A Cash Flow Statement analyzes the effect of various activities in the company on cash and, that is, it shows the inflow and outflow of cash and cash equivalents. A Fund Flow Statement analyzes the financial position of a company by the inflow and outflow of funds. Both the statements are financialRead more

A Cash Flow Statement analyzes the effect of various activities in the company on cash and, that is, it shows the inflow and outflow of cash and cash equivalents.

A Fund Flow Statement analyzes the financial position of a company by the inflow and outflow of funds.

Both the statements are financial statements and are used to analyze the financial performance of the company of two different reporting periods. Both the statements record the inflow and outflow of cash or funds, as the case may be.

The primary objective of preparing a Cash Flow Statement is to gain an understanding of the changes in the net working capital of the company and to classify the activities in the company under three different heads which helps in better analysis of Financial Statements for management, outsiders, and investors.

The primary objective of preparing a Fund Flow Statement is to track the movements of funds in the company, as the extent of use of long-term and short-term borrowings, frequency of their procurement, its application, etc.

The components of the Cash Flow Statement are:

- Cash Flow from Operating Activities- activities concerning the regular business operations and working capital are classified under this head.

- Cash Flow from Investing Activities- investment in long-term assets or sale of such assets are considered under this head.

- Cash Flow from Financing Activities- borrowings that a company makes to fund its operations, their interest payment, and repayment are covered under this head.

The components of the Fund Flow Statement are:

Sources of Funds:

- Owners

- Outsiders

Application of Funds:

- Funds deployed in Fixed Assets

- Funds deployed in Current Assets

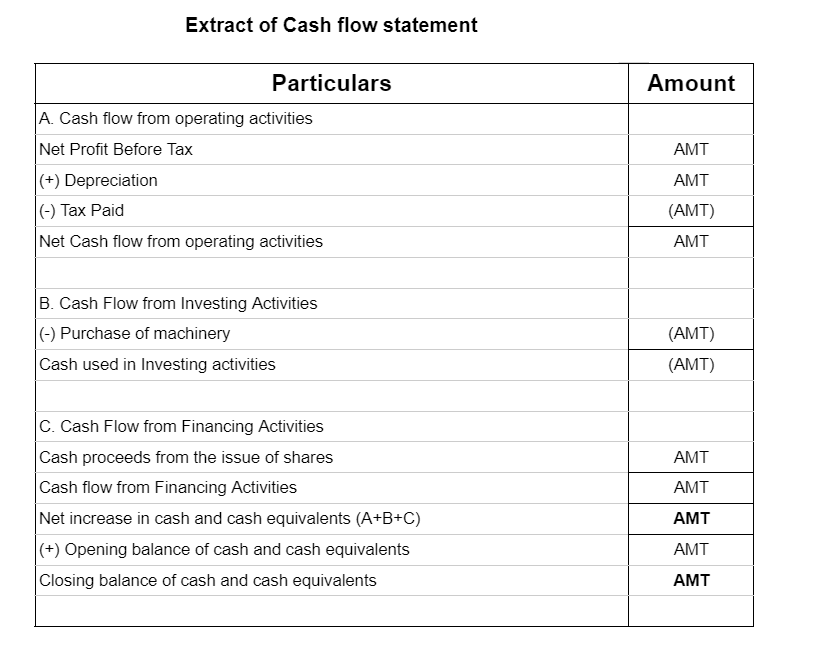

A sample format of the Cash Flow Statement will be:

| Particulars | Amount |

| Cash Flow from Operating Activities | XXX |

| Cash Flow from Investing Activities | XXX |

| Cash Flow from Financing Activities | XXX |

| Net Increase (Decrease) in Cash and Cash Equivalents | XXX |

| Cash and Cash Equivalents at the beginning | XXX |

| Cash and Cash Equivalents at the end | XXX |

A sample format of the Fund Flow Statement will be:

| Particulars | Amount |

| Sources of Funds | XXX |

| Funds from Operations | XXX |

| Sale of Fixed Assets | XXX |

| Issue of Shares | XXX |

| Issue of Debentures | XXX |

| Long Term Borrowings | XXX |

| Total (A) | XXX |

| Application of Funds | XXX |

| Loss from Operations | XXX |

| Payment of Tax | XXX |

| Repayment of Loan | XXX |

| Redemption of Debentures | XXX |

| Redemption of Preference Shares | XXX |

| Total (B) | XXX |

| Net Increase (Decrease) in Working Capital | XXX |

To conclude the difference between Fund Flow and Cash Flow Statement will be:

| Cash Flow Statement | Fund Flow Statement |

| Record of inflow and outflow of cash. | Record of sources and application of funds. |

| Prepared to analyze cash used in various activities. | Prepared to track the movement of funds and their applications. |

Components include:

|

Components include:

· Sources of Funds · Application of Funds |

See less

A cash flow statement is a statement showing the inflow and outflow of cash and cash equivalents during a financial year. Cash Flow Statements along with Income statements and Balance Sheet are the most important financial statements for a company. The Cash Flow Statement provides a picture to the sRead more

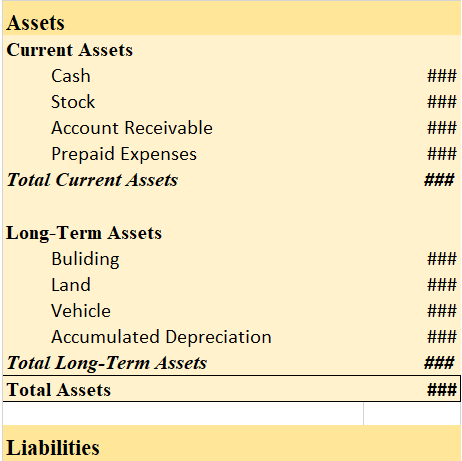

A cash flow statement is a statement showing the inflow and outflow of cash and cash equivalents during a financial year. Cash Flow Statements along with Income statements and Balance Sheet are the most important financial statements for a company.

The Cash Flow Statement provides a picture to the shareholders, government, and the public of how the company manages its obligations and fund its operations. It is a crucial measure to determine the financial health of a company.

The Cash Flow Statement is created from the Income Statement and the Balance Sheet. While Income Statement shows money engaged in various transactions during the year, the Balance Sheet presents information about the opening and closing balances.

The primary objective of a Cash Flow Statement is to present a record of inflow and outflow of cash, cash equivalents, and marketable securities through various activities of a company.

Various activities in a company can be broadly classified into three parts or heads:

Cash Flow Statements also present a picture of the liquidity of the company and are therefore used by the management of a company to take decisions with the help of the right information.

Cash Flow Statements are a great source of comparison between a company’s last year’s performance to its current year or with other companies in the same industry and hence, helps shareholders and potential investors to make the right decisions.

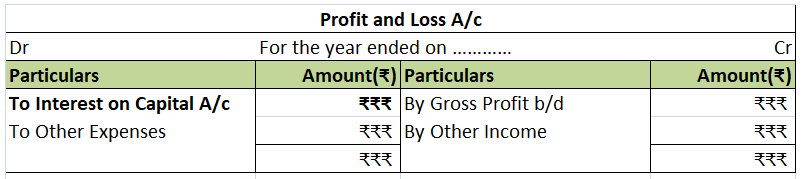

It also helps to differentiate between non-cash and cash items; incomes and expenditures are divided into separate heads.

See less