The journal entry for the closing stock is passed at the year-end as closing stock is the inventory held by a business at the end of its accounting period. However, the entry for recording closing stock depends on how it is treated in the books of accounts. The two types of the accounting treatmentRead more

The journal entry for the closing stock is passed at the year-end as closing stock is the inventory held by a business at the end of its accounting period. However, the entry for recording closing stock depends on how it is treated in the books of accounts.

The two types of the accounting treatment of closing stock are as follows:

- Closing stock is not shown in the Trial Balance.

- Closing stock is shown in the Trial Balance.

Closing stock is not shown in the Trial Balance:

As per this treatment, the closing stock is not shown in the Trial Balance because it is already a part of the purchases of the business. Showing it in the Trial Balance would lead to a double effect. This will not give us accurate profit/loss at the end of the year.

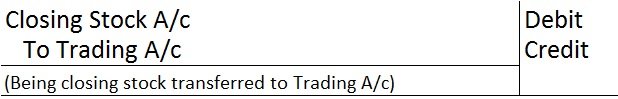

The closing stock is transferred to Trading A/c by passing a closing entry.

Closing stock is an asset. It is debited because there is an increase in the assets. Trading A/c is credited because of the Matching concept as the value of the closing stock is adjusted against the cost of goods sold.

At the end of the year, it is shown on the Asset side of the Balance Sheet, under the head Current Assets and sub-head Inventory.

For example,

ABC Ltd. at the beginning of the year had an opening inventory of 20,000. During the year, purchases worth 5,000 were made and goods worth 10,000 were sold. At the end of the year, the value of the closing stock will be 15,000 (20,000 + 5,000 – 10,000).

Now the closing stock worth 15,000 will be recorded through this journal entry:

| Closing Stock A/c | 15,000 |

| To Trading A/c | 15,000 |

| (Being closing stock worth 15,000 transferred to Trading A/c) |

Closing stock is shown in the Trial Balance:

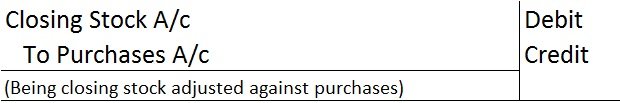

This scenario is possible only when the closing stock is adjusted against purchases. By adjusting against purchases, the double effect of showing both purchases and closing stock in Trial Balance is eliminated.

The following entry is recorded to adjust closing stock against purchases.

Closing Stock is debited as there is an increase in the asset. Purchase A/c is credited because of the Matching concept.

After recording the adjustment entry, the closing stock is shown on the debit column of the Trial Balance. It is not shown in the Trading A/c as it is already adjusted against purchases. In the Balance Sheet, it is shown as a Current Asset.

See less

When it is said that furniture is purchased for office use, it means it is an asset for the business and the journal entry for this event will be the following: Furniture A/c Dr. Amt To Cash/Bank / Vendor A/c Cr. Amt (Being furniture purchased for office use) Explanation of the journal as per the goRead more

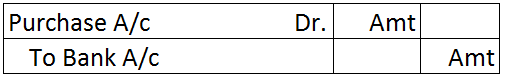

When it is said that furniture is purchased for office use, it means it is an asset for the business and the journal entry for this event will be the following:

Explanation of the journal as per the golden rules of accounting

The furniture account is a real account because it represents a material asset and the golden rule for real accounts is “Debit what comes in, credit what goes out”. Hence, the furniture account is debited as it is increased. The cash and bank are also real accounts and they are debited because there is an outflow from cash or bank.

If the furniture is purchased on credit then the vendor account is credited. A vendor account represents a person and the golden rule for personal accounts is, “Debit the receiver, credit the giver”. It is credited as the furniture is given by the vendor.

Explanation of journal as per modern rules of accounting

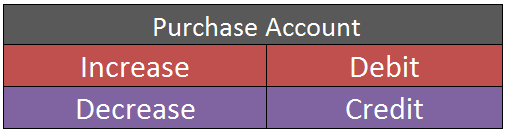

The furniture account is an asset account hence it is debited as asset accounts are debited on increase. Cash and bank accounts are also assets accounts and they are credited as they are decreased on the purchase of furniture.

A vendor account is a liability account as there is an obligation to pay the vendor. It is credited as it is increased. Liability accounts are credited on the increase and vice versa.

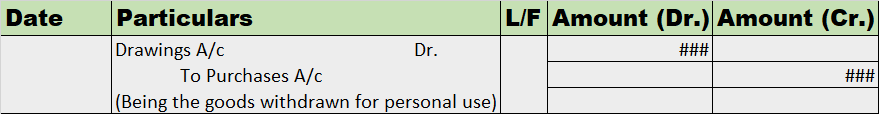

When furniture is purchased for personal use

If the furniture is purchased for personal use and the payment is made or is to be made out of business, then the asset will not be recognised as an asset for the business and it will be recorded as a drawing. It will be deducted out of capital. The journal entry will be the following:

See less