There are three types of businesses that can be commenced, they are sole proprietorship, partnership, and joint-stock company. As we all know, to start any business a certain sum of money has to be invested by the owner which is known as the capital of the business in terms of accounting. In companiRead more

There are three types of businesses that can be commenced, they are sole proprietorship, partnership, and joint-stock company. As we all know, to start any business a certain sum of money has to be invested by the owner which is known as the capital of the business in terms of accounting.

In companies, commencement is a declaration issued by the company’s directors with the registrar stating that the subscribers of the company have paid the amount agreed. In a sole proprietorship, the business can be commenced with the introduction of any asset such as cash, stock, furniture, etc.

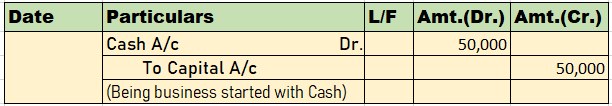

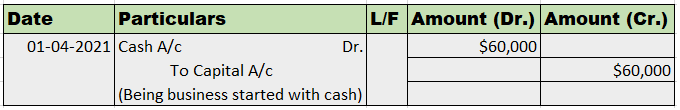

Journal entry

In the journal entry, “Started business with Cash”

As per the golden rules of accounting, the cash a/c is debited because we bring in cash to the business, and as the rule says “debit what comes in, credit what goes out.” Whereas the capital a/c is credited because “debit all expenses and losses, credit all incomes and gains”

As per modern rules of accounting, cash a/c is debited as cash is a current asset, and assets are debited when they increase. Whereas, on the increment on liabilities, they are credited, therefore, capital a/c is credited.

Therefore, the entry we’ll be passing is-

See less

The receipt of cash is recorded by debiting the cash account to the account from which the cash is received. This source account may be the sales account, account receivable account or any other account from which cash is received. The journal entry is: An entity may receive cash in the following evRead more

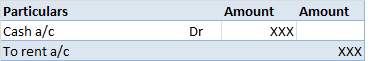

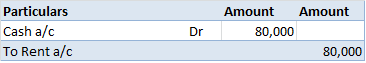

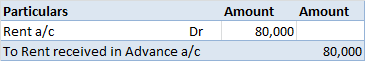

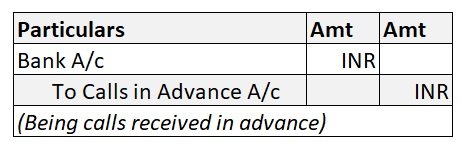

The receipt of cash is recorded by debiting the cash account to the account from which the cash is received. This source account may be the sales account, account receivable account or any other account from which cash is received.

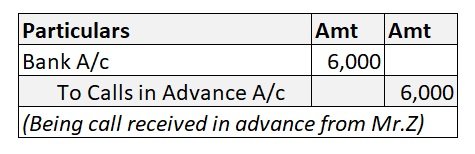

The journal entry is:

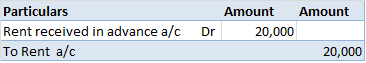

An entity may receive cash in the following events:

This list is not exhaustive. There may be many such events. However, the cash account will be always debited.

Rules of accounting applicable on the cash account

As per the golden rules of accounting, the cash account is a real account as represents an asset. For real accounts, the rule, “Debit the receiver and credit the giver” applies.

Hence, when cash is received, cash is debited and the source (giver) is credited.

As per modern rules of accounting, the cash account is an asset account. Assets accounts are debited when increased and credited when decreased.

Hence, at receipt of cash, cash is debited as cash is increased.

See less