Business commencement with cash The term 'started the business with cash' is basically the commencement of business. In order to start any business, a certain sum of money has to be invested by the owner, which is known as the business's capital in accounting. Commencement of business refers to theRead more

Business commencement with cash

The term ‘started the business with cash’ is basically the commencement of business. In order to start any business, a certain sum of money has to be invested by the owner, which is known as the business’s capital in accounting.

Commencement of business refers to the starting or beginning of the business. In companies, it’s a declaration issued by the company’s directors with the registrar stating that the subscribers of the company have paid the amount agreed. In a sole proprietorship, the business can be commenced with the introduction of any asset such as cash, stock, furniture, etc.

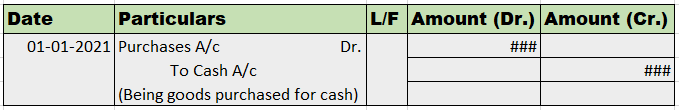

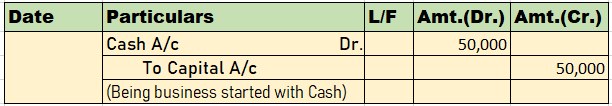

Therefore, we may also call it the first journal entry of business because generally, people tend to start the business with cash rather than something else.

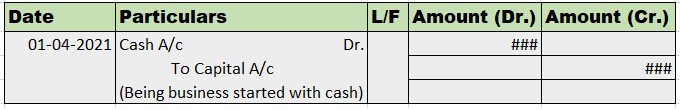

Journal entry

Explanation via rules

As per the golden rules of accounting, the cash a/c is debited as the rule says “debit what comes in, credit what goes out.” Whereas the capital a/c is credited because “debit all expenses and losses, credit all incomes and gains”

As per modern rules of accounting, cash is a current asset, and assets are debited when they increase. Whereas, on the increment on liabilities, they are credited, therefore, capital a/c is credited.

See less

The debts that have a higher chance of not being paid are called doubtful debts. They are a part of the regular dealing of the company and may arise due to disputes or treachery on the part of debtors. Bad debts refer to the doubtful debts that no longer seem to be recoverable from the business. WriRead more

The debts that have a higher chance of not being paid are called doubtful debts. They are a part of the regular dealing of the company and may arise due to disputes or treachery on the part of debtors.

Bad debts refer to the doubtful debts that no longer seem to be recoverable from the business.

Written off means an expense, income, asset, liability is no more recorded in the books of accounts because they no longer hold relevance for the business.

When doubtful debts turn into bad debt, they are written off from the books after a stipulated time as they no longer seem recoverable.

If any cash is received against such bad debts that were written off, it is known as cash received against bad debts written off. Cash is received against bad debts usually when the debtor is declared insolvent and money is recovered from its estate.

Bad debts recovered are considered an income for the company as they were previously written off as a loss and any cash received against it is considered as income.

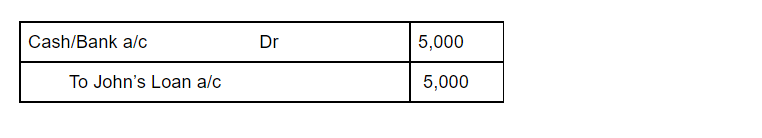

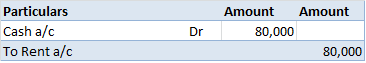

Journal entry for such situation is:

Cash or Bank A/c (Dr.)

To Bad Debts Recovered A/c

We debit the increase in assets, and since cash is coming into the business it is debited.

We credit the income, and since bad debts recovered is an income to the business it is credited.

See less