Buildings S.No. Particulars Rate 1 Buildings which are used mainly for residential purposes except hotels and boarding houses. 5% 2 Buildings other than those used mainly for residential purposes and not covered by sub-items (1) above and (3) below. 10% 3 Buildings acquired on or after the 1st day oRead more

| Buildings | ||

| S.No. | Particulars | Rate |

| 1 | Buildings which are used mainly for residential purposes except hotels and boarding houses. | 5% |

| 2 | Buildings other than those used mainly for residential purposes and not covered by sub-items (1) above and (3) below. | 10% |

| 3 | Buildings acquired on or after the 1st day of September, 2002 for installing machinery and plant forming part of water supply project or water treatment system and which is put to use for the purpose of business of providing infra- structure facilities. | 40% |

| 4 | Purely temporary erections such as wooden structures. | 40% |

| Furniture & Fittings | ||

| S.No. | Particulars | Rate |

| Furniture and fittings including electrical fittings. | 10% | |

| Machinery & Plant | ||

| S.No. | Particulars | Rate |

| 1 | Machinery and plant other than those covered by sub-items (2), (3) and (8) below. | 15% |

| 2 (i) | Motor cars, other than those used in a business of running them on hire, acquired or put to use on or after the 1st day of April, 1990 except those covered under entry (ii). | 15% |

| 2 (ii) | Motor cars, other than those used in a business of running them on hire, acquired on or after the 23rd day of August, 2019 but before the 1st day of April, 2020 and is put to use before the 1st day of April, 2020. | 30% |

| 3 (i) | Aeroplanes – Aero engines. | 40% |

| 3 (ii) | (a) Motor buses, motor lorries and motor taxis used in a business of running them on hire other than those covered under entry (b). | 30% |

| (b) Motor buses, motor lorries and motor taxis used in a business of running them on hire, acquired on or after the 23rd day of August, 2019 but before the 1st day of April, 2020 and is put to use before the 1st day of April, 2020. | 45% | |

| 3 (iii) | Commercial vehicle which is acquired by the assessee on or after the 1st day of October, 1998, but before the 1st day of April, 1999 and is put to use for any period before the 1st day of April, 1999 for the purposes of business or profession. | 40% |

| 3 (iv) | New commercial vehicle which is acquired on or after the 1st October, 1998, but before the 1st April, 1999 in replacement of condemned vehicle of over 15 years of age and is put to use for any period before the 1st day of April, 1999 for the purposes of business or profession. | 40% |

| 3 (v) | New commercial vehicle which is acquired on or after the 1st April, 1999 but before the 1st April, 2000 in replacement of condemned vehicle of over 15 years of age and is put to use before the 1st April, 2000 for the purposes of business or profession. | 40% |

| 3 (vi) | New commercial vehicle which is acquired on or after the 1st April, 2001 but before the 1st April, 2002 and is put to use before the 1st day of April, 2002 for the purposes of business or profession. | 40% |

| 3 (via) | New commercial vehicle which is acquired on or after the 1st January, 2009 but before the 1st October, 2009 and is put to use before the 1st October, 2009 for the purposes of business or profession. | 40% |

| 3 (vii) | Moulds used in rubber and plastic goods factories. | 30% |

| 3 (viii) | Air pollution control equipment. | 40% |

| 3 (ix) | Water pollution control equipment. | 40% |

| 3 (x) | Solid waste control equipments & solid waste recycling and resource recovery systems. | 40% |

| 3 (xi) | Machinery and plant, used in semi-conductor industry covering all integrated circuits (ICs). | 30% |

| 3 (xia) | Life saving medical equipment. | 40% |

| 4 | Containers made of glass or plastic used as re-fills. | 40% |

| 5 | Computers including computer software. | 40% |

| 6 | Machinery and plant, used in weaving, processing and garment sector of textile industry, which is purchased & put to use under TUFS on or after the 1st April, 2001 but before the 1st April, 2004. | 40% |

| 7 | Machinery and plant, acquired and installed on or after the 1st September, 2002 in a water supply project or a water treatment system and which is put to use for the purpose of business of providing infrastructure facility. | 40% |

| 8 (i) | Wooden parts used in artificial silk manufacturing machinery. | 40% |

| 8 (ii) | Cinematograph films – bulbs of studio lights. | 40% |

| 8 (iii) | Match factories – Wooden match frames. | 40% |

| 8 (iv) | Mines and quarries. | 40% |

| 8 (v) | Salt works – Salt pans, reservoirs and condensers, etc., made of earthy, sandy or clayey material or any other similar material. | 40% |

| 8 (vi) | Flour mills – Rollers. | 40% |

| 8 (vii) | Iron and steel industry – Rolling mill rolls. | 40% |

| 8 (viii) | Sugar works – Rollers. | 40% |

| 8 (ix) | Energy saving devices: (a) Specialised boilers and furnaces. | 40% |

| (b) Instrumentation and monitoring system for monitoring energy flows. | 40% | |

| (c) Waste heat recovery equipment. | 40% | |

| (d) Co-generation systems. | 40% | |

| (e) Electrical equipment. | 40% | |

| (f) Burners. | 40% | |

| (g) Other equipment. | 40% | |

| 8 (x) | Gas cylinders including valves and regulators. | 40% |

| 8 (xi) | Glass manufacturing concerns – Direct fire glass melting furnaces. | 40% |

| 8 (xii) | Mineral oil concerns: (a) Plant used in field operations (above ground) distribution – Returnable packages. | 40% |

| (b) Plant used in field operations (below ground), but not including kerbside pumps including underground tanks and fittings used in field operations (distribution) by mineral oil concerns. | 40% | |

| (c) Oil wells not covered in clauses (a) and (b). | 15% | |

| 8 (ix) | Renewal energy devices. | 40% |

| 9 (i) | Books owned by assessees carrying on a profession. | 40% |

| 9 (ii) | Books owned by assessees carrying on business in running lending libraries. | 40% |

| Ships | ||

| S.No. | Particulars | Rate |

| 1 | Ocean-going ships including dredgers, tugs, barges, survey launches and other similar ships used mainly for dredging purposes and fishing vessels with wooden hull. | 20% |

| 2 | Vessels ordinarily operating on inland waters, not covered by sub-item (3) below. | 20% |

| 3 | Vessels ordinarily operating on inland waters being speed boats. | 20% |

| Intangible Assets | ||

| S.No. | Particulars | Rate |

| 1 | Know-how, patents, copyrights, trademarks, licences, franchises or any other business or commercial rights of similar nature not being goodwill of business of profession. | 25% |

See less

Plant and Machinery are the equipment attached to the earth that supports the manufacturing of the company or its operations. These are tangible non-current assets to the company and as a result, have a debit balance. Depreciation is the decrease in the value of an asset that is spread over the expeRead more

Plant and Machinery are the equipment attached to the earth that supports the manufacturing of the company or its operations. These are tangible non-current assets to the company and as a result, have a debit balance.

Depreciation is the decrease in the value of an asset that is spread over the expected life of the asset. Not depreciating an asset presents a false image of the company as the asset is recorded at a higher value and profit is overstated as depreciation expense is not provided for.

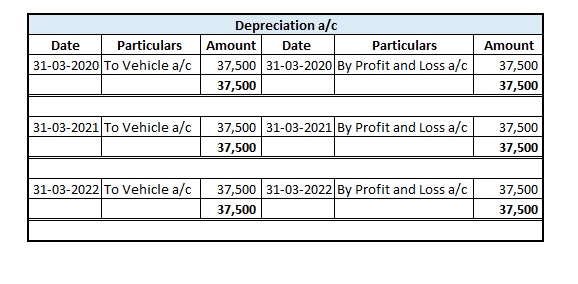

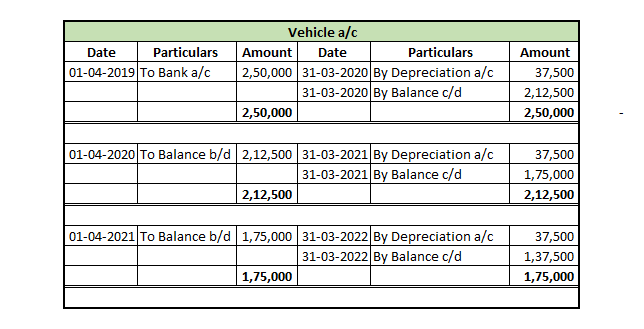

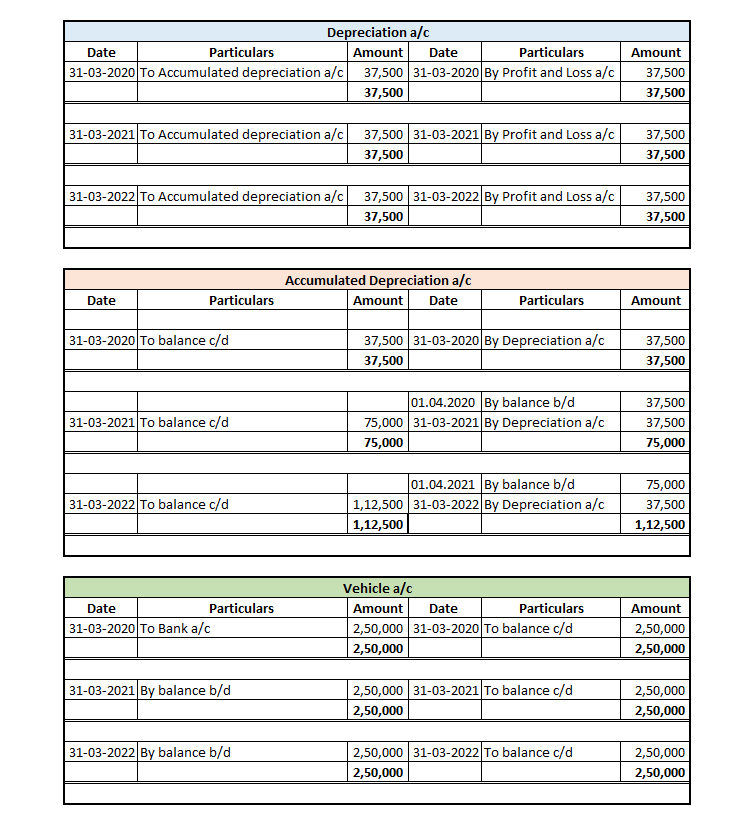

There are two ways that a company provide depreciation:

For most of the depreciation methods, we need a rate to provide for depreciation every year. Now, for accounting purposes, the management can use a rate they think is suitable depending on the use and expected life of the machinery.

Depreciation is calculated on the basis of the Companies act, 2013 for the purpose of book-keeping. According to Schedule 2 of the Companies Act, depreciation on plant and machinery is calculated on the basis of either SLM or WDV.

Plant and machinery for those special rates are not assigned useful life is considered to be 15 years and depreciation is calculated @ 18.10% on WDV and @6.33% on SLM.

According to the Income Tax Act, 15% depreciation is provided every year on Plant and Machinery and, an additional 20% depreciation is provided in the first year of installation of machinery.

Depreciation on Machinery is charged on the basis of usage of such machinery. if it is used for 180 days or more then full depreciation is allowed and if it is used for less than 180 days then only 50% depreciation is allowed.

See less