A. For a certain given period B. At a particular point of time C. After a fixed date D. None of the above

Interest on capital is the interest provided on the capital invested in the business. It is calculated as a percentage on the capital invested. Interest on capital is provided if there is any rule established by the owner of the capital. Otherwise, it is not provided. We generally encounter ‘InteresRead more

Interest on capital is the interest provided on the capital invested in the business. It is calculated as a percentage on the capital invested. Interest on capital is provided if there is any rule established by the owner of the capital. Otherwise, it is not provided.

We generally encounter ‘Interest on capital’ in partnership accounting but a sole proprietorship can also provide interest on capital.

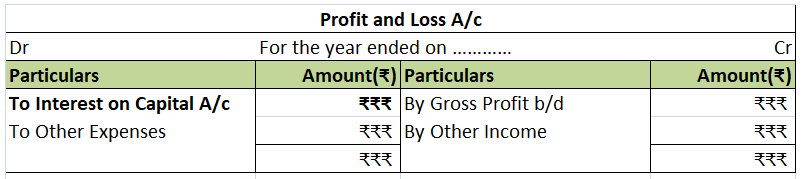

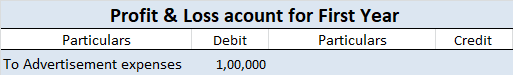

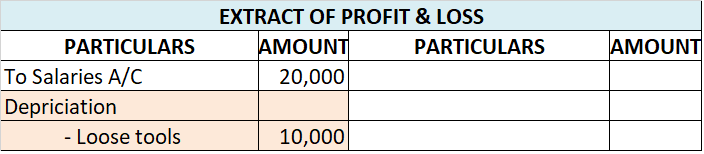

Interest on capital is charged or appropriated from the profits of the firm. Hence, it appears on the debit side of the profit and loss account.

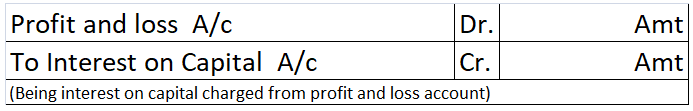

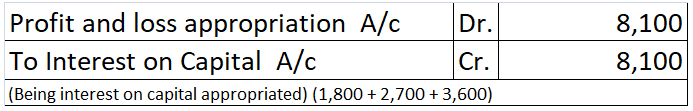

The journal entry is as follows:

The partners, in case the firm makes profit, are provided interest on their capital balance apart from their share of profit if provision of interest on capital is mentioned in the partnership deed.

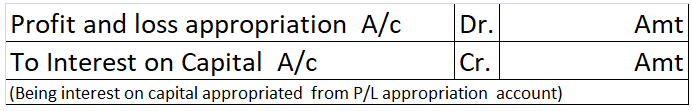

Hence, interest on capital is an appropriation of profit in partnership accounting. The journal in case of partnership account is as follows:

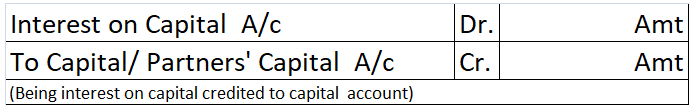

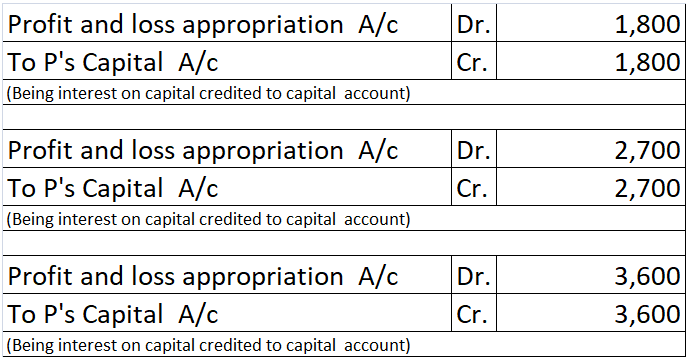

The Interest on capital is credited to the capital/ partners’ capital account thereby increasing the capital balance. The journal is as follows:

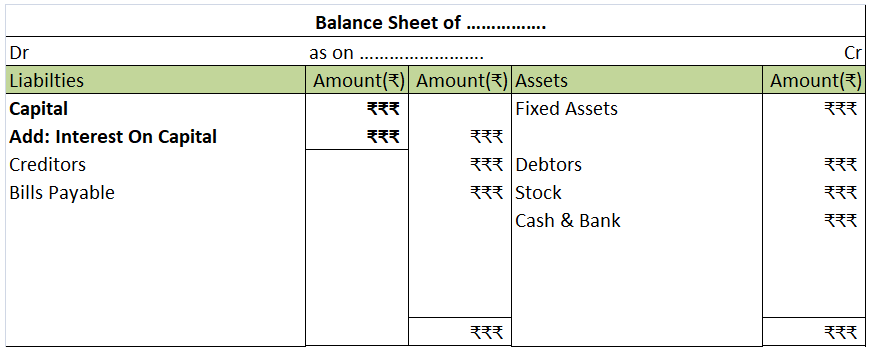

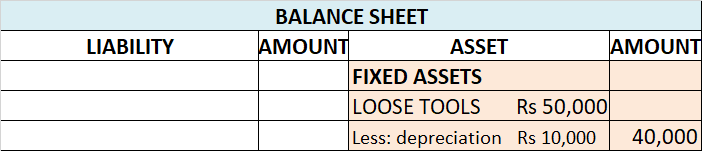

In the balance sheet it is shown as an addition to the capital account.

Numerical example

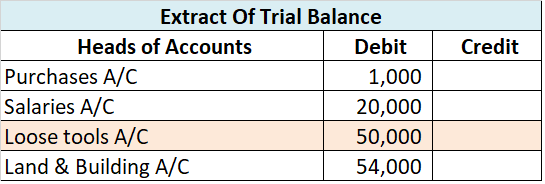

P, Q and R are partners. Their firm reported a net profit of ₹ 20,000. Their capitals are ₹30,000, ₹45,000 and ₹60,000. It is in their partnership deed to provide the partners 4% interest on capital and a salary of ₹5,000 per annum for Q. Calculate the interest on capital.

Solution:

Interest on capital to be provided to the partners:

P – ₹30,000 x 6% = ₹1,800

Q – ₹45,000 x 6% = ₹2,700

R – ₹60,000 x 6% = ₹3,600

This interest will be credited to the partners’ capital. The journals are as follows:

The correct option is Option (b) at a particular point of time. A balance sheet discloses the financial position of an entity at a particular point of time. The particular point of time is generally the last date of an accounting year. Most of the business concerns follow an accounting year ending oRead more

The correct option is Option (b) at a particular point of time.

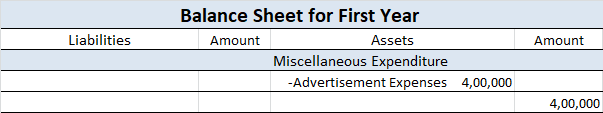

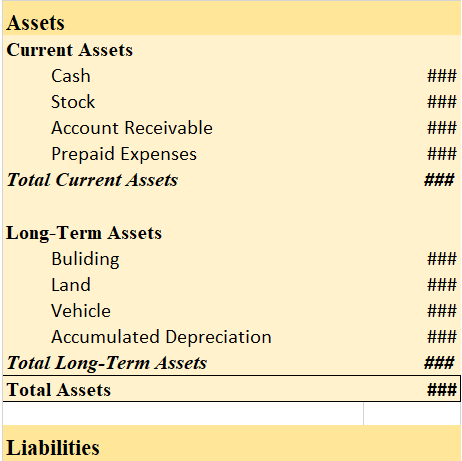

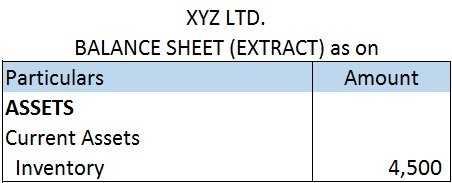

A balance sheet discloses the financial position of an entity at a particular point of time. The particular point of time is generally the last date of an accounting year. Most of the business concerns follow an accounting year ending on 31st March and prepare their balance sheet as at 31st March.

By financial position, it means the value of assets and liabilities of the entity. As an entity may enter into monetary transactions every day, the values of the assets and liabilities may also vary every day. Hence, to prepare the balance sheet of an entity, a particular point of time is to be chosen which is generally the last date of an accounting year

Option (a) for a given period of time is incorrect.

It is because the values of assets and liabilities of concern may differ daily, a balance sheet cannot be prepared to disclose the financial position of an entity for a given period of time.

The statement of profit or loss is prepared for a given period of time as it discloses the overall performance of an entity for a given period of time.

Option (c) after a fixed date is also incorrect.

The phrase, “after a fixed date” does not indicate a particular point of time. It may mean any day after a fixed date. For example, if there is an instruction to prepare a balance sheet that discloses the financial position of a concern after 30th March, it may mean 31st March, 1st April or any day thereafter.

As we know that a balance can be prepared for a particular point of time, this option seems wrong.

Option (d) None of these is incorrect too as Option (b) is the correct one.

See less