The correct option is Option (b) at a particular point of time. A balance sheet discloses the financial position of an entity at a particular point of time. The particular point of time is generally the last date of an accounting year. Most of the business concerns follow an accounting year ending oRead more

The correct option is Option (b) at a particular point of time.

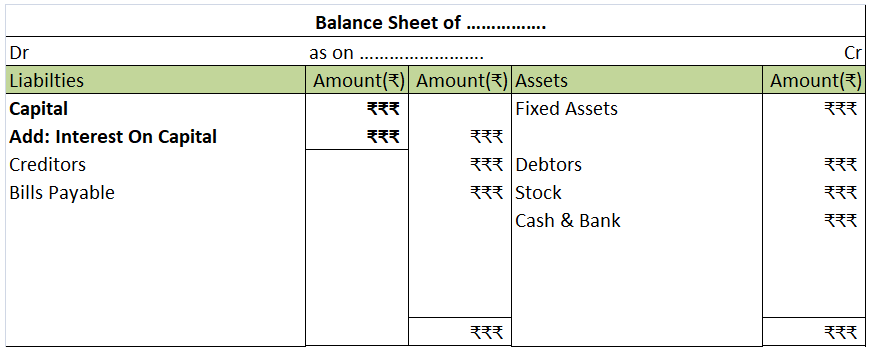

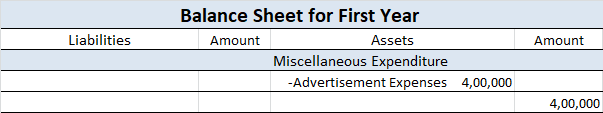

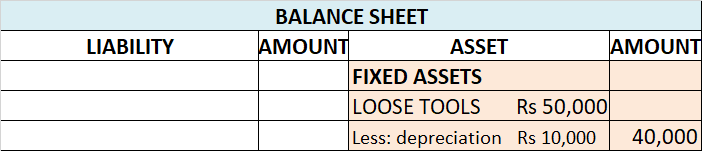

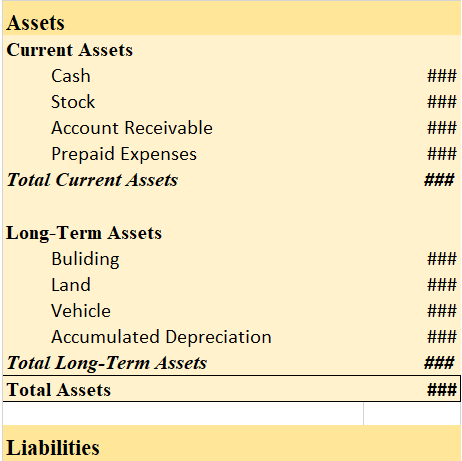

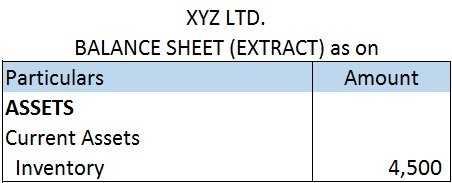

A balance sheet discloses the financial position of an entity at a particular point of time. The particular point of time is generally the last date of an accounting year. Most of the business concerns follow an accounting year ending on 31st March and prepare their balance sheet as at 31st March.

By financial position, it means the value of assets and liabilities of the entity. As an entity may enter into monetary transactions every day, the values of the assets and liabilities may also vary every day. Hence, to prepare the balance sheet of an entity, a particular point of time is to be chosen which is generally the last date of an accounting year

Option (a) for a given period of time is incorrect.

It is because the values of assets and liabilities of concern may differ daily, a balance sheet cannot be prepared to disclose the financial position of an entity for a given period of time.

The statement of profit or loss is prepared for a given period of time as it discloses the overall performance of an entity for a given period of time.

Option (c) after a fixed date is also incorrect.

The phrase, “after a fixed date” does not indicate a particular point of time. It may mean any day after a fixed date. For example, if there is an instruction to prepare a balance sheet that discloses the financial position of a concern after 30th March, it may mean 31st March, 1st April or any day thereafter.

As we know that a balance can be prepared for a particular point of time, this option seems wrong.

Option (d) None of these is incorrect too as Option (b) is the correct one.

See less

Profit refers to the excess of total revenue over total expenses. According to the rule "Debit all expenses and losses, Credit all incomes and gains", expenses are recorded on the debit side while revenues are recorded on the credit side. There is profit when Total revenue > Total expenses, whichRead more

Profit refers to the excess of total revenue over total expenses. According to the rule “Debit all expenses and losses, Credit all incomes and gains”, expenses are recorded on the debit side while revenues are recorded on the credit side.

There is profit when Total revenue > Total expenses, which means the balance of the credit side > the balance of the debit side. Since, in accounting Dr. side is always equal to the credit side, a balancing figure (representing profit or loss) is shown on the shorter side, to make both sides equal.

When Credit side > Debit side, Profit(balancing figure) is shown on the Dr. side so that both sides are equal.

PROFIT

Profit refers to the excess of total revenue over the total expenses of the business for an accounting year. In simple words, it shows how much extra the firm earned after deducting all the expenses it incurred during the year.

Profit = Total Revenue – Total Expenses

Suppose, the firm earned a total revenue of $10,000 for the accounting year 2022-23. Also, it incurred total expenses of $6,000 during the year. So, Profit for the AY 2022-23 is $4,000.

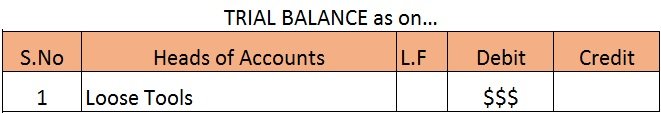

ASCERTAINING PROFIT

To ascertain profit earned or loss incurred by the firm during an accounting year, it prepares two accounts.

Points to be noted:

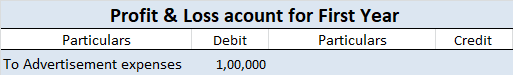

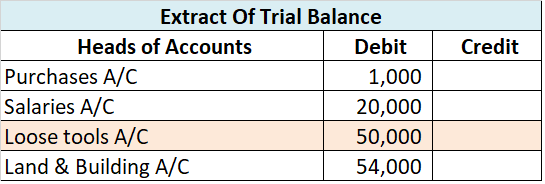

TRADING ACCOUNT

It is the first final account prepared for calculating gross profit or gross loss during the year because of the trading activities of the firm.

Trading activities are related to the buying and selling of goods. In between buying and selling a lot of activities are there like transportation, warehousing, loading, unloading, etc. All expenses that are directly related to buying and selling as well as manufacturing of goods are known as Direct expenses and are also recorded in the trading accounts.

Items included on the debit side:

Items included on the credit side:

Gross Profit is when Cr. side (incomes) > Dr. side (expenses). It is recorded on the debit side as a balancing figure.

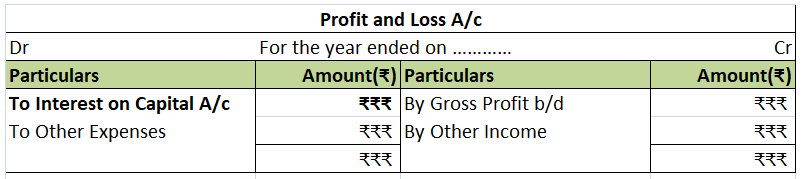

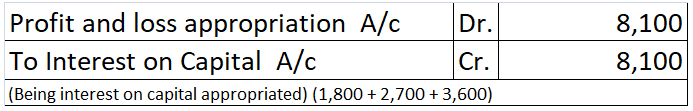

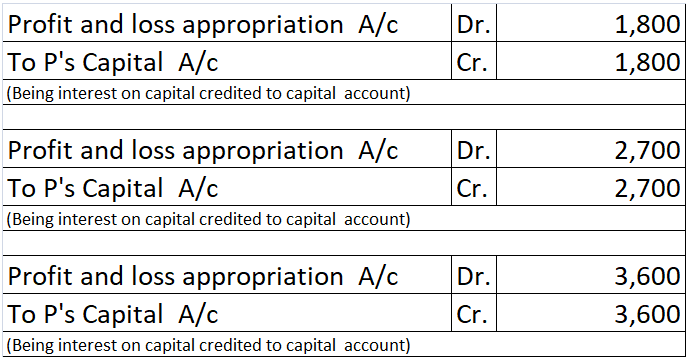

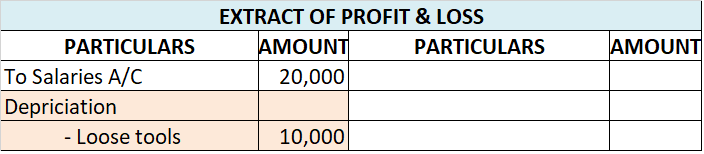

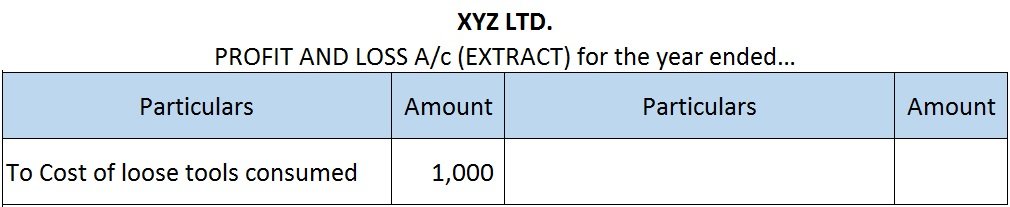

PROFIT AND LOSS ACCOUNT

A businessman incurs a lot of expenses during the year which may be directly related or indirectly related to the business.

As the Trading account only considers direct expenses, the businessman prepares the P&L A/c which considers all the expenses incurred during a year to ascertain net profit or loss.

Items written on the Debit side

Items written on the Credit side

Net Profit is when the Cr. side (incomes)> Dr. side(expenses). It is recorded on the Debit side as a balancing figure.

See less