Definition Goodwill is an intangible asset that places an enterprise in an advantageous position due to which the enterprise is able to earn higher profits without extra effort. For example, if the enterprise has rendered good services to its customers, it will be satisfied with the quality of its sRead more

Definition

Goodwill is an intangible asset that places an enterprise in an advantageous position due to which the enterprise is able to earn higher profits without extra effort.

For example, if the enterprise has rendered good services to its customers, it will be satisfied with the quality of its services, which will bring them back to the enterprise.

Features

The value of goodwill is a subjective assessment of the valuer.

• It helps in earning higher profits.

• It is an intangible asset.

• It is an attractive force that brings in customers to the business.

• It has realizable value when the business is sold out.

Need for goodwill valuation

The need for the valuation of goodwill arises in the following circumstances :

• When there is a change in profit sharing ratio.

• When a new partner is admitted.

• When partner retires or dies.

• When a partnership firm is sold as a going concern.

• When two or more firms amalgamate.

Classification of goodwill

Goodwill is classified into two categories:

• Purchased goodwill

• Self-generated goodwill

Purchased goodwill :

Is that goodwill acquired by the firm for consideration whether paid or kind?

For example: when a business is purchased and purchase consideration is more than the value of net assets the difference amount is the value of purchase goodwill.

Self-generated goodwill

It is that goodwill that is not purchased for consideration but is earned by the management’s efforts.

It is an internally generated goodwill that arises from a number of factors ( such as favorable location, efficient management, good quality of products, etc ) that a running business possesses due to which it is able to earn higher profits.

Methods of valuation

1. Average profit method

2. Super profit method

3. Capitalization method

Average profit method: goodwill under the average profit method can be calculated either by :

• Simple average profit method or

• Weighted average profit method

See less

Yes, Goodwill is a fixed asset because it adds to the value of the business over a long period. Goodwill can never be calculated for a short period. GOODWILL Basically, goodwill is a premium or you can say an additional price you are paying because of the reputation of a firm or a person. YouRead more

Yes, Goodwill is a fixed asset because it adds to the value of the business over a long period. Goodwill can never be calculated for a short period.

GOODWILL

Basically, goodwill is a premium or you can say an additional price you are paying because of the reputation of a firm or a person.

You may have seen some famous shop in your locality which usually charges a higher price as compared to the other local shops selling the same product.

You may have also noticed that bigger brands like Bata, Titan, Zara, etc. charge higher prices for their products as compared to the same products available in the local market and people are even willing to pay for them. Ever wondered why?

This is because of the goodwill created by them over the years by providing quality products and services, good employee relationships, a strong customer base, social service, a brand name and so on. Customers trust them and for this trust, they are even willing to pay higher prices.

Goodwill is the quantitative value (i.e. in monetary terms) of the reputation of the firm in the market.

FIXED ASSETS

An asset is any possession or property of the business that enables the firm to get cash or any benefit in the future.

Fixed Assets are assets which are purchased for long-term use. They are for continued use in the business for producing goods or services and are not meant for resale. For example- Plant, machinery, building, goodwill, patents etc.

Fixed assets can be tangible or intangible.

Tangible assets are those assets which can be seen and touched and have physical existence like Plant and machinery, building, stock, furniture etc.

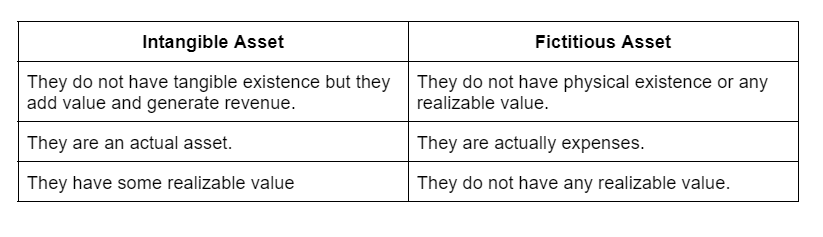

Intangible assets are those assets which cannot be seen or touched i.e. they don’t have any physical existence like goodwill, patent, trademark, prepaid expenses etc. Even though they can’t be seen or touched by they have value and are not fictitious assets.

Goodwill as a Fixed Asset

Goodwill is an intangible asset as it cannot be seen or touched but has value and adds value to the business over a long period. Thus, goodwill is a fixed asset.

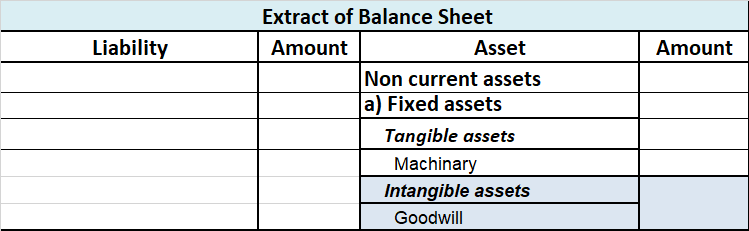

It is shown in the balance sheet as a Fixed asset under the head Intangible asset.

Goodwill can be

Self-generated goodwill is created over a period due to the good reputation of the business. It is the difference between the value of the firm and the fair value of the net tangible assets of the firm.

Goodwill = Value of the firm – Fair value of net tangible assets

Here, F.V of net tangible assets = Fair value of tangible assets- Fair value of tangible liabilities

Purchased goodwill arises when one business purchases another business. It is the difference between the price paid for the purchased firm and the sum of the fair market value of the assets received and liabilities to be paid by them on behalf of the purchased firm.

Goodwill = Purchase price – (F.V of assets received + F.V of liabilities to be paid)

Only purchased goodwill is recorded in the books of accounts because it is difficult to correctly calculate the value of self-generated goodwill as the future is uncertain, also its valuation depends on the judgement of the person calculating it, which defers from person to person. Since there is no fixed standard to calculate self-generated goodwill only purchased goodwill is recorded as the price paid for it at the time of acquiring another business.

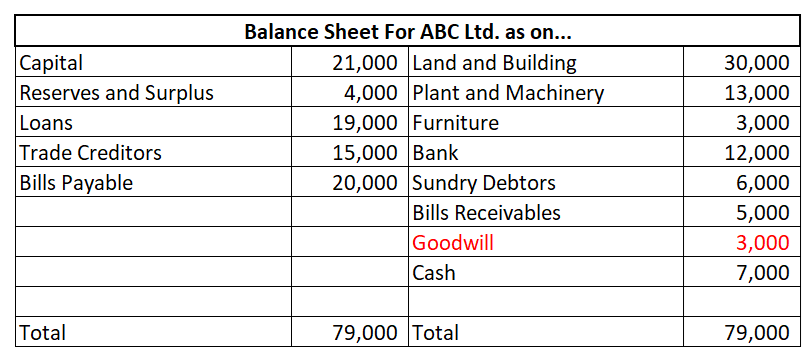

Suppose Firm A acquired Firm B.

Purchase price= $100,000

Assets received=$60,000

Liabilities (to be paid by Firm A on behalf of Firm B) = $10,000

Goodwill = $100,000 – ($60,000 + $10,000) = $30,000

This, goodwill of $30,000 will be recorded under the head Fixed Asset, subhead Intangible Assets in the balance sheet of Firm A (that is in the balance sheet of the acquiring firm)

See less