When the Accumulated depreciation account is not maintained, the journal entry for vehicle depreciation shall be Particulars Debit Credit Depreciation a/c Dr. (xxx) To Vehicle a/c (xxx) (Being DepreciationRead more

When the Accumulated depreciation account is not maintained, the journal entry for vehicle depreciation shall be

| Particulars | Debit | Credit |

| Depreciation a/c Dr. | (xxx) | |

| To Vehicle a/c | (xxx) | |

| (Being Depreciation charge on Vehicle made) |

For example, let us assume that a vehicle (Bike) was purchased on 1st April 2019 with INR. 2,50,000, the rate of depreciation is 15% and also the Company follows the straight-line method of calculating depreciation.

Then the journal entries shall be,

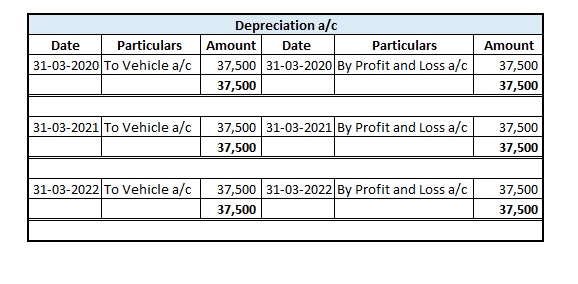

The depreciation charge for the 1st Year

| Date | Particulars | Debit | Credit |

| 31-03-2020 | Depreciation a/c Dr. | 37,500 | |

| To Vehicle a/c | 37,500 | ||

| (Being Depreciation made on Vehicle) |

The depreciation charge for the 2nd Year

| Date | Particulars | Debit | Credit |

| 31-03-2021 | Depreciation a/c Dr. | 37,500 | |

| To Vehicle a/c | 37,500 | ||

| (Being Depreciation made on Vehicle) |

The depreciation charge for the 3rd Year

| Date | Particulars | Debit | Credit |

| 31-03-2022 | Depreciation a/c Dr. | 37,500 | |

| To Vehicle a/c | 37,500 | ||

| (Being Depreciation made on Vehicle) |

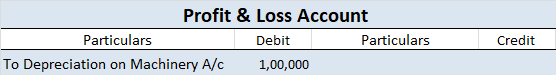

The respective ledger accounts for all three years are given below:

When the Accumulated depreciation account is maintained, the journal entry for vehicle depreciation shall be

| Particulars | Debit | Credit |

| Depreciation a/c Dr. | (xxx) | |

| To Accumulated depreciation a/c | (xxx) | |

| (Being Depreciation charge on Vehicle made) |

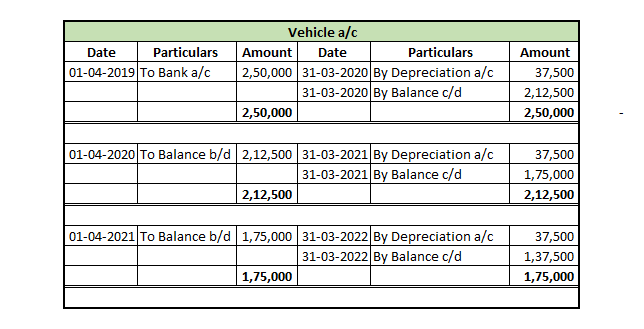

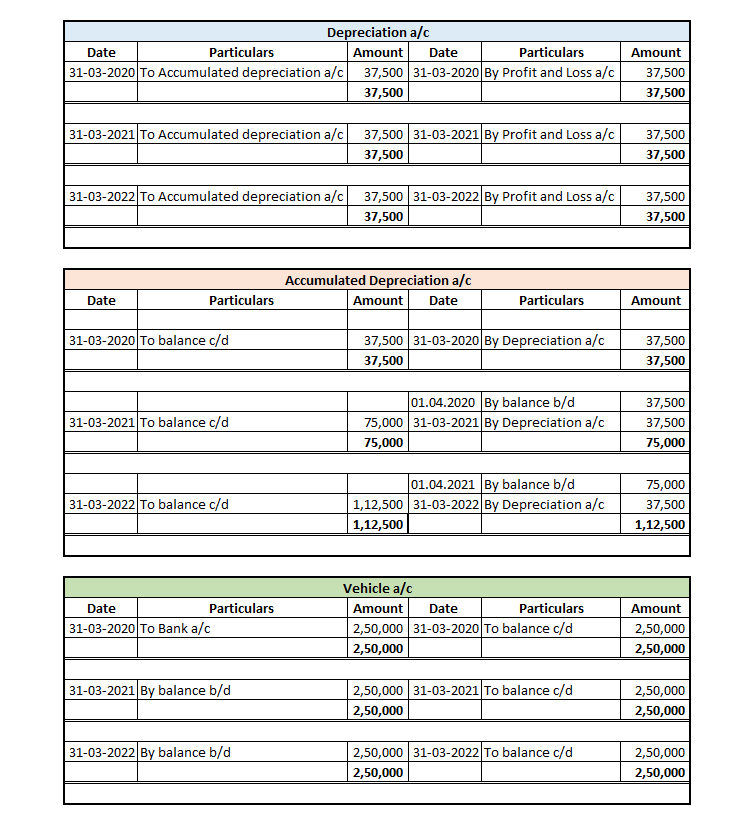

Taking the above said example,

The depreciation charge for the 1st Year

| Date | Particulars | Debit | Credit |

| 31-03-2020 | Depreciation a/c Dr. | 37,500 | |

| To accumulated depreciation a/c | 37,500 | ||

| (Being Depreciation made on Vehicle) |

The depreciation charge for the 2nd Year

| Date | Particulars | Debit | Credit |

| 31-03-2021 | Depreciation a/c Dr. | 37,500 | |

| To accumulated depreciation a/c | 37,500 | ||

| (Being Depreciation made on Vehicle) |

The depreciation charge for the 3rd Year

| Date | Particulars | Debit | Credit |

| 31-03-2021 | Depreciation a/c Dr. | 37,500 | |

| To accumulated depreciation a/c | 37,500 | ||

| (Being Depreciation made on Vehicle) |

The respective ledger accounts for all three years are given below:

See less

Depreciation on Tools and Equipment Tools and Equipment are the instruments that are used for producing any product, machine, or service. Also, tools and equipment are a part of plants and machinery, making them a major fixed asset. Therefore, a certain percentage of depreciation is charged on ToolsRead more

Depreciation on Tools and Equipment

Tools and Equipment are the instruments that are used for producing any product, machine, or service. Also, tools and equipment are a part of plants and machinery, making them a major fixed asset. Therefore, a certain percentage of depreciation is charged on Tools and Equipment.

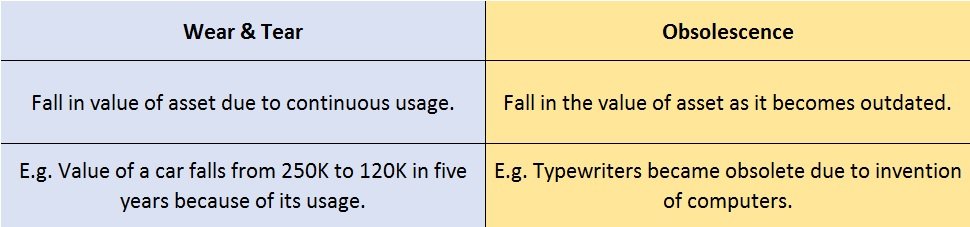

As we’re aware, depreciation refers to a process in which assets lose their value over time until it becomes obsolete or zero. It is chargeable on the fixed assets and it ultimately results in depreciation of the value of fixed assets except, land. The land is an exception in fixed assets as where all the fixed assets are depreciated, the land’s value is appreciated over time.

The rate of depreciation as per the Income Tax Act on tools and equipment (plant and machinery) is 15%.

Example

Suppose given below are the details regarding the tools and equipment:

And, we’re required to calculate the value of the tools and equipment as on 1-Mar-22

In this, as we can see the business’ accounting period starts in March and ends in April. Therefore, we can easily deduct the depreciation amount and get the desired result.

Solution: Opening Value = $30,000

Depreciation = 15% of $30,000 = $4,500

Value of tools and equipment as on 1-Mar-22 = $30,000 – $4500 = $25,500

See less