The debts that have a higher chance of not being paid are called doubtful debts. They are a part of the regular dealing of the company and may arise due to disputes or treachery on the part of debtors. Bad debts refer to the doubtful debts that no longer seem to be recoverable from the business. WriRead more

The debts that have a higher chance of not being paid are called doubtful debts. They are a part of the regular dealing of the company and may arise due to disputes or treachery on the part of debtors.

Bad debts refer to the doubtful debts that no longer seem to be recoverable from the business.

Written off means an expense, income, asset, liability is no more recorded in the books of accounts because they no longer hold relevance for the business.

When doubtful debts turn into bad debt, they are written off from the books after a stipulated time as they no longer seem recoverable.

If any cash is received against such bad debts that were written off, it is known as cash received against bad debts written off. Cash is received against bad debts usually when the debtor is declared insolvent and money is recovered from its estate.

Bad debts recovered are considered an income for the company as they were previously written off as a loss and any cash received against it is considered as income.

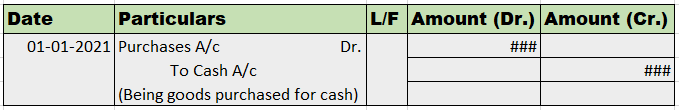

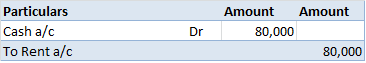

Journal entry for such situation is:

Cash or Bank A/c (Dr.)

To Bad Debts Recovered A/c

We debit the increase in assets, and since cash is coming into the business it is debited.

We credit the income, and since bad debts recovered is an income to the business it is credited.

See less

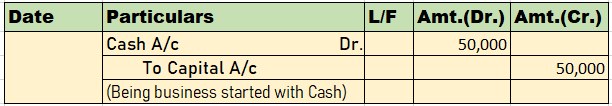

Definition Posting refers to moving the transaction entries from the journal to the ledger books of the company. It is an important part of the accounting cycle. Posting helps us to classify transactions in a better manner. A journal is used to record transactions in chronological order while ledgerRead more

Definition

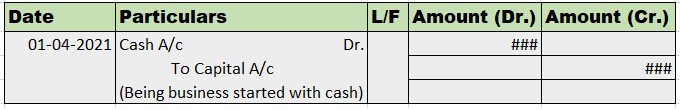

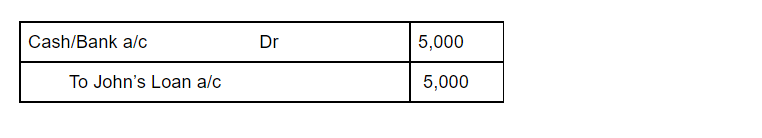

Posting refers to moving the transaction entries from the journal to the ledger books of the company. It is an important part of the accounting cycle.

Posting helps us to classify transactions in a better manner.

A journal is used to record transactions in chronological order while ledger books are used to classify transactions into assets, liabilities, expenses, and incomes.

Steps of Posting

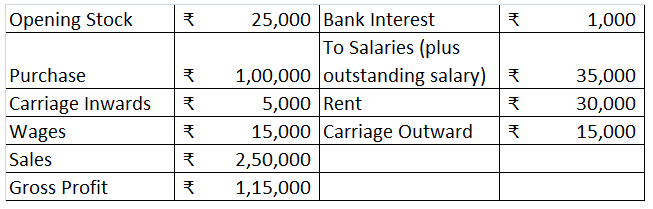

• Create and name ledger accounts for different items of trial balance

• Identify those entries in the journal that relate to the relevant ledger book under consideration.

• Post the entry on the debit or credit side of the ledger account.

• For example, when salaries are paid a salary account is debited and a bank account is credited. When posting this transaction in the bank account we will debit the bank account and write “To salaries” under the head “particular”. This will indicate that salaries were paid from a bank account causing a reduction in the bank balance.

• After all the journal entries relevant to a particular ledger account have been posted in it, we will tally the total of the debit and the credit side of the ledger account to ascertain any balance left.

• Usually, asset accounts have the debit side exceeding the credit side. That is to say, they have a debit balance. Liability accounts usually have a credit balance.

• It is not necessary that every ledger account may have a balance left at the end. The total of the amounts on the debit side may be equal to the total of the amounts on the credit side in some ledger accounts.

• The last step is to recheck the ledger account to identify and correct any mistakes that may have occurred during the posting process.

Importance of Posting

• Posting helps us to classify transactions in a better and more efficient manner.

• Posting makes the books of accounts more readable.

• An accountant may choose to engage in posting once every month or even once every day as per the requirements of the business and the financial reporting norms.

• Posting is necessary for the creation of financial statements. A trial balance cannot be drafted without determining the balance of each ledger account.

• Posting helps us to know the balance of each account This helps to run the business smoothly by tracking balances timely and making up for any likely deficiency in advance.

• Analysis of how balances of various ledger accounts have changed over time helps us to draw valuable conclusions for the business.

Conclusion

We can conclude by saying that the process of posting refers to transferring the entries from the journal to the ledger accounts.

Posting is an essential step of the accounting cycle and without it, financial statements cannot be prepared. Any error while posting is bound to adversely affect the creation of the financial statements.

See less