A balance sheet of a company is a financial statement that depicts the assets, liabilities and shareholders’ equity of the company at a point of time, usually at the end of the accounting year. A balance sheet of a company is reported in a vertical format which is different from that of a partnershiRead more

A balance sheet of a company is a financial statement that depicts the assets, liabilities and shareholders’ equity of the company at a point of time, usually at the end of the accounting year. A balance sheet of a company is reported in a vertical format which is different from that of a partnership where the horizontal format is used.

COMPONENTS OF A BALANCE SHEET

The three main components of a balance sheet are Assets, Liabilities and Shareholders’ equity.

- Assets: They are divided into two main categories that are current assets and non-current assets. If an asset is expected to be realised within 12 months or is primarily held for being traded, or is cash or cash equivalent, then those assets are termed as current assets. All assets that are not current assets are grouped under non-current assets. They are normally realised after 12 months.

- Liabilities: They are categorised as current liabilities and non-current liabilities. If the amount owed by the company to an outside party is due to be settled in 12 months, then it can be termed as a current liability. The rest of the liabilities are referred to as non-current liability.

- Shareholders’ Equity: This is the money owed to the owners of the company, that is shareholders. It is also called net assets since it is equal to the difference between total assets and total liabilities. Their main categories are Shareholders’ Capital and Reserves and Surplus.

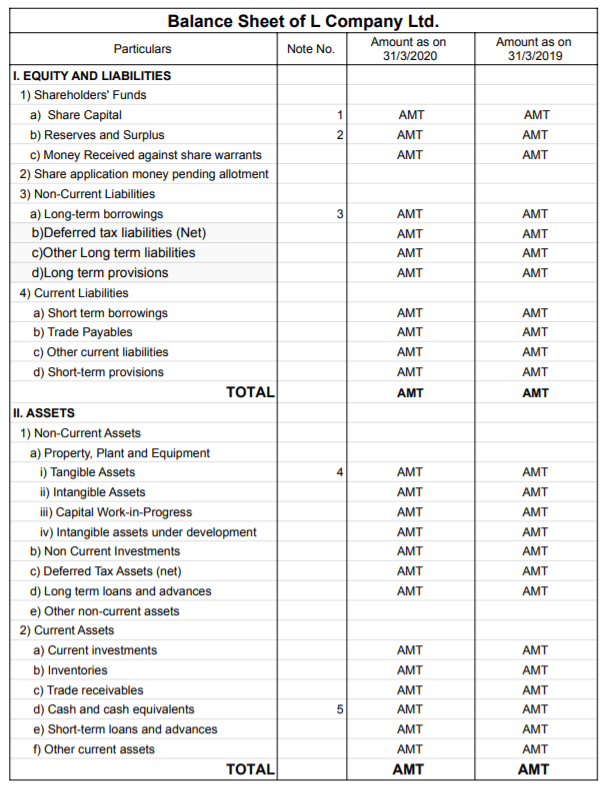

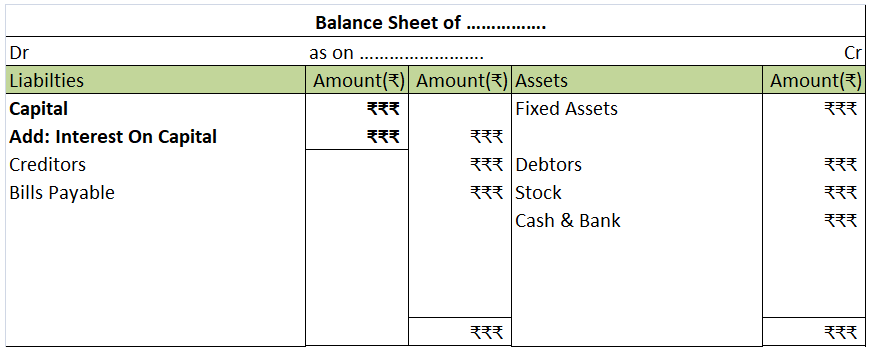

FORMAT OF BALANCE SHEET

As per the Companies Act 2013, the following format should be used for preparing a balance sheet.

From the above Balance sheet, we should get:

Assets = Liabilities + Shareholders’ Equity

Relevant notes for each component should also be prepared when necessary.

See less

Definition Bad debts are a debt owed to an enterprise that is considered to be irrecoverable or we can say that it is owed to the business that is written off because it is irrecoverable. Bad debts will be treated in the following ways : On the debit side of the profit and loss account. In the curreRead more

Definition

Bad debts are a debt owed to an enterprise that is considered to be irrecoverable or we can say that it is owed to the business that is written off because it is irrecoverable.

Bad debts will be treated in the following ways :

On the debit side of the profit and loss account.

In the current assets side of the balance sheet, these are deducted from sundry debtors.

For example loans from banks are declared as bad debt, sales made on credit and amounts not received from customers, etc.

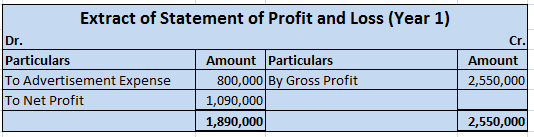

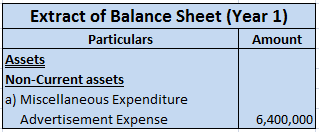

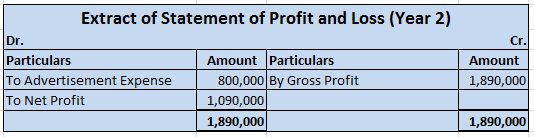

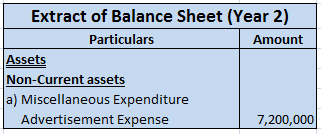

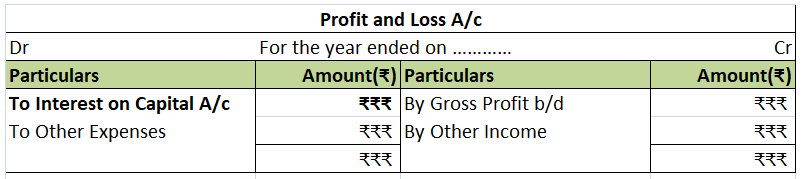

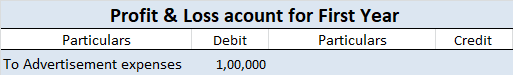

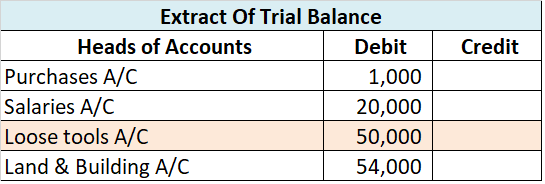

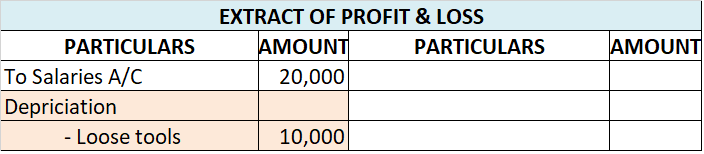

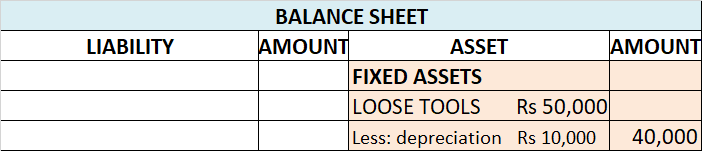

Now I will show you an extract of the profit and loss account and balance sheet

Current assets are defined as cash and other assets that are expected to be converted into cash or consumed in the production of goods or the rendering of services in the ordinary course of business.

For example, debtors exist to convert them into cash i.e., receive the amount from them, bills receivable exist again for receiving cash against it, etc.

Current liabilities are defined as liabilities that are payable normally within 12 months from the end of the accounting period or in other words which fall due for payment in a relatively short period.

For example bills payable, short-term loans, etc.

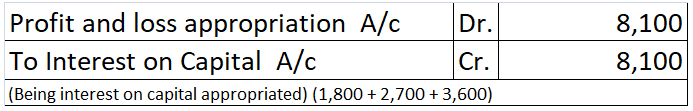

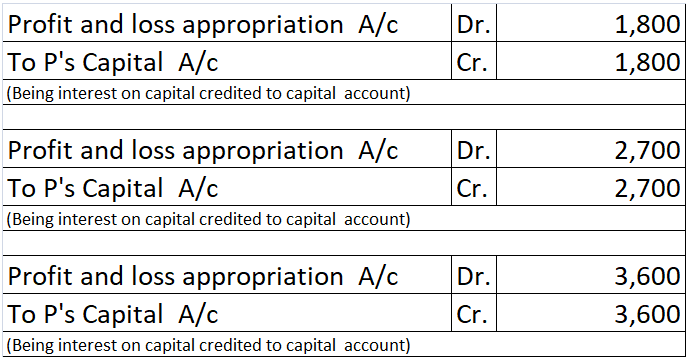

Accounting treatment

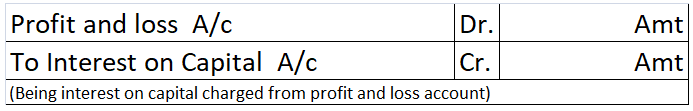

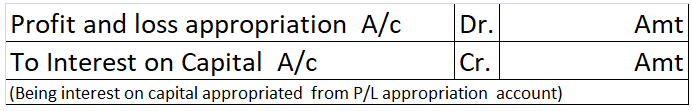

Now let me try to explain to you the accounting treatment for bad debts which is as follows :

Reasons for bad debts

There are several reasons why businesses may have bad debts some of them are as follows:-

Accounting methods

There are two methods for accounting for bad debts which are mentioned below:-

Related terms

So there are a few related terms whose meanings you should know

See less