how it works in the double-entry bookkeeping system of accounting.

Example

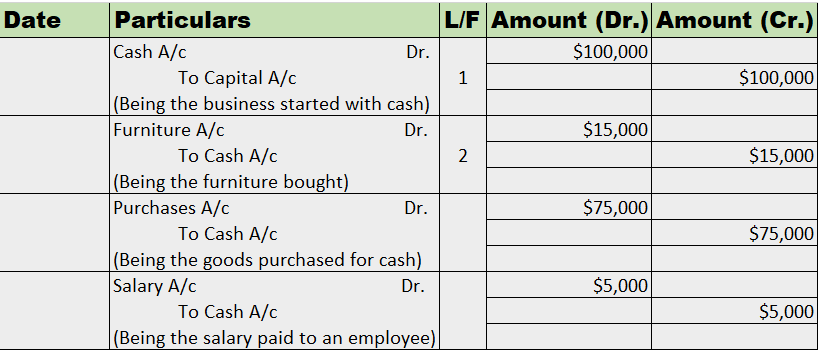

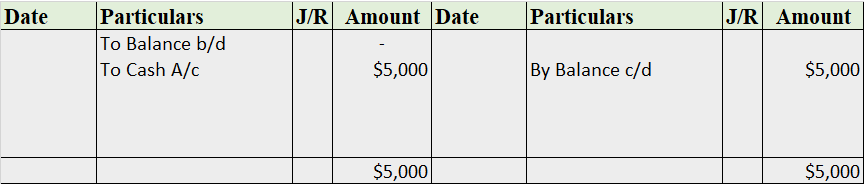

Mr. Tony Stark started the business with cash of $100,000 on April 1, 2021. He bought furniture for business for $15,000. He further purchased goods for $75,000.

Now, we’ll be journalizing the transactions and posting them into the ledger accounts.

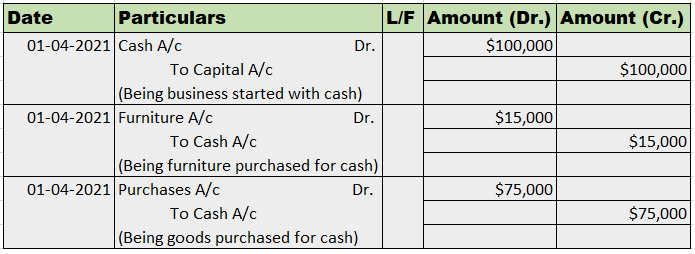

Journal Entries

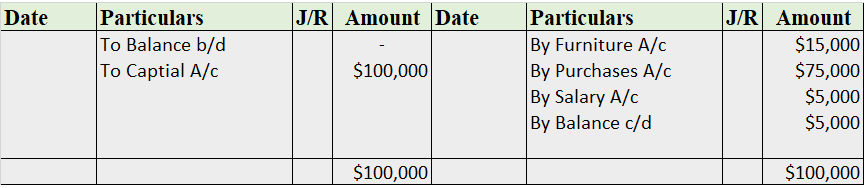

Posting to Ledger Account

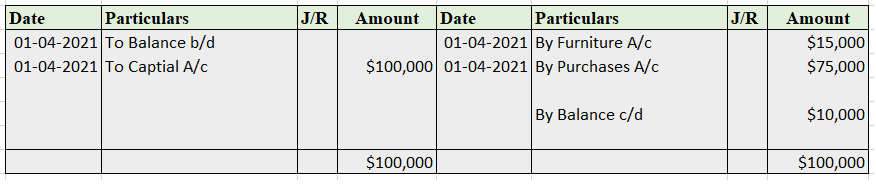

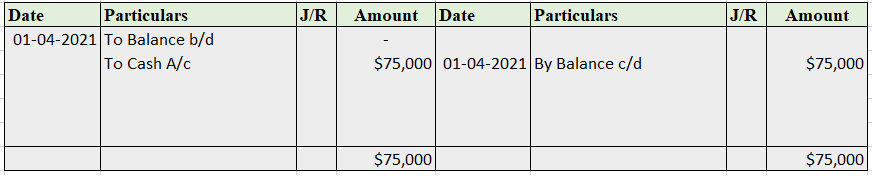

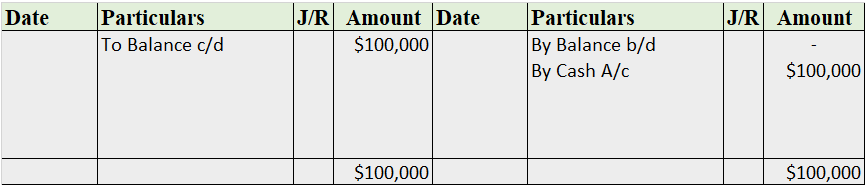

Cash A/c

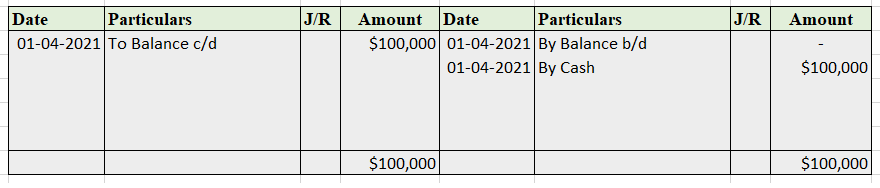

Capital A/c

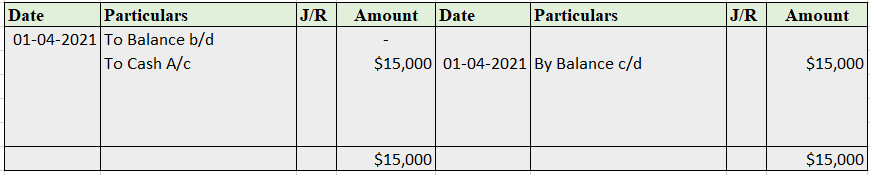

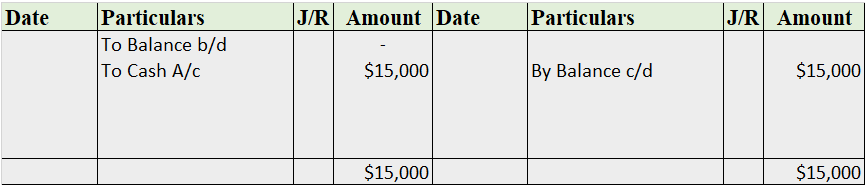

Furniture A/c

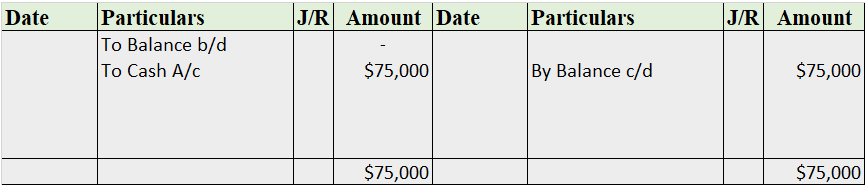

Purchases A/c

See less

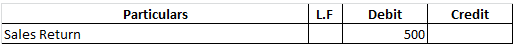

Definition The trial balance is a list of all the closing balances of the general ledger at the end of the year. Or in other words, I can say that it is a statement showing debit and credit balances. A trial balance is prepared on a particular date and not on a particular period. Importance As the tRead more

Definition

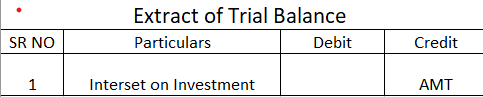

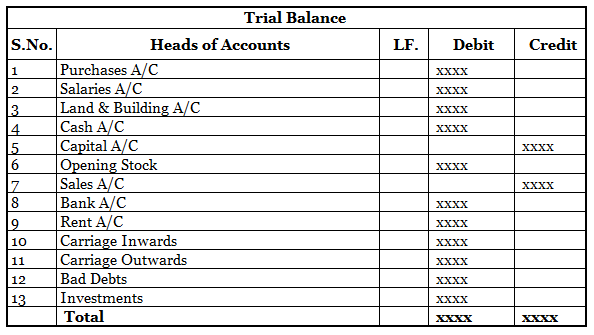

The trial balance is a list of all the closing balances of the general ledger at the end of the year. Or in other words, I can say that it is a statement showing debit and credit balances.

A trial balance is prepared on a particular date and not on a particular period.

Importance

As the trial balance is prepared at the end of the year so it is important for the preparation of financial statements like balance sheet or profit and loss

Purpose of trial balance which are as follows:

Preparation of trial balance

Methods of preparation

These are two methods that you can use to prepare trail balance, now let me explain to you in detail about these methods which are as follows:-

Balance method

Total amount method

Steps to prepare a trial balance

A suspense account is generated when the above case arises that is trial balance did not agree after transferring the balance of all ledger accounts including cash and bank balance.

And also errors are not located in timely, then the trial balance is tallied by transferring the difference between the debit and credit side to an account known as a suspense account.

Rules of trial balance

When we prepare a trial balance from the given list of ledger balances, the following rules to be kept in mind that are as follows :

Are placed in the debit column of the trial balance.

Are placed in the credit column of the trial balance.

See less