Bad Debt is the amount that is irrecoverable from the debtors. It is the portion of the receivables. It includes two accounts “Bad Debts A/c” and “Debtors A/c or Accounts Receivable A/c”. The amount cannot be recovered by the debtor for reasons like the debtor is no longer in the position to pay offRead more

Bad Debt is the amount that is irrecoverable from the debtors. It is the portion of the receivables. It includes two accounts “Bad Debts A/c” and “Debtors A/c or Accounts Receivable A/c”.

The amount cannot be recovered by the debtor for reasons like the debtor is no longer in the position to pay off the debt or has become insolvent.

There are two methods to write off bad debts:

- Direct Method

- Allowance for Doubtful Debts

1. Direct Method: In this method, the amount of bad debts is directly deducted from the total receivables and the second effect is transferred to the debit side of Profit and Loss A/c as an expense.

The journal entry for bad debts as per modern rules of accounting is as follows:

| Bad Debts A/c | Debit | Increase in expenses |

| To Accounts Receivable A/c | Credit | Decrease in assets |

| (Being bad debts written off ) |

Journal entry for transferring bad debts to profit and loss account:

| Profit and Loss A/c | Debit |

| To Bad Debts A/c | Credit |

| (Being bad debts transferred to profit and loss a/c ) |

For example, A Ltd had a total receivable of Rs.2,50,000 and bad debts for the period amounted to Rs.10,000.

Here, the journal entries will be:

| Bad Debts A/c | Debit | 10,000 |

| To Accounts Receivable A/c | Credit | 10,000 |

| (Being bad debts written off ) |

| Profit and Loss A/c | Debit | 10,000 |

| To Bad Debts A/c | Credit | 10,000 |

| (Being bad debts transferred to profit and loss a/c ) |

2. Allowance for Doubtful Debts: In this method allowance is the estimation of the debts which is doubtful to be paid. The company creates a reserve for such debts which are uncollectible.

Firstly, the company will create a reserve which will be based on the accounts receivable. The journal entry will be:

| Bad Debts A/c | Debit |

| To Allowance for Doubtful Debts A/c | Credit |

| (Being allowance for doubtful debts created) |

When a specific receivable is uncollectible it will be charged as an expense, and Allowance for Doubtful Debts will be “Debited” and Accounts Receivable will be “Credited”.

| Allowance for Doubtful Debts A/c | Debit |

| To Accounts Receivable A/c | Credit |

| (Being bad debts written off) |

For example, Mr.B sold goods worth Rs.15,000 to Mr.D. He creates an allowance of Rs.15,000 in case Mr.D fails to pay the amount. At the end of the period, Mr.D defaults and does not pay the debt.

In this case, Mr.B will first record the journal entry for allowance and then will write off Mr.D’s account.

| Bad Debts A/c | 15,000 |

| To Allowance for Doubtful Debts A/c | 15,000 |

| (Being allowance of Rs.10,000 created for doubtful debts) |

| Allowance for Doubtful Debts A/c | 15,000 |

| To Mr.D’s A/c | 15,000 |

| (Being Mr.D’s account written off) |

Debts are of two types one is Good Debt, and another one is Bad debt. Bad Debts The amount which is not recoverable from the debtors is called Bad debt. It is an uncollectable amount from the organization's customers due to the customer's inability to pay the amount of money taken on credit. Read more

Debts are of two types one is Good Debt, and another one is Bad debt.

Bad Debts

The amount which is not recoverable from the debtors is called Bad debt. It is an uncollectable amount from the organization’s customers due to the customer’s inability to pay the amount of money taken on credit.

Example 1

Mr A borrowed $100 from Mr B for his college fee and agrees to pay in 2 months. After the time period is complete Mr A failed to repay the borrowed amount. This is a Bad Debt for Mr B.

Example 2

XYZ Co. had made a credit sale of $50,000. A debtor who has to pay $1000 has been bankrupted. XYZ co. cannot recover the amount from the Debtor, so it records the irrecoverable amount as a bad debt.

Journal Entry

In this entry, “Bad debts are written off of Rs. 2000.”

Bad debt is the amount not recoverable from debtors, which is a loss for the organization.

Modern Rule

The Modern rules of accounting for Expenses are “Debit the increase in expenses and Credit the decrease in expenses.”

Golden Rule

The Golden rules of accounting for expenses and losses are “Debit all expenses and losses, Credit all incomes and gains.”

Bad Debts A/c Dr. 2,000

To Debtor’s A/c 2000

Bad debt is treated as a loss for the organization. As per the rule, this should be debited to the profit and loss account.

Profit and Loss A/c Dr. – 2000

To Bad Debts A/c – 2000

Instead of passing two separate entries for writing off, we can combine the entries and pass one entry.

Profit and Loss A/c Dr. 2000

To Debtor’s A/c 2000

Recovery of Bad debts

Recovery of Bad debt is the amount received for a debt that was written off in the past. It was considered uncollectable.

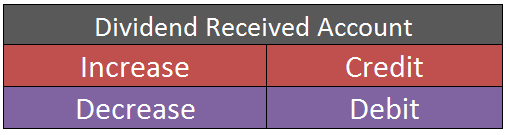

When we write off bad debt, it is recorded as a loss, but the recovery of bad debts is treated as an income for the business.

It is treated as an income and the recovery of bad debt is shown on the credit side of the Income statement.

Journal Entry for Recovery of Bad debts

Bank/Cash A/c Dr. – Amount

To Bad Debts Recovered A/c – Amount

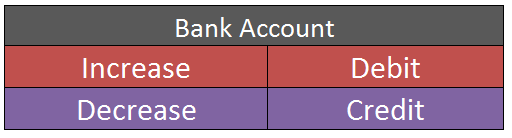

Rules applied in the Journal entry are as per the Golden rules of accounting,

“Cash/Bank A/C” is a real account therefore debit what comes in and credit what goes out.

“Bad Debts Recovered A/C” is a nominal account therefore debit all expenses and losses, and credit all incomes and gains.

Treatment of “Bad Debt written off of Rs.2ooo.”

In Trial Balance: No effect

In Income Statement: It is shown on the debit side as Rs.2000 (loss)

In Balance Sheet: Rs.2000 shall be deducted from the sundry debtor account.

See less