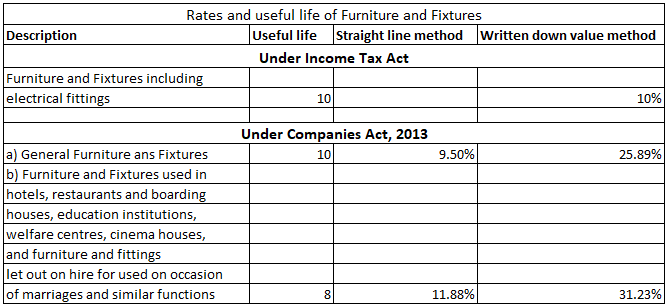

The Furniture and Fixture is depreciated @10% according to the income tax act and as per the companies act, 2013 @9.50% under Straight line method and @25.89% under written down value method. Furniture and fixture form a major part to furnish an office. For Example, the chair, table, bookshelves, etRead more

The Furniture and Fixture is depreciated @10% according to the income tax act and as per the companies act, 2013 @9.50% under Straight line method and @25.89% under written down value method.

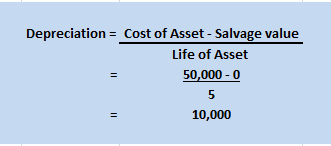

Furniture and fixture form a major part to furnish an office. For Example, the chair, table, bookshelves, etc. all comes under Furniture and Fixture. The useful life of Furniture and Fixtures is estimated as 5-10 years depending upon the kind of furniture.

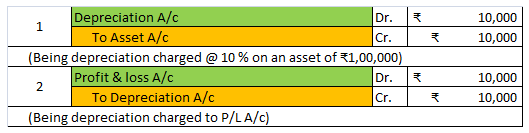

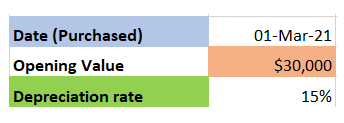

Rate of depreciation in reference to days

- If Furniture is bought and put to use for more than 180 days, then the full rate of depreciation will be charged.

- If the furniture is bought and put to use for less than 180 days, then half the rate of depreciation will be charged.

- If the furniture is bought but is not put to use, then no depreciation will be charged.

As per the companies act 2013, the rate of depreciation for cars/vehicles and their useful life is mentioned below They are categorized by the companies act as follows: when these car/ motor vehicles are owned with no intention to sell within the accounting period and are generally used to generateRead more

As per the companies act 2013, the rate of depreciation for cars/vehicles and their useful life is mentioned below

They are categorized by the companies act as follows:

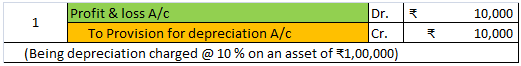

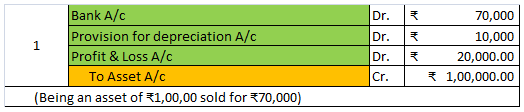

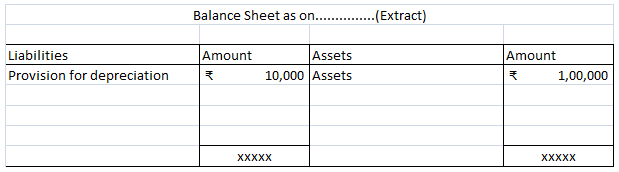

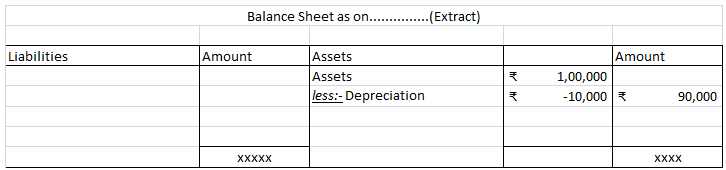

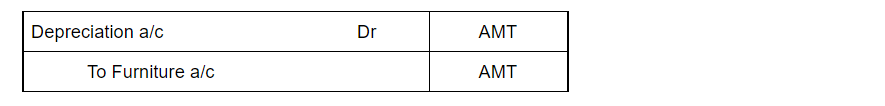

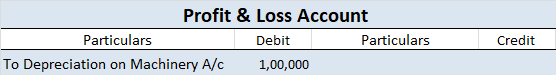

Car/motor vehicles are considered as fixed tangible assets. Treatment of these cars/ motor vehicles is similar to those of other fixed assets. The depreciation will be shown as an expense in the profit and loss account and also the value of these assets will be adjusted in the balance sheet.

Explaining with a simple example: Mars.Ltd purchased a car for Rs 10,00,000, and use it for its official purpose. Its useful life as per act is taken as 6 years and the rate of depreciation as 31.23% as per the WDV method.

Therefore depreciation as per WDV is calculated as follows

Cost of car = Rs 10,00,000

Residual value = NIL

Rate of depreciation = 31.23%

depreciation for first-year = Rs (10,00,000 – NIL)*31.23%

= Rs 3,12,300

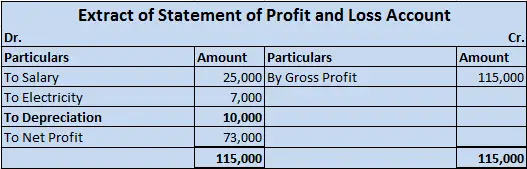

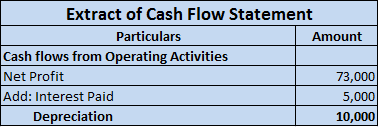

Calculated depreciation on this car will be shown in the profit and loss account as an expense and the same will be treated under the balance sheet every year. Here is the extract of profit and loss and the balance sheet for the above example.

See less